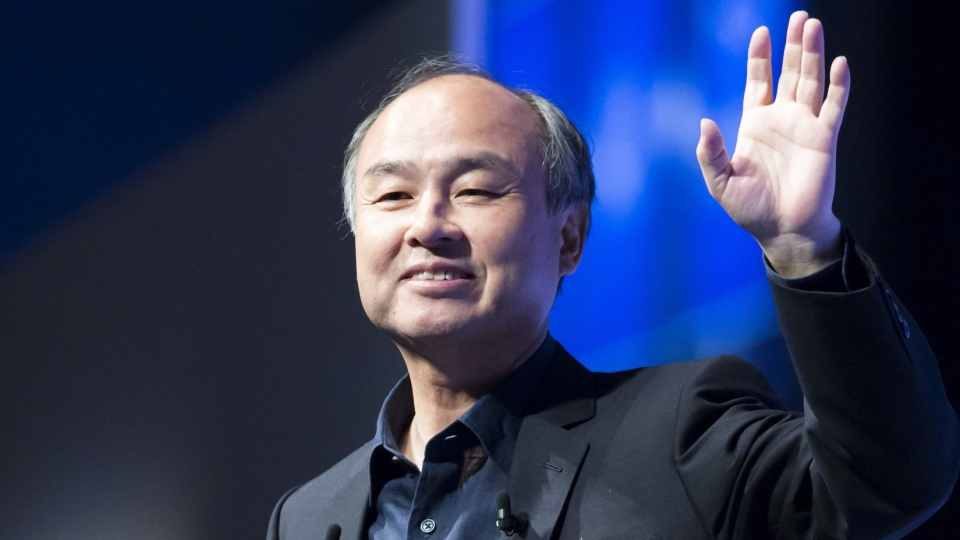

Meet Masayoshi Son, SoftBank CEO, unicorn hunter, and the craziest billionaire who lost $70 billion almost overnight

SoftBank Group is a household name in the startup community. Some of you have probably never heard of this company. We’ve covered extensively over the past five years. Founded in 1981, Softbank is a Japanese conglomerate with a market value of $75 billion.

The company owns stakes in many technology, energy, and financial companies. Softbank also runs Vision Fund, the world’s largest technology-focused venture capital fund, with over $100 billion in funding capital.

However, what most people don’t know about Softbank is its founder, Masayoshi Son, a Japanese business magnate and investor of Korean descent. Born on August 11, 1957, in Tosu, Saga, Japan, into a second-generation Zainichi Korean family, Son is the founder, chairman, and CEO of SoftBank, CEO of SoftBank Mobile, and chairman of UK-based semiconductor company Arm Holdings.

Son started his entrepreneurial journey after he relocated from Japan to the United States where he invented the first electronic dictionary, which he sold to Sharp for $1.7 million.

Son started his entrepreneur journey after he invented the first electronic dictionary, which he sold to Sharp for $1.7 million. He later used the capital to launch SoftBank at the age of 24. Accustomed to adversity and failure, Son told Bloomberg’s David Rubenstein in an interview back in 2018 that he lost $70 billion of his investment during the dot-com crash of 2000 before re-building to the point that he was able to buy Softbank back from Vodafone Japan, giving it a stake in Japan’s $78 billion mobile markets. Son later acquired one of the US’s big three networks, Sprint.

Fast forward to November 2019, SoftBank posted an $8.9 billion loss from its investment in Uber and WeWork. Commenting on the loss, Softbank CEO Son, 65, told a news conference in a remarkable admission for an executive well known for his ebullience, “My investment judgment was poor in many ways and I am reflecting deeply on that.”

But that was not all. Two years earlier, Son made a personal investment in bitcoin in late 2017 and lost more than $130 million when he sold out in early 2018, according to a report from The Wall Street Journal (WSJ), citing unidentified people familiar with the matter. Unfortunately, Son got out too early.

Per WSJ, Son’s investment in digital currency came at the peak of the bitcoin frenzy after the world’s most popular cryptocurrency had already risen more than 10-fold in 2017, the people said. Bitcoin later peaked at nearly $20,000 in mid-December 2017, and Mr. Son sold in early 2018 after bitcoin had plummeted.

Almost two years after WSJ first reported the story, Unilad, a U.K.-based new site, reported that Son recently spoke at the online DealBook conference from The New York Times, telling the tale of how he tried and failed to master Bitcoin during his downtime. According to the report, a “Bitcoin evangelist” and friend of Son’s advised him to invest at least one percent of his assets into bitcoins, which at the time came to about $200 million.

Son went on to say that he ‘doesn’t understand bitcoin. He said that after spending about five minutes a day checking Bitcoin’s sometimes sudden drops and spikes in value, he found it “distracting his focus on his own business” and decided to quit and sold his bitcoin investment at a loss. Had Son waited for another three years, he would have profited from his investment.

‘I feel so much better,’ Son said. He later told the online DealBook conference audience that while he is glad to be free of cryptocurrency, the popularity of digital currency will not die down any time soon. Son said, “I think the digital currency will be useful. But I don’t know what digital currency, what structure, and so on.”

However, before you start feeling bad for Son, don’t worry! This month, SoftBank bet finally paid off. DoorDash is one of the tech startups backed by Softbank in its early days. Last month, the food delivery startup filed to go public at a $30 billion valuation. DoorDash was hoping to list 33 million shares at a price between $75 and $85. But its stock popped after opening at $182 per share on the New York Stock Exchange.

The payday finally came for SoftBank’s as its SoftBank Vision Fund turns $680 million DoorDash investment into $11.5 billion. SoftBank made an almost 17X gain on its investment in the startup which made its market debut yesterday.

Since then, SoftBank Vision Fund has invested billions of dollars in popular startups. Some of SoftBank’s portfolio of companies include well-known startups that have already gone public including, Better.com, Uber, Didi, Coupang, and many more.

Son was also an early investor in many internet firms. He invested a $20 million stake into Alibaba in 1999 and owns 29.5% of Alibaba, which is worth around $108.7 billion as of 23rd October 2018. Son also invested in Yahoo in 1995. According to Forbes magazine, Son’s estimated net worth is the US $23 billion and he is the richest man in Japan.

Below is a mini-documentary video about Son: The Unicorn Hunter and The Craziest Billionaire.