Crypto tech startup iZUMi Finance raises $30M in new funding to expand ecosystem and debuts iZiSwap on BNB Chain

Back in March, crypto tech startup iZUMi Finance, , the innovative multi-chain DeFi protocol that provides Liquidity as a Service (LaaS) on multi-chains, made a splash after it partnered with HOURAI to bring its upcoming NFTs with value from iZUMi’s DeFi derivatives.

A month earlier, iZUMi also launched a revolutionary decentralized autonomous organization (DAO) with veNFT governance based on quadratic voting. Now iZUMi is out with another major announcement.

Today, iZUMi Finance announced the launch of its next-generation Decentralized Exchange (DEX) iZiSwap on BNB Chain. In conjunction with the launch, iZUMi announced it has raised $30 million in new funding to expand ecosystem.

Incorporated with the Discretized-Liquidity-AMM model that promises to reduce price slippage when swapping tokens, it comes alongside the debut of iZUMi’s new, U.S. dollar-pegged, 100% collateral-backed bond iUSD.

iZUMi Raises $30M & Expands Ecosystem

Through the sale of Bond Vouchers and iUSD claims, iZUMi announced it has raised $30 million to support the early liquidity provision of iZiSwap’s launch. Ivy Ventures, Cobo, Mirana and other institutional investors contributed $20 million towards the raise, including $11 million raised via Bond Voucher sale on Solv Protocol, to support the future development of the iZUMi ecosystem.

There was incredible demand from the community for iZUMi Bond Voucher, with $4 million BUSD worth of vouchers sold out in just 17 minutes during the raise, and an additional 5,000 BNB – equivalent to $2 million USD – selling out in just under three hours.

iZUMi Finance has held a new round of Bond Voucher sale to raise 2,500 WETH and 550,000 BIT to energize the liquidity providers of the BIT/ETH pool on Uniswap V3. Previously on May 8, BitDAO created their liquidity pool of BIT/ETH on Uniswap V3, with its liquidity service provided by iZUMi Finance. These two parties launched an incentive period that lasts for 2 months, rewarding liquidity providers with dual rewards of iZi/BIT tokens.

New Features in iZiSwap

The introduction of iZUMi’s new Discretized-Liquidity-AMM will enable the rollout of a unique Limit Order feature in iZiSwap that guarantees traders no slippage and cheaper trading fees.

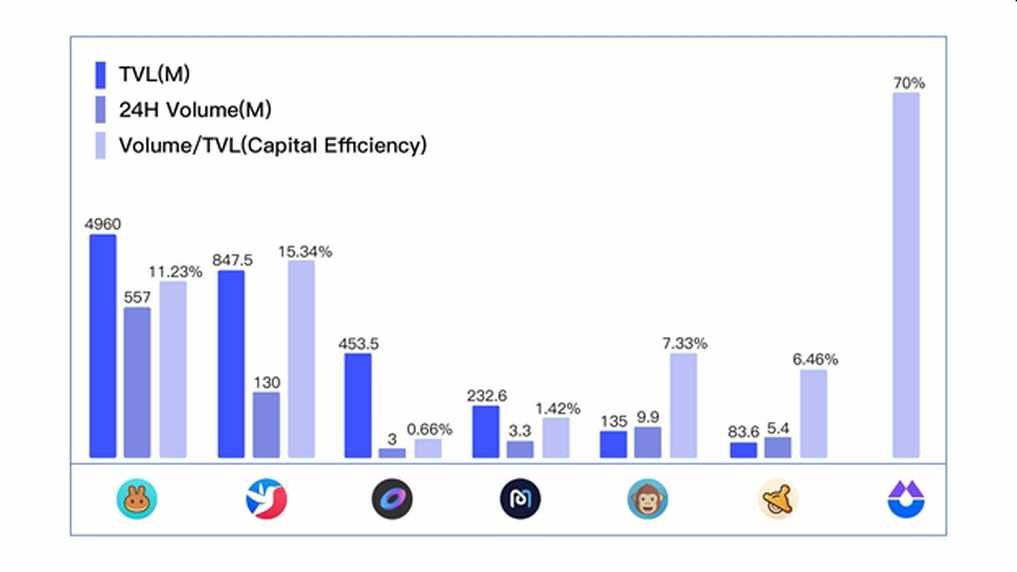

(A Capital Efficiency Comparison between iZiSwap & Major V2 DEXs on BNB Chain)

