Elon Musk says Twitter’s deal is “temporarily on hold” pending details on fake accounts

Shares of Twitter tumbled in pre-market trading after Elon Musk announced early this morning that Twitter’s deal is on “temporary hold.” Musk’s announcement came just a few days after short-seller Hindenburg Research warned that Twitter is overpriced and that there is a “significant risk” that the deal could get repriced lower.

This morning, Musk partially confirmed the report. In a post this morning, Musk said the “Twitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of users.”

Twitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of usershttps://t.co/Y2t0QMuuyn

— Elon Musk (@elonmusk) May 13, 2022

Musk’s tweet also referenced another report from Reuters which found that fake accounts represented less than 5% of Twitter’s user base. Per Reuters, Twitter said in the filing it faced several risks until the deal with Musk is closed, such as whether advertisers would continue to spend on Twitter and “potential uncertainty regarding our future plans and strategy.”

Meanwhile, about a half an ago, Musk stated that he’s still committed to the deal. “Still committed to acquisition,” Musk tweeted.

Still committed to acquisition

— Elon Musk (@elonmusk) May 13, 2022

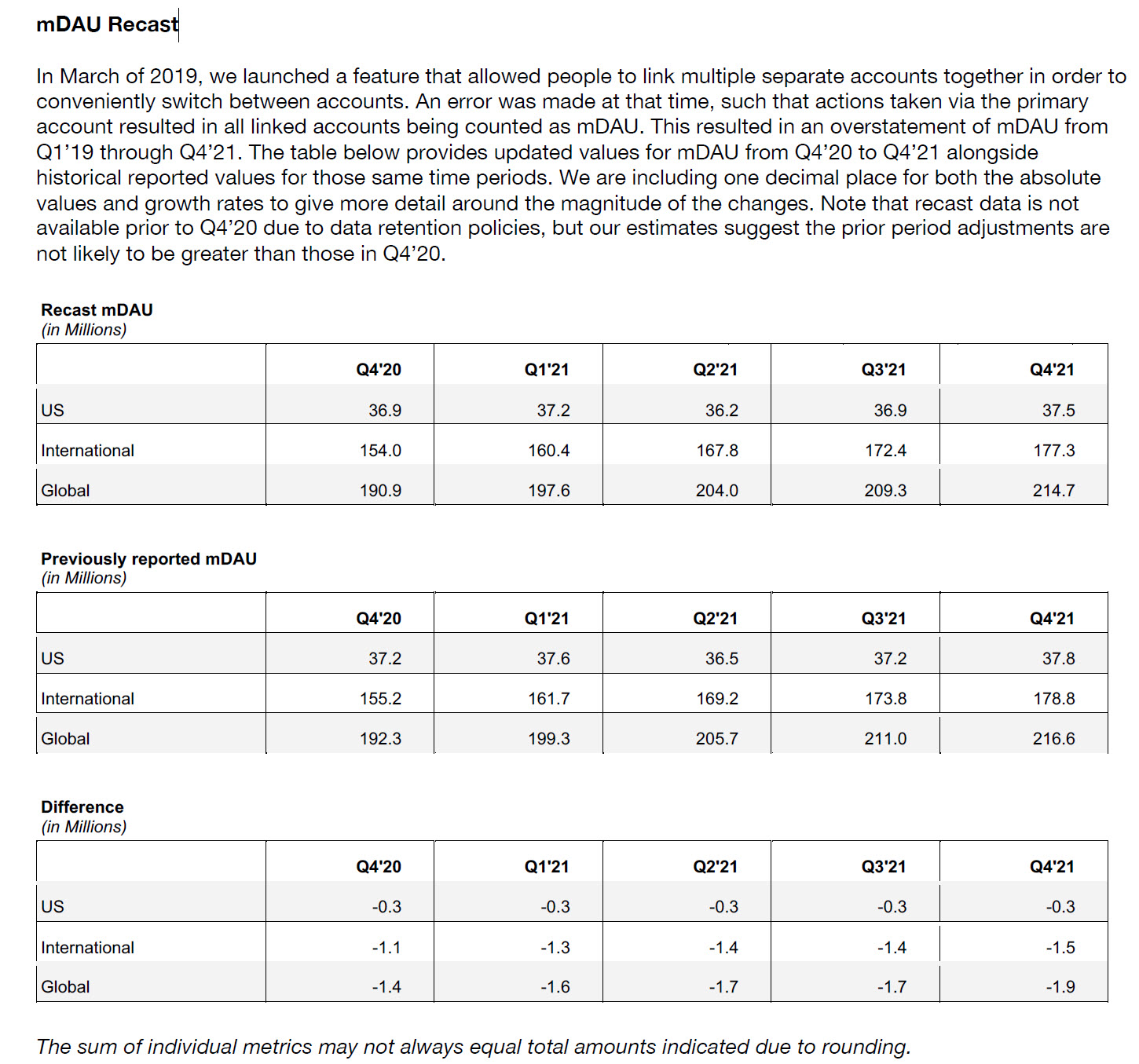

As we reported back in late April, Twitter admitted in its quarterly earnings report for the first quarter of 2022 that it has been overstating millions of its active users since 2019. The difference in monetizable daily active users (mDAU) counted ranges from 1.4 million to 1.9 million daily users. The largest difference was found in the last quarter of 2021, the company said.

On April 25, Twitter agreed to sell the company to Elon Musk for $44 billion. Under the terms of the agreement, Twitter stockholders will receive $54.20 in cash for each share of Twitter common stock that they own upon closing the proposed transaction.

The purchase price represents a 38% premium to Twitter’s closing stock price on April 1, 2022, which was the last trading day before Mr. Musk disclosed his approximately 9% stake in Twitter. Musk needed to use his Tesla stock to raise $21 billion in equity to fund his takeover of the social media giant.

Under the terms of the agreement, Twitter stockholders will receive $54.20 in cash for each share of Twitter common stock that they own upon closing the proposed transaction. The purchase price represents a 38% premium to Twitter’s closing stock price on April 1, 2022, which was the last trading day before Mr. Musk disclosed his approximately 9% stake in Twitter.