FinTech startup Stripe jumps into crypto with a feature that lets merchants pay their users in cryptocurrency using USDC stablecoin

About a year ago, fintech startup Stripe launched Stripe Tax to simplify global tax compliance for small businesses and merchants. The new Stripe Tax automates tax calculation and collection for transactions on Stripe, tells businesses where they need to collect taxes, and creates comprehensive reports to make filing taxes easy. Now, the $95 billion unicorn tech startup is going the extra mile to help online merchants pay their users using cryptocurrency.

Today, Stripe announced a new feature that will enable businesses and merchants to pay their users via cryptocurrencies, starting with Twitter, in the latest sign that fintech companies are warming to digital assets.

Stripe said on Friday that it will start offering merchants the ability to make payouts in crypto through the stablecoin USDC, which is issued by crypto firm Circle. We wrote about Circle last week after the company raised $400 million in funding led by BlackRock and Fidelity.

The use of stablecoins, especially Circle’s stablecoin, has increased in reach and popularity over the years. Crypto day traders typically use Stablecoins as safe haven by shifting their unstable tokens to safe real currencies (like the dollar) because wild market fluctuations make it unsafe to hold. Unlike regular cryptocurrencies like Bitcoin and Ether which go through volatility, stablecoins are tokens that are pegged to fiat currencies to maintain a stable price.

According to Stripe, starting Friday, Twitter will let a certain number of creators receive their earnings from its paid Ticketed Spaces and Super Follows features in USDC. Citing the digital coin’s notoriety for volatile price swings and a lack of efficiency in making everyday transactions, Stripe stopped accepting payments using bitcoin in January 2018.

“While the ‘store of value’ aspects of cryptocurrencies typically receives the most attention, we view the prospect of ‘open-access global financial rails’ as being at least equally compelling,” Stripe said in a blog post on Friday. “As a result, we’ve been exploring ways to use cryptocurrency-based platforms to unlock broader access.”

“We plan to add support for additional rails and payout currencies over time,” Stripe added.

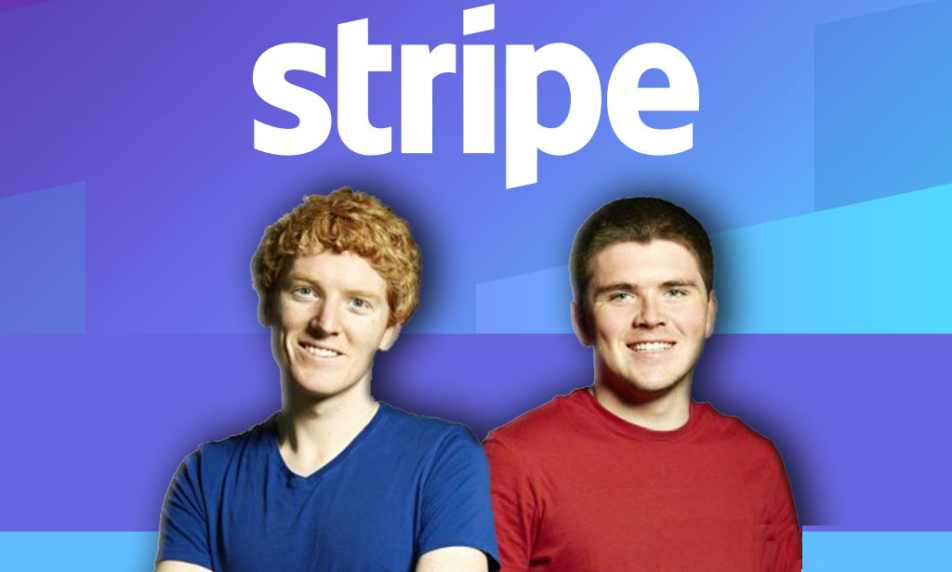

The San Francisco-based Stripe software platform was founded in 2010 by two Irish brothers Patrick Collison and John Collison to compete directly with PayPal, Adyen, and Square. The company allows businesses to accept online payments. Today, Stripe is now one of the most valuable fintech startups in the world. Patrick and John Collison, who are 32 and 30 respectively, are each worth over $11 billion.