The 6 largest U.S. tech companies lost over $500 billion in just one day of stock market rout

The elite trillion-dollar big tech club known as MAMATA used to be worth a combined market value of $10 trillion. But that changed this week after the turmoil in the stock market caused the six largest U.S. tech companies to lose over $500 billion in just one day of the stock market rout.

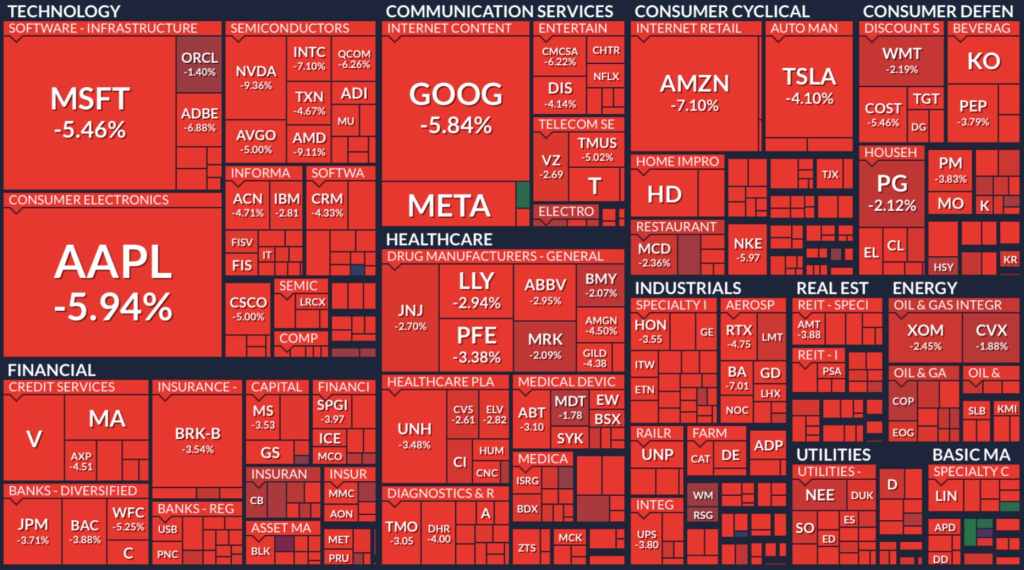

Apple, the world’s most valuable public company, suffered the most loss closing at $153.84 for a loss of just under 6%. The carnage didn’t stop there. Microsoft lost over 4%, Meta Platforms down more than 7%, and chip giant Nvidia shed 9.5%.

Why are tech stocks crashing?

It all started this morning after August’s inflation report showed prices higher than expected, which dampens the hopes the Federal Reserve would not be aggressive in raising the interest rates. Headline inflation rose 0.1% month over month and core inflation rose 0.6% month over month. On a year-over-year basis, inflation was 8.3%. At the close of the market, Dow tumbles 1,200 points, making it the worst day since June 2020.

The worst hit

Apple lost $154.11 billion in market cap and fell 5.87%, while Microsoft lost $109.33 billion and fell 5.5%, both seeing their steepest drops since Sept. 2020. Alphabet, Amazon, Meta, and Nvidia were also down, losing tens of billions each.

Almost all technology stocks were in the red. But Twitter shares ticked higher by 0.7% after a report that shareholders prepared to vote on Elon Musk’s $44 billion takeover, which they are expected to approve.

When all the dust settled, the Dow Jones Industrial Average lost 1,276.37 points, or 3.94%, to close at 31,104.97. The S&P 500 dropped 4.32% to 3,932.69, and the Nasdaq Composite sank 5.16% to end the day at 11,633.57. Only five stocks in the S&P 500 finished in positive territory.

The wipe-out is not limited to stocks. Bitcoin also shed $1K in 3 minutes as US CPI inflation overshoots. The world’s most popular cryptocurrency is now trading at $20,197.90 after crossing the $23,000 mark just a few days ago.