From unicorn to bankruptcy: WeWork, once most valuable US startup, files for bankruptcy

WeWork, the once-celebrated co-working unicorn startup, filed for Chapter 11 bankruptcy protection in New Jersey following years of struggles that started with a failed IPO in 2019.

A company spokesperson said that approximately 92% of its lenders had consented to convert their secured debt into equity as part of a restructuring support agreement, effectively eliminating around $3 billion in debt, Reuters reported.

The SoftBank-backed WeWork has reshaped the global office sector with its rapid ascent and subsequent fall. Seeking U.S. bankruptcy protection on Monday, WeWork’s prospects dimmed as the companies it hoped would utilize its office-sharing spaces did not meet expectations.

WeWork’s troubles began after scrapping the IPO, revealing its financial state, and highlighting the immense control held by its eccentric founder, Adam Neumann. Subsequently, in its rush for growth before going public via SPAC, WeWork committed to costly leases, resulting in ongoing challenges.

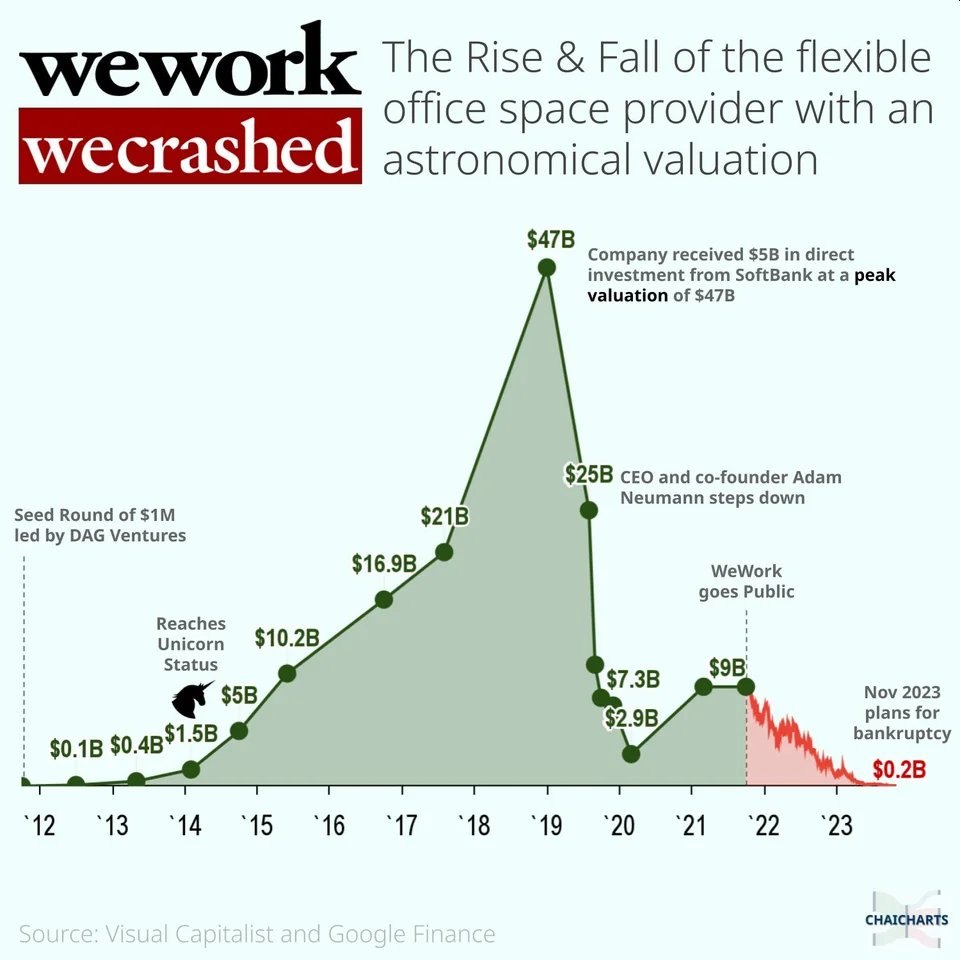

At its peak, the company was valued at $47 billion. However, it has experienced a continuous decline, with its stock plummeting by 98% this year, culminating in an approximate value of just $45 million as of last week.

