Apple jumps on Buy Now, Pay Later (BNPL) bandwagon to take on PayPal, Klarna, and Affirm

As you may recall back in March, Apple quietly acquired London-based fintech startup Credit Kudos for $150 million as part of its push to dominate the payments space. Now, the trillion-dollar tech giant is pushing further into finance and getting into the BNPL game with the launch of Apple Pay Later.

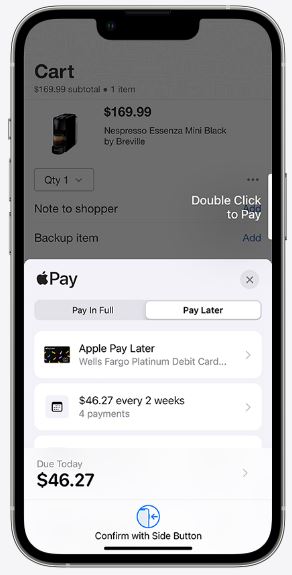

During its annual Worldwide Developer Conference (WWDC) which started on Monday, Apple announced it plans to expand its fintech offerings when it launches the new iPhone software, iOS 16, this fall. The Apple Pay Later will allow Apple customers to buy things wherever Apple Pay is accepted and then pay for it in four payments over a period of six weeks, with no fees.

Source: Apple.com

According to the announcement, The Apple Pay Later, which is one of the several new features for the iPhone’s Wallet app, will enable Apple to directly compete with similar products from other fintech companies such as PayPal, Affirm, and Europe’s most valuable fintech startup Klarna.

According to its website, “Apple Pay Later lets customers split a purchase into four equal payments over six weeks, with no interest or fees to pay. Apple Pay Later is available for purchases in apps and online when customers check out with Apple Pay.2 And it’s built into Wallet so customers can easily track what they owe and when they owe it.”

Apple also said that by using the Mastercard network, Apple Pay Later just works with Apple Pay and requires no integration for merchants.

The Buy now, pay later (BNPL) phenomenon has grown in popularity in recent years as consumers seek alternative methods of financing. BNPL is a new payment option that allows consumers to receive their purchase right away (Buy Now), either online or in-store, and then pay (Pay Later) for their purchase in installments. BNPL is now revolutionizing the customer journey by being seamlessly integrated into e-commerce as a checkout option.

So far, BNPL accounts for only a small portion of overall credit card spending. However, with the coronavirus pandemic-fueled e-commerce boom, this alternative model of financing may be poised to disrupt the $8 trillion US payment card industry.

As we reported late last month, Klarna announced it was laying off 10% of its workforce as the economic downturn hits buy now, pay later space. Inflation and recession have forced consumers to cut back on non-essential items like clothing to focus on basic needs such as food, healthcare, and energy.

The economic downturn has rippled into the buy now, pay later (BNPL) sector forcing companies to make tough cost-cutting decisions including hiring freezes and layoffs.