The rise and fall of Facebook: Meta loses over $700 billion over risky bet on the metaverse; stock sinks 73%

Before changing its name to Meta, Facebook is probably the most hated company in the world. In a just few months, the once $1 trillion social giant has seen its market value crash to just $246 billion. “Facebook’s monopoly is imploding before our eyes.”

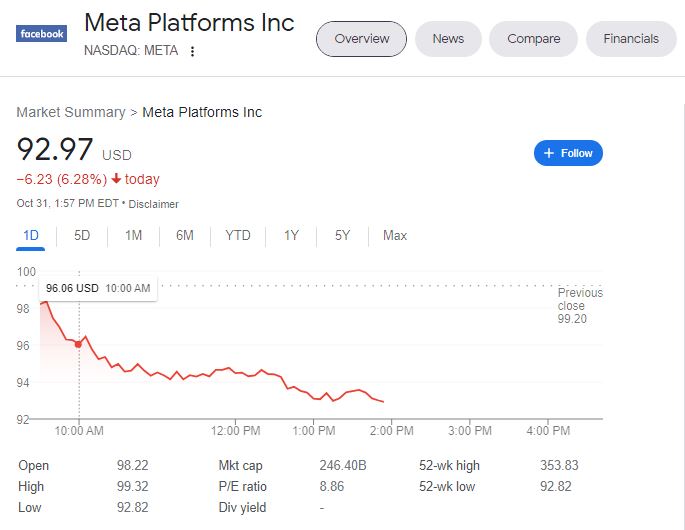

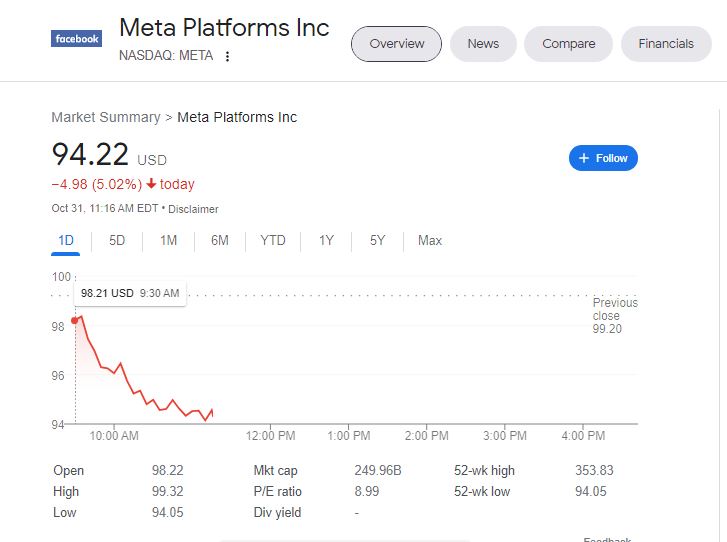

At the current rate, Meta may become an irrelevant company used mainly by boomers. Last week, Meta stock was trading at $98 as of the close of the market on Friday. Today, Meta stock has fallen by another $5, trading at a little over $92.

Today, Meta stock continues on its downward spiral as the now plunges to an all-time low price of $94.38 as of the time of writing. Wall Street punished Meta Platforms for its risky bets on the metaverse, making many predict that Meta may be going the way of MySpace, Netscape, and Yahoo.

Meta has lost over $700 billion of its market value since October 2021 when CEO Mark Zuckerberg rebranded the social giant to a metaverse company. That’s not all. Zuckerberg has also lost over $100 billion in personal net worth. But Zuckerberg is backing down. Instead, the company doubles down and said it plans to spend billions more to achieve its metaverse ambition. Over the last year, Meta spent $45 billion on stock buybacks at $330 a share. Today, its stock is now worth only $94.

Meta believes the metaverse is a game-changing technology and believes the early mover advantage will potentially make Meta the first multi-trillion dollar company. While its stock continues the free fall, Zuckerberg doubled down on losing even more money building the metaverse.

Meta also said it plans to invest $10 billion in the metaverse to reflect the company’s new vision. At the time, Meta said it plans to hire 10,000 people in the European Union to build a “metaverse.” Zuckerberg added that the metaverse is a major investment for the company and plays a vital role in the company going forward.

