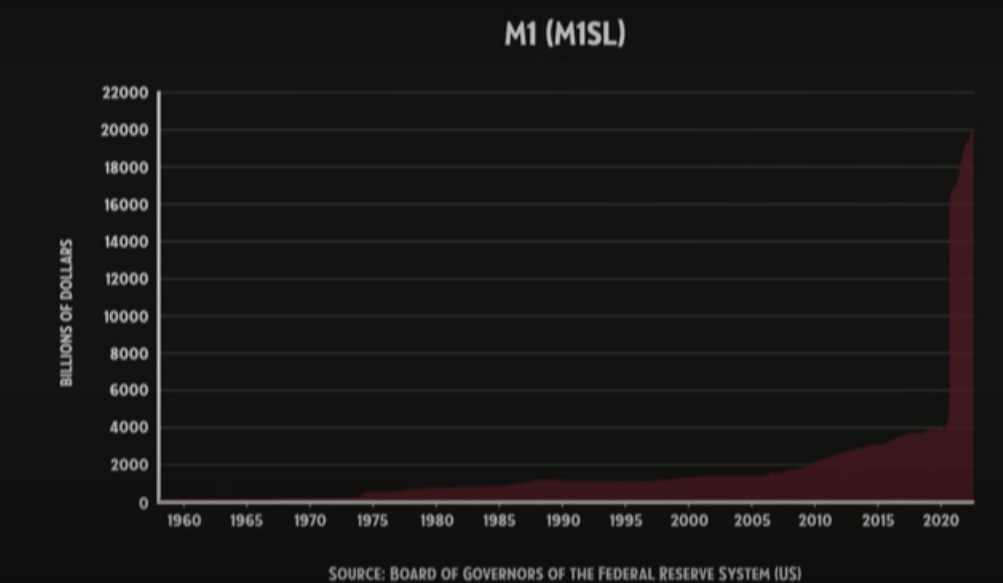

80% of all US dollars in existence were printed in the last 22 months (from $4 trillion in January 2020 to $20 trillion in October 2021) – UPDATED

Last year, we published a piece titled “40% of US dollars in existence were printed in the last 12 months,” where we highlighted the staggering increase in currency circulation. The article quickly became one of our most widely read articles, garnering over a quarter of a million unique visitors.

As of January 6, 2020, the US Federal Reserve held around $4 trillion. Since then, there have been significant shifts. The Fed ramped up its quantitative easing efforts—often termed as money printing—to bolster liquidity in US banks and infuse trillions of dollars into the economy.

Fast forward to February 2022, and US inflation has surged to a 40-year high, reaching 7.5% in 2021, fueled by the Federal Reserve’s continuous injection of funds into the economy. Many observers draw comparisons between the current situation and the hyperinflation experienced in 1921 Weimar Germany.

The Fed’s reliance on money printing has buoyed Wall Street but exacerbated economic inequality. While the stock market and cryptocurrencies soar to record highs, income and wages remain relatively stagnant. The relentless printing of money by the Federal Reserve further devalues the dollar, placing millions of Americans at a financial disadvantage.

Now, over a year after our initial report, the Federal Reserve has updated its figures. The situation has worsened. It’s no longer just 40%, 50%, or even 70% of all US dollars printed since 2020—it’s nearly 80%. To comprehend the enormity of the Fed’s money printing, let’s rewind 22 months. At the outset of 2020, currency in circulation stood at $4.0192 trillion. By January 4, 2021, this figure had surged to $6.7 trillion. Then came an unprecedented surge. By October 2021, the amount in circulation had skyrocketed to $20.0831 trillion.

What started as an emergency monetary policy to shield the economy from the COVID-19 pandemic in 2020 has led to further devaluation of US dollars. Since March 15, 2020, the Federal Research buys $80 billion in Treasuries and $40 billion in housing-backed securities each month, pushing the Fed’s balance sheet to $8.66 trillion as of December 7, 2021.

However, the Fed’s asset and bond purchases are just is of the ways the Federal Research injects trillions into the economy. In addition, the U.S. government also issued stimulus checks to millions of employed Americans. Where did the money come from? The government had to borrow by selling its debt in the form of U.S. Treasury bonds and other types of securities. Then after the bonds are sold, the Federal Reserve gets to work and starts printing money.

Meanwhile, the Fed’s excessive money printing is beginning to have a devastating effect on the economy and people’s purchasing power. For example, the annual inflation rate in the US surged to 6.8% in November of 2021, the fastest rate since 1982.

At the rate we’re going, the Fed’s addiction to printing led to further devaluation of the US dollar since money printing doesn’t necessarily increase productivity or economic output. What the Fed is doing now has been tried throughout history. The outcome is always the same. Take, for example, Germany. Between June 1921 and November 1923 in Weimar Germany, the highest monthly inflation rate rose by over 30,000%. Zimbabwe is another country with hyperinflation.

Meanwhile, money printing is nothing new. The Federal Reserve has been printing money since 1971 when the United States moved away from the gold standard in 1971 after President Nixon ended the convertibility of U.S. dollars to gold.

On Aug. 15, 1971, Former President Richard Nixon said in a speech, “I have directed [Treasury] Secretary Connally to suspend temporarily the convertibility of the dollar into gold or other reserve assets, except in amounts and conditions determined to be in the interest of monetary stability and in the best interests of the United States.”

In 1970, the average income was $9,400 and a new house was $23,400. Today, the cost of an average home is over $200,000.

Is the Federal Reserve repeating the same mistakes of 1921 Weimar Germany?

So if history is any guide, what the Federal Reserve is doing now has been tried throughout history. As the Federal Reserve continues to print trillions of dollars out of thin air with no productivity to back it up, at some point down the road, the world will finally lose faith in the US dollar as a global currency and conclude that it no longer makes sense to store their wealth in US dollars.

Today, the Federal Reserve appears to be following in the footsteps of 1923 Germany’s Weimar Republic shortly after World War I. The country has often been cited as a classic of unending money printing. Between June 1921 and November 1923, the highest monthly inflation rate rose by over 30,000% in Weimar Germany.

It all started around 1921 when Germany stopped backing its currency with gold and instead fired up its money-printing machine (similar to what the Federal Reserve is doing today) in order to finance the war. Then the money-printing machines continued printing after the war to help pay for reparations imposed upon Germany by the Allies.

In closing, below is a video from our friend, Jake Tran, about how Nixon’s 1971 decision because a turning point for the United States, and how 1971 marked the year humanity became enslaved.

February 2022 Update: Inflation hits a 40-year high, rises to 7.5% in 2021 even as the Federal Reserve continues to print trillions out of thin air. The US is now on the path of 1921 Weimar Germany.