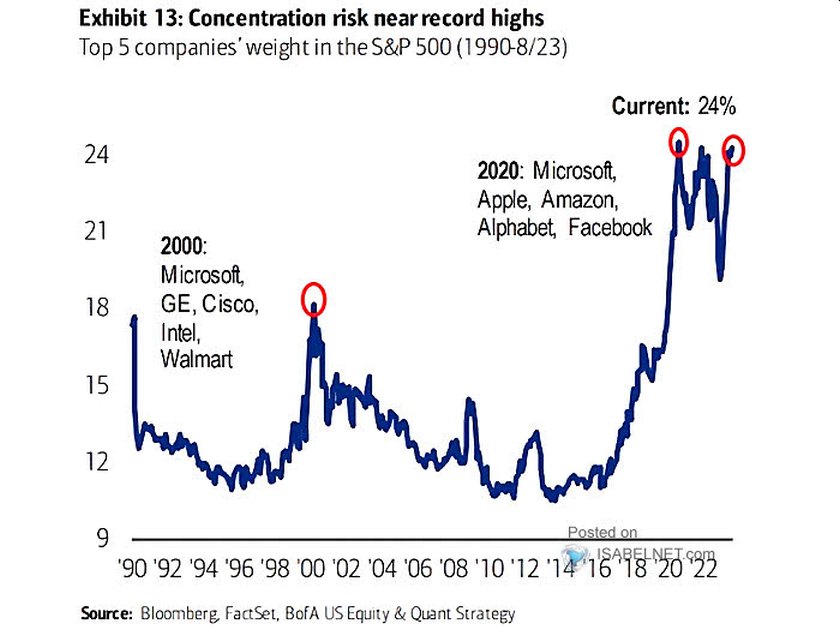

These 5 big tech companies now represent about 25% of the entire S&P 500’s market cap

In a clear illustration of the growing consolidation of wealth within a handful of major tech corporations, a recent chart published by Bloomberg highlights the fact that the top five big tech companies now collectively account for approximately a quarter of the entire market capitalization of the S&P 500 in 2022.

Drawing on data from Bloomberg, Factset, Bank of America US Equity, and Quant Strategy, it becomes evident that Apple, Amazon, Google’s Alphabet, Microsoft, and Meta, formerly known as Facebook, together exert control over a significant 24% of the overall market capitalization of the S&P 500. Remarkably, this figure mirrors the identical level observed in 2020, just prior to the market downturn triggered by the pandemic.

To put this into historical context, in 2008, these same top five tech giants represented a comparatively modest 14% of the S&P 500’s market capitalization. The chart’s depiction serves as compelling evidence of the pronounced concentration of market influence within a select group of tech and, underscoring the notion that risk levels in financial markets are approaching historic highs.

However, this trend extends beyond the S&P 500 and is also noticeable within the Nasdaq. In this case, the stocks of the five major tech companies have contributed to a substantial 70% of the year-to-date (YTD) gain in the Nasdaq index, according to Kobeissi who first shared the insights on X.

The same can be seen in the Nasdaq where 5 stocks have accounted for 70% of the YTD gain.

If you take out the top 7 performing stocks in the S&P 500, it is up less than 5% this year.

Is AI the next big thing?

Follow us @KobeissiLetter for real time analysis as this develops.

— The Kobeissi Letter (@KobeissiLetter) September 22, 2023

Two years ago, we delved into the exclusive trillion-dollar club known as MAMATA, which comprises Microsoft, Apple, Meta, Amazon, Tesla, and Alphabet. At that time, the collective market capitalization of these six tech titans had surged past the $10 trillion mark, amounting to approximately two-thirds of the entire Gross Domestic Product (GDP) of Europe.

AI-Driven Hype

What lies at the core of the recent upsurge in market capitalization for these tech giants? Many attribute their current success to the rapid advancements in artificial intelligence, fueled by the sudden success of OpenAI’s ChatGPT.

The growing integration of AI technologies gives a significant competitive edge to these big tech companies, subsequently translating into increased revenues and profitability. Consequently, investors are displaying a greater willingness to invest at premium valuations in the shares of these tech giants, thereby propelling their market capitalization to soaring heights.