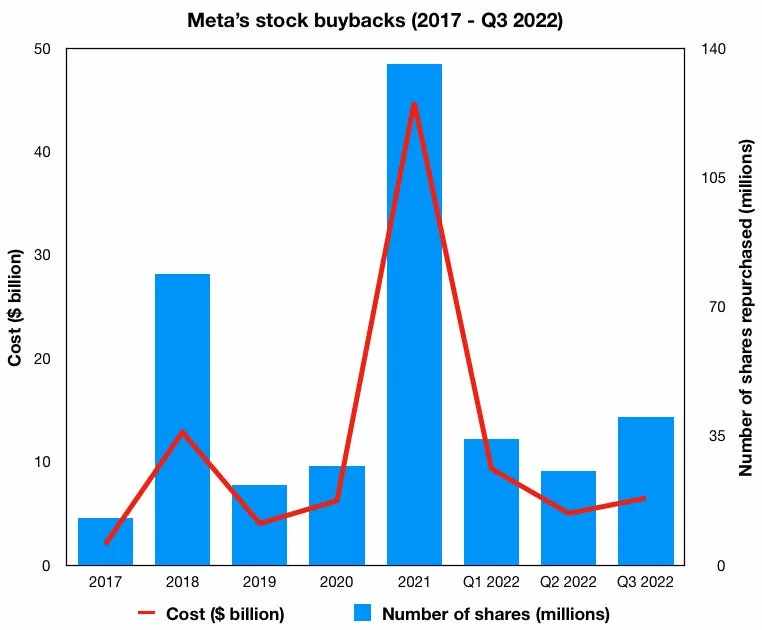

Banking on the future success of the metaverse. Meta also spent about $45 billion buying back 136 million shares in 2021. The social giant paid around $330 per share, according to a report from Business Insider, citing filings from the Securities and Exchange Commission (SEC).

Fast forward a year later, Meta stock is now trading in two digits. The stock has since plunged to under $100, or less than a third of the buyback price. Yesterday, Meta stock fell as low as $97. For now, this further shows that Meta’s gamble on the metaverse has not paid off and it’s probably not going as the social giant as hoped. The social giant massively overpaid for its own shares.

That’s not all. In the first nine months of this year, Meta also repurchased another 100 million shares at a cost of $21 billion, or around $210 a share, which is more than double the current stock price.

Credit: Markets Insider/SEC filings

Meta’s woes started long before the company’s metaverse announcement in October 2021. During the earnings calls yesterday, during the earnings call yesterday, Zuckerberg reiterated his commitment to spending billions of dollars developing the metaverse as investors grow weary about the health of Meta’s online advertising business. In the past 12 months, Meta has repurchased $42 billion of stock at an average price of $300. It is now trading at $112.

“I just think that there’s a difference between something being experimental and not knowing how good it’s going to end up being,” Zuckerberg said in response. “But I think a lot of the things that we’re working on across the family of apps, we’re quite confident that they’re going to work and be good,” he added.

However, Zuckerberg said he “can’t tell you right now how big they are going to scale to be,” each improvement is “kind of going in the right direction.” Zuckerberg said that “obviously, the metaverse is a longer-term set of efforts that we’re working on” and that he thinks “that that is going to end up working, too.”

Meta has lost more than 70% of its value since peaking last year as all its business units continue to get pummeled on multiple fronts. The social giant has lost 70% of its value YTD as its stock falls from $300 to just $100.

It all started back in October of last year after Meta founder and CEO Mark Zuckerberg changed the corporate name from Facebook to Meta to reflect its focus on the metaverse, a term the social giant described as “an embodied internet where you’re in the experience, not just looking at it. We call this the metaverse, and it will touch every product we build.”

Zuckerberg is now doubling down on losing even more money building the metaverse. Meta also said it plans to invest $10 billion in the metaverse to reflect the company’s new vision. At the time, Meta said it plans to hire 10,000 people in the European Union to build a “metaverse.” Zuckerberg added that the metaverse is a major investment for the company and plays a vital role in the company going forward.

Below is a video of Meta introducing the world to its metaverse. Many have speculated that the metaverse is nothing but a glorified gaming platform and is not ready to be used in real life.

Meta stock is now trading at $94.22 as of the time of writing.

Update: 2 PM EST: Meta stock is now trading at $92.97, with more room to fall. It’s anyone’s guess when the stock will reach zero.