Top 100 Startups Reshaping the B2B Payments Fintech Market

In 2020, the global GDP amounted to about $84.54 trillion, according to data from research firm Statista. On the other hand, the global B2B eCommerce market was estimated to be $12.2 trillion in 2019, which is over 6 times that of the B2C market. Some analysts think the figure is way higher. Nonetheless, the global eCommerce market number doesn’t really tell the whole story.

Now, consider millions of companies around the world and the number of global eCommerce transactions that take place every year, and trillions of dollars involved. Over the last decade, the Internet has led to the rise in cross-border trading and enable businesses that previously lacked access to the Internet to sell their products in a global market. This has also driven the growth of the global B2B payments market.

It is estimated that B2B payments volume totals approximately $120 trillion per year globally and roughly $25 trillion per year domestically. The growth is expected to rise as more and more businesses are moving online due to the covid induced pandemic.

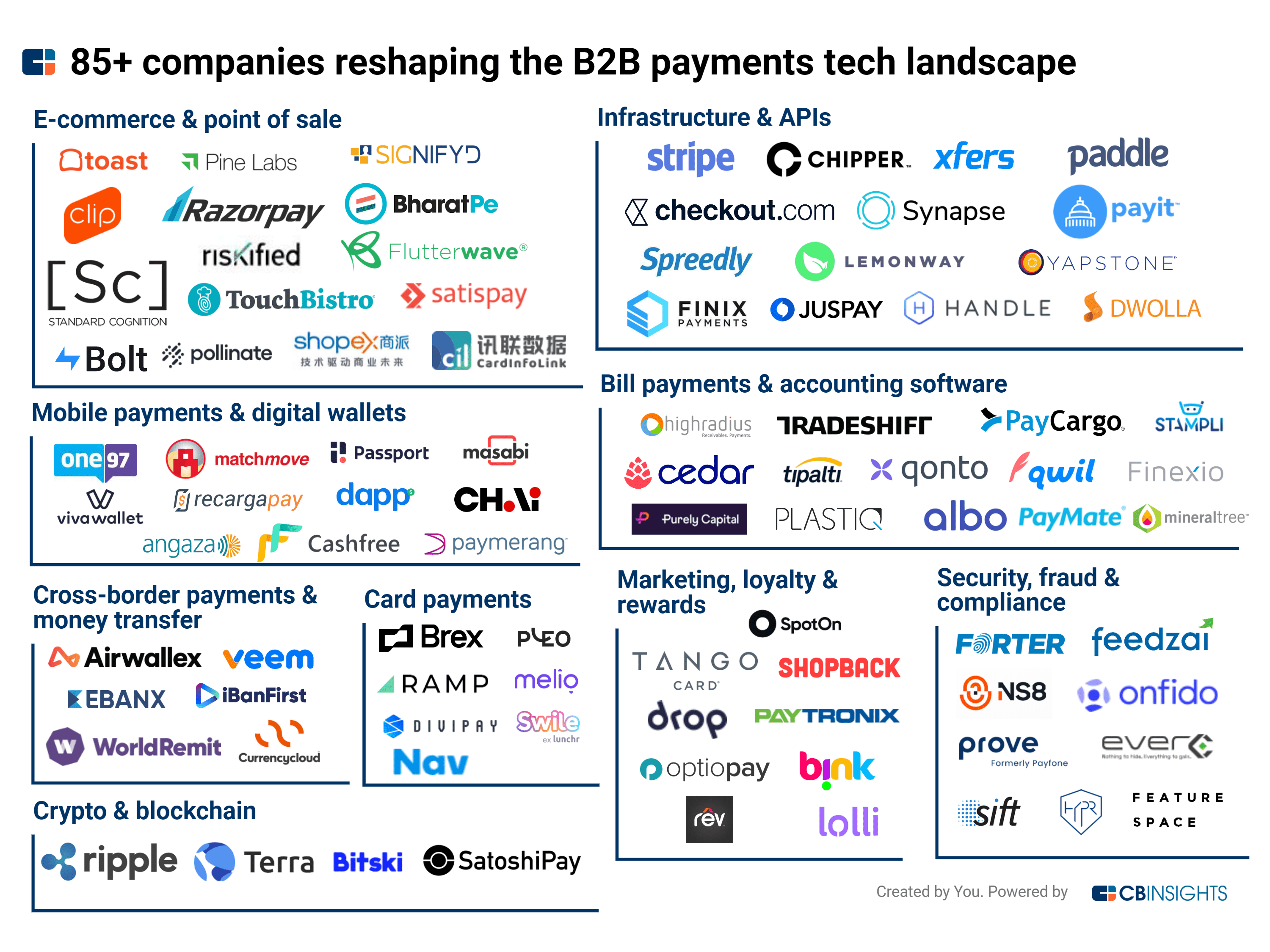

As the B2B payments fintech market heat up, hundreds of tech startups are flocking the space competing to get a piece of the pie. These startups are transforming every aspect of the payments value chain — from point-of-sale systems to API integrations to crypto.

