All FTX digital assets are now in the control of the Bahamas Securities Commission

On 12 November, the Bahamas Securities Commission (SCB) issued an order for FTX Digital Markets (FDM) to transfer the contents of its crypto wallets to a government-controlled wallet.

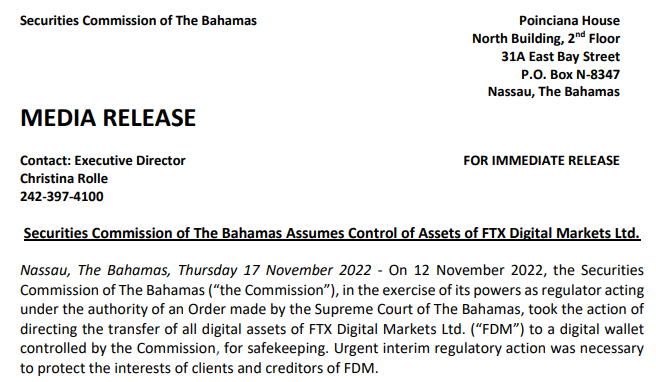

A little over a week later, the Bahamas regulator announced it now has under its control all FTX digital assets, the SCB revealed via Twitter on 18 November. “Securities Commission of The Bahamas Assumes Control of Assets of FTX Digital Markets Ltd,” the Commission tweeted.

According to the media release, SCB said it exercised its power as a regulator and take “urgent interim regulatory action” to protect the interests of clients and creditors of FDM.

https://twitter.com/SCBgov_bs/status/1593395137786171393

It still remains unknown when or if these transfers took place. The announcement also complicates the ongoing bankruptcy currently going on in the US. While the majority of companies connected to FTX filed for Chapter 11 protection in Delaware, FTX Digital Markets Ltd. filed a Chapter 15 bankruptcy protection—which allows a foreign debtor to file for bankruptcy protection in the U.S.

On November 11, the embattled crypto exchange FTX filed for Chapter 11 bankruptcy protection. Immediately after the news, the disgraced FTX founder Sam Bankman-Fried (also known as SBF) resigned as the CEO of the crypto exchange FTX Group and John J. Ray III was appointed the new CEO.

According to the court filings (see PDF below), FTX is a complex web of 134 corporate entities around the world, collectively referred to now as FTX Group. All of these 134 companies are now been put into bankruptcy.

During the bankruptcy hearing at the U.S. Bankruptcy Court for the District of Delaware, the newly appointed FTX CEO John Ray III, who also oversaw Enron’s bankruptcy, said that “in his 40 years of legal and restructuring experience,” he had never seen “such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

In the filing, Ray also disclosed that he did “not have confidence” in the accuracy of the balance sheets for FTX and its sister company Alameda Research, writing that they were “unaudited and produced while the Debtors [FTX] were controlled by Mr. Bankman-Fried.”

Ray added:

Bankman-Fried and FTX “management practices included the use of an unsecured group email account as the root user to access confidential private keys and critically sensitive data for the FTX Group companies around the world, the absence of daily reconciliation of positions on the blockchain, the use of software to conceal the misuse of customer funds.”

Ray also stated in the bankruptcy filing that FTX’s luxurious homes in the Bahamas were purchased “in the personal name of these employees and advisors.”

Update: 10:00 AM EST – “FTX in a bombshell emergency court filing Thursday said evidence suggests Bahamian regulators directed former CEO Sam Bankman-Fried to gain “unauthorized access” to FTX systems to obtain digital assets belonging to the company after it had filed for bankruptcy protection, CNBC reported.

“The filing said that Bankman-Fried transferred those assets to the custody of the Bahamian government. It cites an interview published by Vox on Wednesday where Bankman-Fried expresses serious disdain for regulators.

“F— regulators,” he said in the interview. “They make everything worse. They don’t protect customers at all.”

“You know what was maybe my biggest single f—-p?” he asked. “Chapter 11.””

It gets even worse. The court filing also revealed: “[I]n connection with investigating a hack on Sunday, November 13, Mr. Bankman-Fried and [FTX co-founder Gary] Wang, stated in recorded and verified texts that “Bahamas regulators” instructed that certain post-petition transfers of Debtor assets be made by Mr. Wang and Mr. Bankman-Fried (who the Debtors understand were both effectively in the custody of Bahamas authorities) and that such assets were “custodied on FireBlocks under control of Bahamian gov’t.”