Coinbase warns users their crypto assets could become company property if it goes bankrupt

This week is probably the worst, if not one of the worst weeks, for crypto investors. The crypto markets are now becoming increasingly shaky by the hours. Just as investors are reeling from the collapse of the Terra Luna stablecoin and Terra token, Coingbase, one of the largest cryptocurrency exchanges, just dropped another bombshell revelation.

Coinbase warns its users could lose their crypto holdings if the company goes bankrupt. Coinbase warned its customers their crypto holdings could be viewed as general unsecured assets during the bankruptcy proceedings.

The disclosure was made in the company’s first-quarter earnings report. That was the first time Coinbase ever mentioned the risk factor. It also noted that Coinbase held $256 billion in fiat currencies and virtual coins.

Coinbase said that “the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings and such customers could be treated as our general unsecured creditors” Below is an excerpt from the report.

“Because custodially held crypto assets may be considered to be the property of a bankruptcy estate, in the event of a bankruptcy, the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings and such customers could be treated as our general unsecured creditors.”

The crypto trading company also said: “Our failure to safeguard and manage our customers’ fiat currencies and crypto assets could adversely impact our business, operating results, and financial condition.”

For many years, crypto enthusiasts have long touted the decentralized movement as a way to give ordinary people complete control and ownership of their finances without intervention from central financial authority. Now, this revelation adds to the list of things they have to worry about in addition to losing their crypto assets to hackers.

As Wall Street Journal also noted, “Cryptocurrency trading platforms might look and feel like regular brokerage apps to everyday users, but regulators have long warned they lack the oversight and investor protections that are built into traditional financial services.”

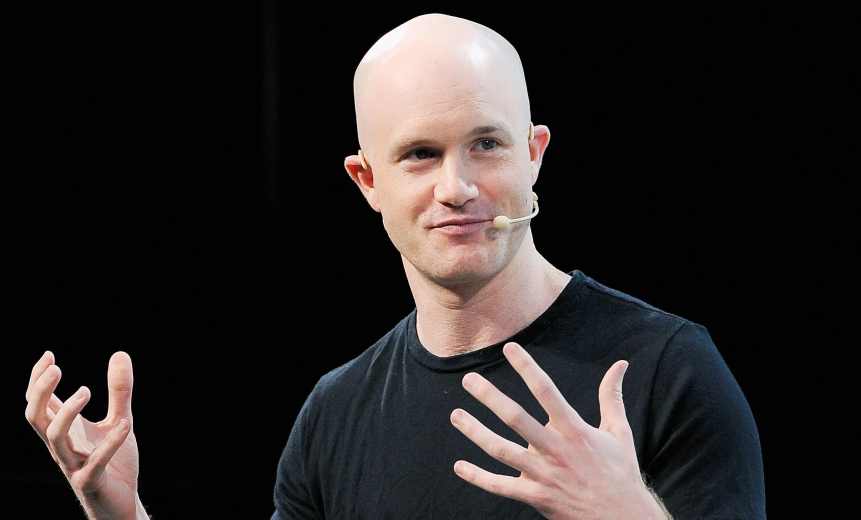

Meanwhile, following the earnings report, Coinbase stock tumbled more than 23%. Coinbase CEO Brian Armstrong tried to reassure users saying there’s no risk of bankruptcy right now. In a post on Twitter Tuesday night, Brian told the users that their funds were safe and apologized for not being more forthright with communicating this risk when it was added.

“1/ There is some noise about a disclosure we made in our 10Q today about how we hold crypto assets. Tl;dr: Your funds are safe at Coinbase, just as they’ve always been,” Armstrong tweeted.

1/ There is some noise about a disclosure we made in our 10Q today about how we hold crypto assets. Tl;dr: Your funds are safe at Coinbase, just as they’ve always been.

— Brian Armstrong (@brian_armstrong) May 11, 2022