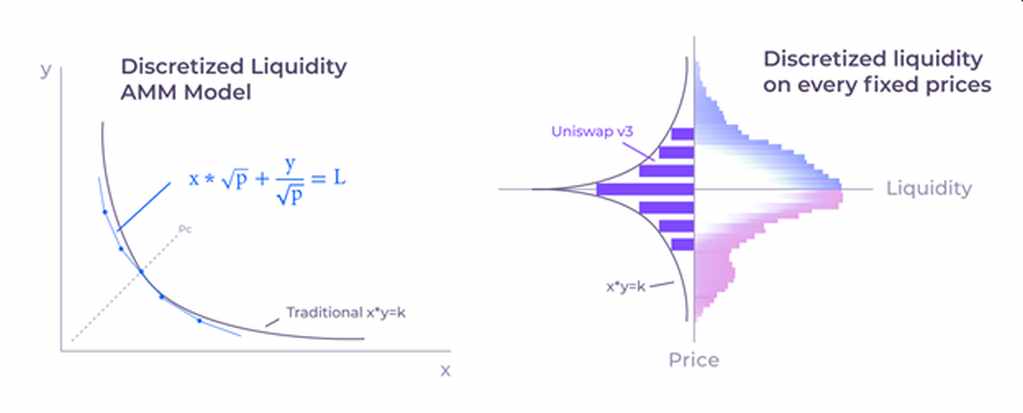

(Mechanism of Discretized-Liquidity-AMM Model)

The Discretized-Liquidity-AMM improves on the Concentrated Liquidity model first deployed by Uniswap V3 makes liquidity positions effective at certain price ranges. With DLAMM, iZiSwap is now able to cut these price ranges into discretized price ticks, pinpointing them to exactly zero. With this, traders on iZiSwap will benefit from enhanced capital efficiency, zero slippage, and cheaper trading fees, with liquidity guaranteed to be available at any price range they demand.

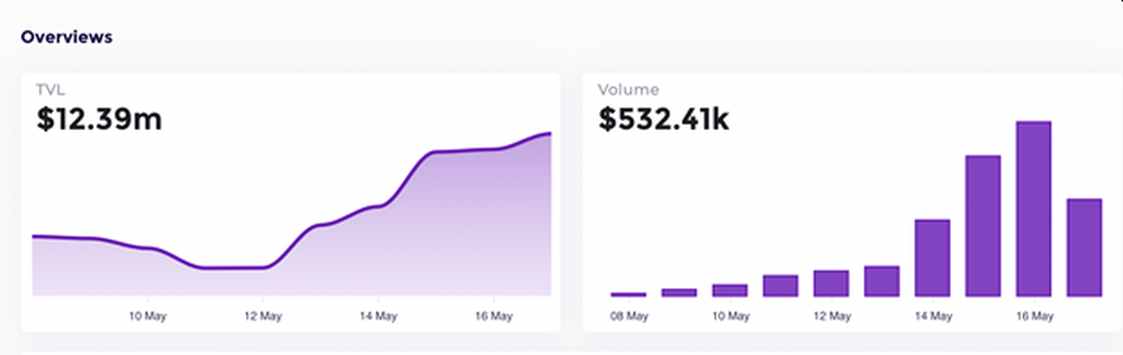

As of May 18, iZiSwap has successfully accumulated over $13M Total Value Locked (TVL) and generated over $500k trading volume in less than two weeks since its soft launch on May 7. On multiple trading pairs of major assets such as BNB, BUSD, and USDT, iZiSwap has exceeded its major competitors on BNB Chain in terms of liquidity depth. iZiSwap has further delivered the message that the innovative DLAMM model has significantly improved capital efficiency than other DEXs that adopted the traditional xy=k V2 AMM model, providing another option for swapping tokens on BNB Chain.

Bond Farming – A Paradigm Shift in Liquidity Mining

Investors gain further opportunities within iZUMi’s ecosystem with the debut of iZUMi Bond USD, a bond that raises funds for the iZUMi Finance protocol to grow its ecosystem of products. iUSD is pegged 1:1 with US Dollars and 100% backed by iZUMi’s collaterals and future revenues, with the supply guaranteed to never exceed the total value of the iZUMi Treasury.

By guaranteeing the principals and interests paid to the investors, Bond Farming has set a paradigm shift in liquidity mining. The revenue generated by Bond Farming will first be used to repay the investors then reward market makers. For liquidity providers, Bond Farming lowers the risk of impermanent loss while giving a higher profit. For protocols, Bond Farming inspires a cheaper solution for distributing incentives, which is vital to survival in a bear market. It’s a win-win situation for both the liquidity providers and the protocols if they adopt Bond Farming on iZUMi.

Solv Protocol, EthSign, and Cobo Wallet also joined iZUMi in Bond Farming to add an extra layer of security and protection. The four-party alliance will work together to safeguard the raised assets.

“Liquidity is the catalyst for growth in DeFi. With the launch of our Discretized-Liquidity AMM and iUSD, iZUMi Finance is eliminating the barriers to liquidity and making DeFi more attractive and efficient for market participants,” iZUMi Co-Founder Jimmy Yin said in a statement.

Founded by Xinshu Dong, iZUMi Finance is the platform providing programmable liquidity as a service on Uniswap V3 multi-chains. It proposes LiquidBox liquidity mining platform that provides Uniswap V3 LP token staking rewards non-homogeneously in different price ranges, which could improve the efficiency of incentive distribution for reward providers and enhance the earnings of liquidity providers in Uniswap V3. In addition, iZUMi will extend liquidity service to multi-chains with built-in DEX and bridges in the future.