We’ve been covering the company for the past four years as it struggled with substantial financial losses and an overwhelming debt burden. Just last month, the office space provider skipped $95 million in interest payments, just two months after signaling potential bankruptcy.

WeWork’s challenges can be partly attributed to its aggressive growth strategy. The company committed to long-term leases for office spaces without securing adequate tenants to fill these spaces. Consequently, this mismatch has led to significant financial losses stemming from unoccupied leased spaces.

Moreover, intensifying competition from other shared workspace entities like Regus and IWG has compounded WeWork’s problems. These competitors have outpaced WeWork by offering more attractive pricing and more adaptable leasing terms.

If WeWork proceeds with a bankruptcy filing, it will undoubtedly deal a significant blow to the company and its investors. Furthermore, the repercussions are expected to reverberate through the commercial real estate market.

According to data from Crunchbase, WeWork has raised over $22 billion in funding, inclusive of both investments and debt, from a range of investors including SoftBank, Insight Partners, BlackRock, Goldman Sachs, and several others.

The Rise and Fall Of WeWork

Credit: ChaiCharts

WeWork’s downfall can be attributed to several pivotal factors that unraveled the company’s stability.

The aggressive growth strategy adopted by WeWork proved to be a double-edged sword. Signing long-term leases for office spaces without securing enough tenants beforehand resulted in substantial losses for the company. This approach, while aiming for expansion, ultimately led to financial strain and instability.

The burden of heavy debt loomed large over WeWork, totaling over $9 billion by the end of 2022. This significant debt load severely limited the company’s ability to invest in new growth opportunities, hindering its potential for recovery.

The emergence of increased competition from other shared workspace companies like Regus and IWG posed a serious challenge. These competitors offered more competitive pricing and flexible terms, attracting potential tenants away from WeWork and diminishing its market share.

Adding to the company’s woes were significant corporate governance issues. WeWork’s former CEO, Adam Neumann, faced criticism for his extravagant spending habits and a lack of effective oversight. This governance failure tarnished the company’s image and eroded investor and public confidence.

With the company’s bankruptcy filing, the fate of WeWork’s employees and customers hangs in uncertainty. The looming question remains: what will happen next? WeWork is anticipated to disclose a restructuring plan in the upcoming weeks, outlining the potential future for the company, its workforce, and its patrons.

WeWork was founded in 2010 by Adam Neumann and Miguel McKelvey. It provides members around the world with space, community, and services through both physical and virtual offerings. Its mission is to create a world where people work to make a life, not just a living. As of Q2 2019, WeWork had 528 locations in over 111 cities and 29 countries. WeWork reported a third-quarter loss of $1.3 billion from a revenue of $934 million in 2019. The office-sharing startup currently has about 650,000 subscribers worldwide and hopes to hit 1 million by early 2021.

Since its inception thirteen years ago, the New York-based company has been plagued with setbacks and failures. As we reported back in October 2019, WeWork laid off a quarter of its 12,500 employees, fired its CEO Adam Neumann, and canceled its planned IPO.

Before going public, WeWork raised over $20.6 billion in funding over 17 rounds. Its latest funding was raised on August 14, 2020, from a Debt Financing round. The startup is funded by 18 investors. SoftBank and Goldman Sachs are the most recent investors.

In January 2020, investors saw the writing on the wall and ran for cover after the botched IPO. Here is how Reuters reported the story back then:

“More than a dozen Silicon Valley-based lawyers, entrepreneurs, and venture-capital investors told Reuters that since the embattled WeWork’s canceled public offering and other ill-fated IPOs, investors have been securing protections of their original investments in “unicorns” – private companies valued at $1 billion or more.”

In October 2018, after the failed IPO attempt, SoftBank took control of the struggling real estate startup WeWork slashing its valuation from $47 billion between $7.5 billion to $8 billion. In November 2019, WeWork reported a net loss of $1.25 billion, surpassing its sales. The third-quarter loss more than doubled its loss from the same period the previous year.