FTX founder and former crypto billionaire Bankman-Fried may be going to jail. Here are 2 deleted tweets that may land him in prison

In 2020, FTX founder and CEO Sam Bankman-Fried made headlines after donating a massive $5.2 million to Joe Biden’s campaign, earning him the title of the second-largest donor. However, Bankman-Fried’s fortunes seem poised for a downturn as he finds himself under scrutiny from US regulators regarding client funds and lending practices.

About half an hour 30 minutes ago, Bankman-Fried (also known as SBF) took to Twitter to apologize for misusing clients’ money and tapping into customer accounts to fund risky bets. Contrary to what FTX told its customers, FTX had $16 billion in customer assets and then lent $10 billion of the money to its sister company, Alameda Research, WSJ said.

In a series of tweets posted this morning, SBF apologized for the company’s lack of transparency. But considering the ongoing investigations about the company’s practices by the SEC and FBI, it might be too late for SBF.

“1) I’m sorry. That’s the biggest thing. I fucked up, and should have done better,” SBF tweeted.

SBF added:

“Transparently–my hands were tied during the duration of the possible Binance deal; I wasn’t particularly allowed to say much publicly. But of course it’s on me that we ended up there in the first place.”

2) I also should have been communicating more very recently.

Transparently–my hands were tied during the duration of the possible Binance deal; I wasn't particularly allowed to say much publicly. But of course it's on me that we ended up there in the first place.

— SBF (@SBF_FTX) November 10, 2022

While everyone was talking about him losing his billionaire status, Bankman-Fried, who was once viewed as a white knight waiting to rescue the embattled crypto industry, may end up spending the rest of his life in prison for investing client assets in his company’s treasury. Here is why.

Over the weekend, CEO of the largest crypto exchange Binance Changpeng “CZ” Zhao tweeted that his exchange would reduce its exposure to FTX and slowly withdraw billions of its holdings in FTX’s native token, FTT, “due to recent revelations that have come to light.”

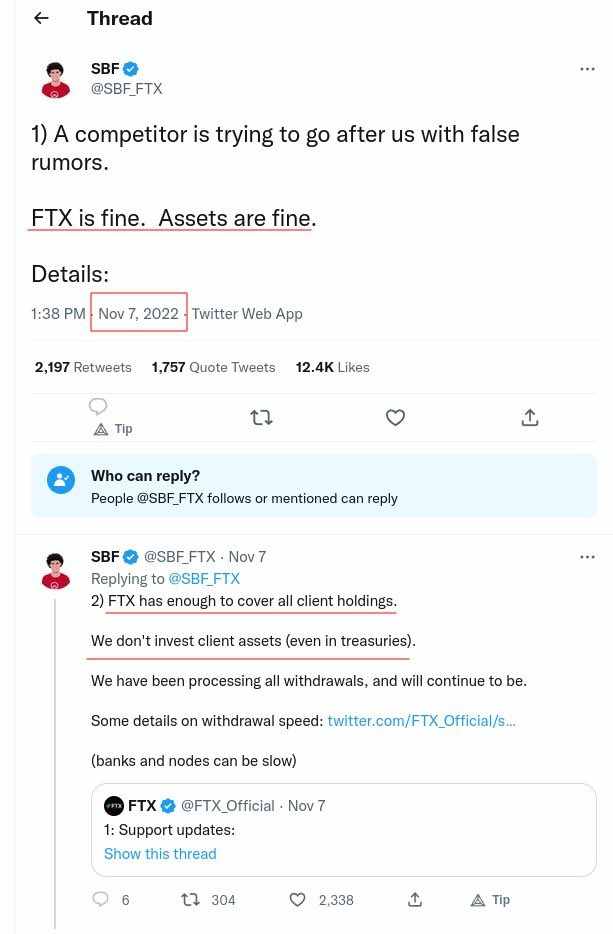

But Bankman-Fried denied the reports tweeting early Monday morning that “FTX is fine. Assets are fine.”

1) A competitor is trying to go after us with false rumors. FTX is fine. Assets are fine.

Details: — SBF (@SBF_FTX) November 7, 2022

In another tweet, SBF reassured FTX customers not to fear that their funds are secured and safe.

“FTX has enough to cover all client holdings,” he added. “We don’t invest client assets (even in Treasurys). We have been processing all withdrawals, and will continue to be,” he tweeted on Monday, adding his company was redeeming money credited to people’s trading accounts for anyone who wished to pull out.

The problem is that SBF has now deleted these two tweets which will be his undoing and be used against him in court. Just like every other content on the internet, it didn’t take long to find the two tweets.

As it turned out, none of what SBF said in the two tweets is true. FTX is not fine. Binance walked away from the FTX deal “after a review of the company’s structure and books.” FTX was also $8 billion in a hole at the time SBF posted the tweet. Bankman-Fried also recently told investors that the company is seeking emergency funding to cover a liquidity shortfall of up to $8 billion.

Second, FTX did invest client assets in treasury and FTX’s sister company, Alameda Research, which Bloomberg also estimated to be worth only $1.

A report published last week by CoinDesk found that the balance sheet of FTX’s sister company Alameda Research was loaded with FTX’s native exchange token FTT. In essence, FTX CEO Sam Bankman-Fried has billions in “assets” under Alameda Research consisting of #FTT tokens issued by his other business, the FTX crypto exchange.

As Duo Nine of Discord explained, just like Celsius Flywheel, FTX prints FTT tokens out of thin air. FTX exchange then lends FTT tokens to Alameda Research, which then borrows USD stablecoins against FTT. Alameda Research then sends USD stables to FTX. You can see the diagram below.

https://twitter.com/DU09BTC/status/1589283736188690432

Furthermore, according to the CoinDesk report, Alameda reportedly possesses $14.6 billion in assets along with $8 billion in liabilities as of June 30. Adding to the complexity, CoinDesk’s investigation reveals that Alameda’s primary assets include approximately $3.66 billion in “unlocked FTT” and $2.16 billion in “FTT collateral.” This suggests that Alameda’s total FTT holdings amount to $5.82 billion, which remarkably surpasses 193% of the known market capitalization of FTT, estimated at around $3 billion according to data from CoinMarketCap.

Meanwhile, investors have withdrawn at least $6 from FTX as the crypto exchange continues downward, according to a report from Reuters, citing a message to staff by its CEO Sam Bankman-Fried. “On an average day, we have tens of millions of dollars of net in/outflows. Things were mostly average until this weekend, a few days ago,” Bankman-Fried wrote in the message.