Crypto investors withdraw over $7 billion from Tether, raising fresh fears about the future of the controversial stablecoin

Last week was one of the worst weeks for crypto investors as LUNA cryptocurrency crashes to $0 causing its TerraUSD (UST) stablecoin to fall further from its $1 peg to 95 cents. The Luna Foundation Guard (LFG), the company behind TerraUSD (UST) stablecoin, had recently acquired $1.5 billion in bitcoin to bolster the reserves of its popular stablecoin.

It now appears the carnage is spreading to the world’s largest stablecoin, Tether. Crypto investors have withdrawn more than $7 billion just a few days after the controversial stablecoin dropped below its $1 peg as the crypto bloodbath continues. Tether’s circulating supply slipped to less than $76 billion on Tuesday from about $83 billion a week ago, according to data from CoinGecko.

Tether is a surrogate crypto dollar that is theoretically pegged at the same value as a dollar but can be traded without following regulations on dollars. Tether is one of the commonly known coins called Stablecoins, which are virtual currencies that are always supposed to have the same real-dollar value.

At around 3:15 a.m. EST last Tuesday, Tether sank to as low as 95 cents on some exchanges. Tether’s decline came after terraUSD, a different stablecoin we covered this morning, dropped 99.7% on Wednesday. The collapse led to fears of possible market contagion. LUNA tokens also lost 96% in the past 24 hours alone, pushing it to less than 10 cents. That’s down from about $60 earlier this week and a record $120 in mid-April.

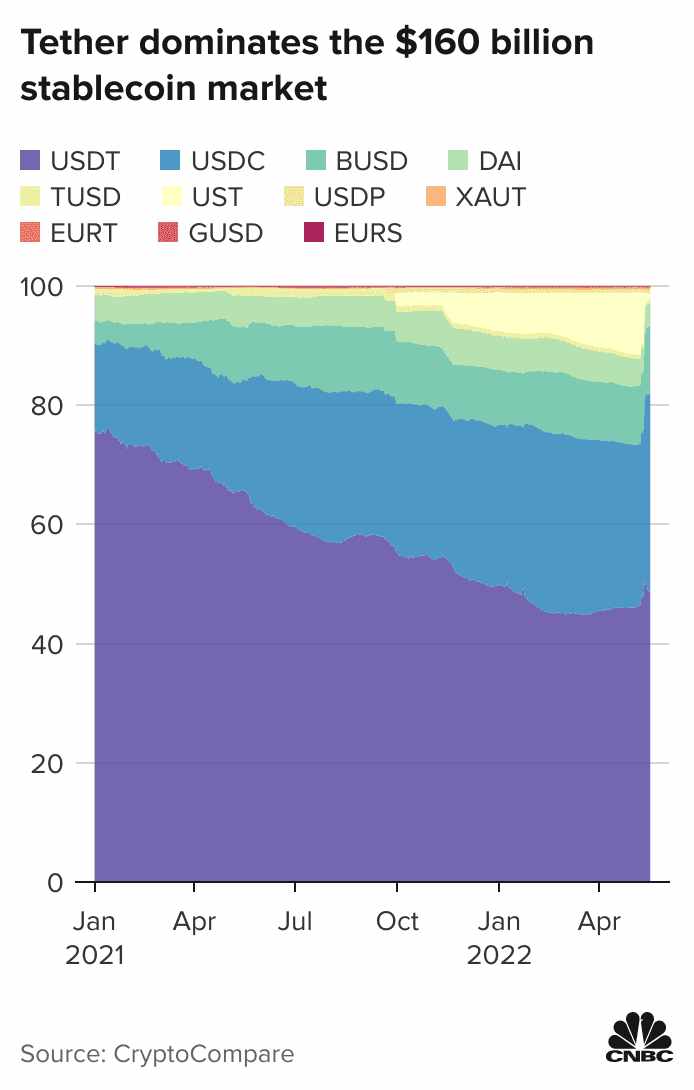

Vijay Ayyar, head of international at crypto exchange Luno, told CNBC that the move by tether was likely “speculation-driven fear” resulting from the fallout of UST’s plunge. “The environment is ripe for such news events to cause ripples through the markets as we can see,” Ayyar added. Meanwhile, Tether continues to dominate the $160 billion stablecoin market (chart below)

Credit: CNBC

We wrote about Tether about a year ago after The New York Attorney General’s Office said that “Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie.” Below is how The New York Attorney General’s Office described Bitfinex and Tether’s illegal activities:

“Bitfinex and Tether recklessly and unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines,” said Attorney General James. “Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie. These companies obscured the true risk investors faced and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system.”

Unknown to many crypto investors, Tether or USDT is a controversial cryptocurrency founded in 2014 and controlled by the same people who founded Bitfinex, with which it shares overlapping officers. Tether is headquartered in the British Virgin Islands, Hong Kong, Isle of Man. According to its LinkedIn profile, Tether has only 13 employees with more than $60 billion under management, making it one of the biggest fintech startups out there.