Crypto Industry Recovers Despite Record Hacks, DappRadar’s October Industry Report Shows

Welcome back to this month’s edition of the DappRadar industry report. In September, we covered DappRadar’s new Q3 industry report that showed how the crypto industry is riding out the bear market. The report also offered a ray of hope and signs of recovery in the crypto economy despite a persistent bear market.

Now, DappRadar’s out with its October Industry Report which shows how the crypto industry is beginning to bounce back despite record hacks. The global app store for decentralized applications company reveals in its latest report that the crypto market continues to grow with its market cap back over $1 trillion.

Summary

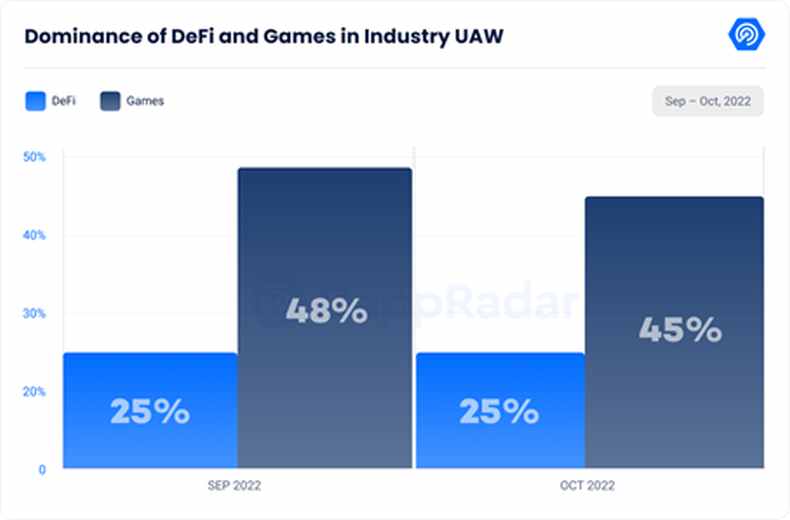

In October the number of industry Unique Active Wallets (UAW) for blockchain dapps reached 2.01 million per day on average, a 6.84% increase from September. This shows once again the industry’s resilience against the wider economic turmoil. The blockchain gaming sector has seen its number of UAW decrease by 2% (898K) from the previous month, and its dominance decreased too, dropping to 45%. On the other hand, DeFi had an increase of 7% (504K) from September and reached above half a million UAW for the first time since June.

Over a million traders embrace NFTs

The NFT trading volume decreased by 30% from September, reaching $662 million, the lowest amount DappRadar recorded this year. In addition, the sales count decreased by 30% month-over-month. Even though the NFT trading volume and sales count decreased, the unique traders count increased by 18% reaching 1.11 million.

Ethereum continues to be in an upward trend with its NFT trading volume for the past two months. In October, it decreased by 21% reaching $324 million, the lowest NFT trading volume since June 2021. Solana’s trading volume decreased by 49% ($66 million), returning to the average trading volume last seen in August and July. The spike in September was driven by the launch of the y00ts collection.

In October, OpenSea market dominance decreased by 8.3% compared to August, and their NFT trading volume decreased 12.1% ($313 million) month-over-month. It is the lowest trading volume since July 2021.

The market has begun to push back against collections that generate ongoing revenue through royalties on NFTs. For example the emergence of royalty-free rivals such as Yawww and Hadeswap has posed a threat to Magic Eden’s 90% market share of the Solana NFT marketplace business. The significant increase in Magic Eden’s market share prior to their decision to waive fees indicates that the Solana NFT ecosystem is more sensitive to the ongoing royalty debate.

Another trend, that of fractionalized NFTs, “F-Nfts” and NFT baskets, is also gaining popularity. Such products allow users to invest in a limited percentage of one NFT, and may facilitate the acquisition of interests in multiple NFTs. Platforms like Fractional, Niftex, and DAOfi allow individuals to purchase and trade F-NFTs the same way an investor can trade stocks on Robinhood.

Gaming sector performance

Gaming blockchain technology remains one of the emerging, promising industries of Web3, with 898,481 daily UAWs in October. “It is worth mentioning that even if the dominance of games for the UAW has decreased from 48% to 45% MoM, it still represents a good indicator for the sector because it still dominates the Web3 industry,” the report concluded.