In the past four years alone, we’ve covered at least one hundred startups that raised new funding to disrupt the B2B payments space. Some of these startups were acquired by other tech giants before they even go public. For example, in October 2020, Stripe acquired Nigeria’s Paystack for over $200 million to expand its footprint in Africa.

And then we have SatoshiPay, a blockchain-based fintech startup that offers a micropayment solution for content creators. The startup recently secured €550,000 in funding to offer B2B cross-border money transfer solutions and connect the world through instant payments using blockchain.

The B2B payments space is very broad and not just business-facing. It includes all tech startup companies that provide payment technology to businesses that enable the transfer, acceptance, and processing of money.

In this piece, we are going to look at the top 100 startup companies reshaping the B2B payments fintech market using data from CBInsights, a research firm that predicts technology trends. Using hundreds of data points, CBInsights, the report was created with data from CB Insights’ emerging technology insights platform, which offers clarity into emerging tech and new business strategies through tools like:

• Earnings Transcripts Search Engine & Analytics to get an information edge on competitors’ and incumbents’ strategies

• Patent Analytics to see where innovation is happening next

• Company Mosaic Scores to evaluate startup health, based on our National Science Foundation-backed algorithm

• Business Relationships to quickly see a company’s competitors, partners, and more

• Market Sizing Tools to visualize market growth and spot the next big opportunity

Below is a breakdown by category of the top 100 startup companies reshaping the B2B payments fintech market.

E-commerce & point of sale (POS): Companies in this category help merchants process payments online or offline through omnichannel and physical point-of-sale systems. For example, India-based Pine Labs ($492M in total funding) offers cloud-based POS payment solutions that allow merchants to accept credit cards, debit cards, e-wallets, and QR codes as payment methods.

Infrastructure & APIs: These companies offer payment infrastructure and API integrations for businesses. Chipper Cash offers an API solution to help businesses send and accept online payments in Africa. The company last raised a $100M Series C at a $2B valuation.

Mobile payments & digital wallets: Companies in this category offer mobile payment solutions and digital wallet (or e-wallet) services to businesses. Passport ($212M in total funding) offers a mobile payment system and operating software specifically designed for clients in the parking, permits, and curb space business.

Singapore-based MatchMove ($151M in total funding) offers an end-to-end virtual wallet and provides expense management, remittance, and banking services to help businesses increase revenue and boost user engagement.

Bill payments & accounting software: This category comprises companies that help businesses pay their bills online and develop solutions for accounts payable, accounts receivable, bookkeeping, treasury, and taxes. HighRadius ($475M in total funding) offers automated accounts receivable and treasury solutions powered by AI that aim to help businesses increase the efficiency of their order-to-cash and treasury systems.

Cross-border payments & money transfer: Companies in this category help businesses send money, in part by facilitating cross-border transactions. Brazil-based EBANX ($460M in total funding) offers cross-border payment processing across Latin America along with other services, such as those for local-fund collecting, customer support, know your customer (KYC), and remittances.

Card payments: Companies in this category provide payment cards and/or credit card offerings to merchants or businesses. For example, Ramp Financial offers corporate cards and a spend management platform to businesses. The company last raised a $50M second Series B at a $1.6B valuation.

Additionally, Denmark-based Pleo offers corporate payment cards and expense management software to businesses. The company recently raised a $150M Series C at a $1.7B valuation.

Marketing, loyalty & rewards: Companies here offer customer engagement tools as well as loyalty/rewards programs for e-commerce companies. Lolli ($10M in total funding) is a bitcoin rewards application that partners with retailers to offer loyal customers free bitcoin or cash.

Security, fraud & compliance: Companies in this category offer security, fraud prevention, and compliance SaaS solutions to businesses. For example, Feedzai offers a cloud platform equipped with a number of features to help manage financial risk, such as account opening authentication, transaction monitoring, and anti-money laundering machine learning technology. The company recently raised a $200M Series D at a $1B valuation.

Crypto & blockchain: These are payment technology companies using cryptocurrency or blockchain technology to provide solutions to businesses. For example, Terra ($57M in total funding) partners with global e-commerce platforms to allow merchants and consumers to take advantage of blockchain benefits, such as low transaction costs.

The market map includes private, active global companies that were selected based on recency of funding, total funding, and primary use-case. It is not intended to be exhaustive of the space and categories are not mutually exclusive.