Coinbase inks a deal with BlackRock to offer bitcoin access to institutional investors, despite crypto bear market

Crypto exchange Coinbase has partnered with the world’s largest asset manager BlackRock to offer direct access to bitcoin to some institutional clients. The partnership further shows that the ongoing crypto bear market has done little to stop investors’ interest in cryptocurrency. Coinbase shares soared by 14% immediately after the announcement.

In a statement, Joseph Chalom, global head of strategic ecosystem partnerships at BlackRock, said: “Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to efficiently manage the operational lifecycle of these assets. The partnership will let them “manage their bitcoin exposures directly in their existing portfolio management and trading workflows.”

The announcement comes the same week after Coinbase announced it is now approaching 100 million verified user accounts. The platform now boasts 98 million authenticated users, 13,000 organizations, and 230,000 network partners in over 100 nations.

In March, BlackRock’s chairman Larry Fink wrote in a letter to shareholders that the firm is studying digital currencies, stablecoins, and the underlying technologies as the firm has seen increasing interest from clients. “A global digital payment system, thoughtfully designed, can enhance the settlement of international transactions while reducing the risk of money laundering and corruption,” Fink wrote.

In recent months, BlackRock has been showing interest in cryptocurrencies. In April, we wrote about Blackrock after it joined forces with Fidelity to invest $400 million in a crypto tech startup and the issuer of USDC stablecoin Circle.

BlackRock is currently the world’s most influential financial company with $9 trillion in assets under management as of June 2021. That’s more than the gross domestic product of every country in the world, except for the US and China. We wrote extensively about BlackRock last year. You can read more here.

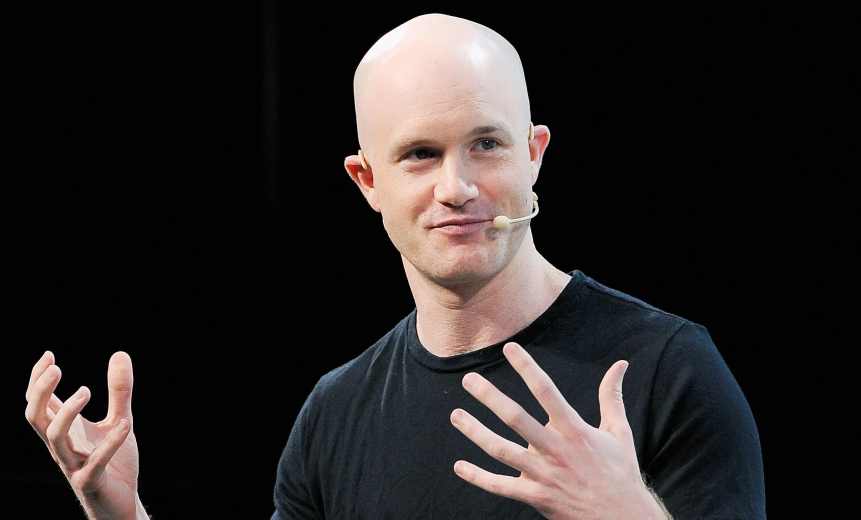

Founded in 2012 by Brian Armstrong and Fred Ehrsam, the San Francisco, California-based Coinbase is a digital currency wallet and platform where merchants and consumers can transact with new digital currencies like bitcoin, ethereum, and litecoin. Since its inception nine years ago, Coinbase has raised a total of $847.3 million in funding over 14 rounds. Its latest funding was raised on December 21, 2018, from a secondary market round.