DeFi continues to recover

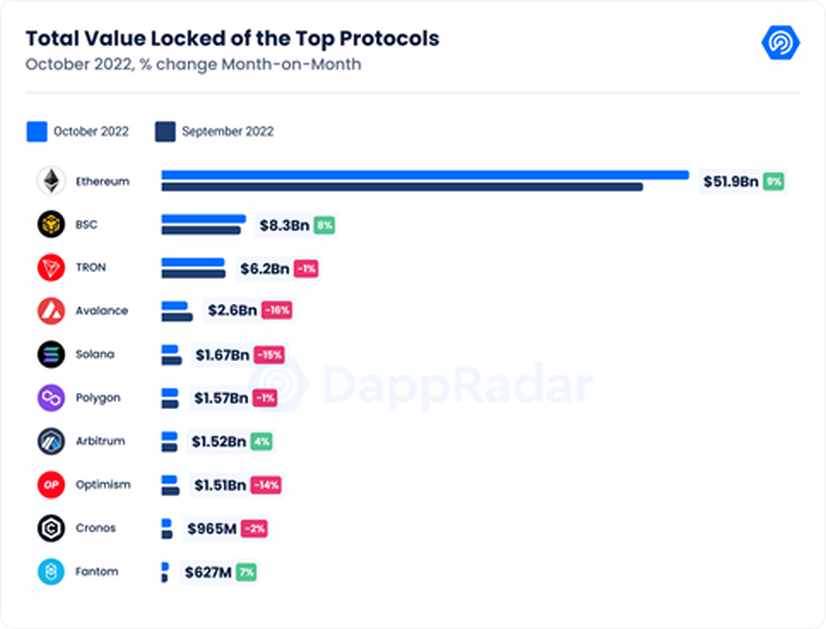

The total value locked in DeFi platforms (TVL) continues to show signs of recovery, this month increased by 5.33%, reaching $83 billion. Ethereum remains the most popular chain with $51 billion TVL, a 9.52% growth from September. Relative to other protocols, its dominance decreased from 69% in September to 61.97% in October. BNB is once again the runner-up with $8.3 billion in TVL, an 8.57% growth from September. The recent BNB Chain exploit didn’t affect the metric at all.

Cryptomarket back over $1 trillion

Cryptomarket back over $1 trillion

The global crypto market cap is finally over the $1 trillion mark, which aided market bullishness. Bitcoin (BTC) and Ether (ETH) had daily gains as bears finally took a back seat. “After the crypto market started to turn green on October 25, over $1.2 billion in short liquidations took place in around 24 hours. The crypto market finally broke free from the tight price range it had oscillated in since September,” the report noted.

Altcoins have also performed strongly through October, led by Dogecoin (DOGE), which closed the month at $0.12, a 50% increase in the past 30 days and six-month highs. This price increase was driven by Elon Musk’s takeover of Twitter and Dogechain’s announcement of its future roadmap.

Business interest in crypto

In October, Web3 and NFT trademark filings were submitted by brands as diverse as musical instrument manufacturer Fender and food giants Del Monte and Kraft. The most important filling though comes from Visa, Paypal, and Western Union.. These moves all suggest that these companies are aware of, and prepared to enter, what they see as a lucrative future crypto market.

Security hacks

According to the database of DeFi scams, hacks, and exploits DEFIYIELD, this month saw the largest value of funds lost all year: $1.09 billion. Cross-chain bridges appear to be a big target for hackers, with 82% of October’s losses down to them.

The biggest fraud this month is Francisco Valdevino da Silva, aka the “Bitcoin Sheikh”. According to the Brazilian authorities, he is suspected of having defrauded and laundered up to 4 billion Brazilian reals (about $766 million) from thousands of Brazilians and citizens from at least ten other countries. If this trend continues, 2022 will likely surpass 2021 as the biggest year for crypto and blockchain hacking on record.

Closing thoughts

The October crypto recovery, with 1.11 million unique traders entering the NFT market, is not without its losers, as well as winners. While the global crypto market capitalization surpassed $1 trillion once again, bolstering optimism, October also recorded the highest value of hacked and stolen crypto assets all year, $1.09 billion. Despite that note of retail investor caution, there’s a distinct trend of big business getting more involved in crypto, indicated by important trademark filings coming from Visa, Paypal, and Western Union. “Unquestionably, a further bull run will occur, and it may be considerably stronger than the previous one. Each time the market encounters adversity, it finally grows stronger, and the caliber of initiatives improves,” the report concluded.

Founded in 2018, DappRadar is the World’s Dapp Store: a global decentralized applications (dapps) store, which makes it easy for more than one million users per month to track, analyze, and discover dapp activity via its online platform. The platform currently hosts more than 12,000 dapps from across 50 blockchains and offers a plethora of consumer-friendly tools, including comprehensive NFT valuation, portfolio management, and daily industry-leading, actionable insight.

As well as the starting point for dapp discovery DappRadar acts as a distribution channel for dapp developers that are looking to reach new consumers. With the DAO launched in late 2021 members of the community can vote on new proposals. The aim is to make DappRadar a decentralized organization where the community has as much say in decisions as the CEO.