U.S. and Canadian regulators open probes into cryptocurrency scams with the launch of “Operation Crypto-Sweep”

Last week, we reported about the Securities and Exchange Commission (SEC)’s launch of HoweyCoins.com, a fictitious ICO website that show how easy it is to scam investors and warn about initial coin offering (ICO) risks. The site is part of the initiative by SEC’s Office of Investor Education and Advocacy (OIEA) to highlight the risks associated with investments ICOs and warn investors about the potential danger of investing in fraudulent ICOs.

Now, regulators in the U.S. and Canada are launching a widespread crackdown on some cryptocurrency investment schemes. Today, the U.S. and Canadian regulators announced they have opened probes into cryptocurrency scams with the launch of “Operation Crypto-Sweep.” The operation is led by the North American Securities Administrators Association and includes 40 state and provincial regulators. According to a report from CNBC, the association have launched least 70 investigations so far.

The coordinated effort by the regulators, was first reported by the Washington Post, focuses on a cryptocurrency fundraising process known as initial coin offerings, or ICOS as well as other “investment schemes.”

“We’re putting ourselves in the shoes of investors. We’re seeing what’s being promoted to investors. And then we’re taking the next step and then we’re finding out whether they’re complying with securities laws,” said Joseph Borg, president of NASAA and the director of the Alabama Securities Commission.

Per Washington Post, Borg posed as members of the public, discovered that 30,000 cryptocurrency-related domain names in recent weeks, with most of which were registered in the past year. What is surprising is that, many of the alleged scams use fake addresses, slick marketing materials and promises of over 4 percent daily interest, regulators said.

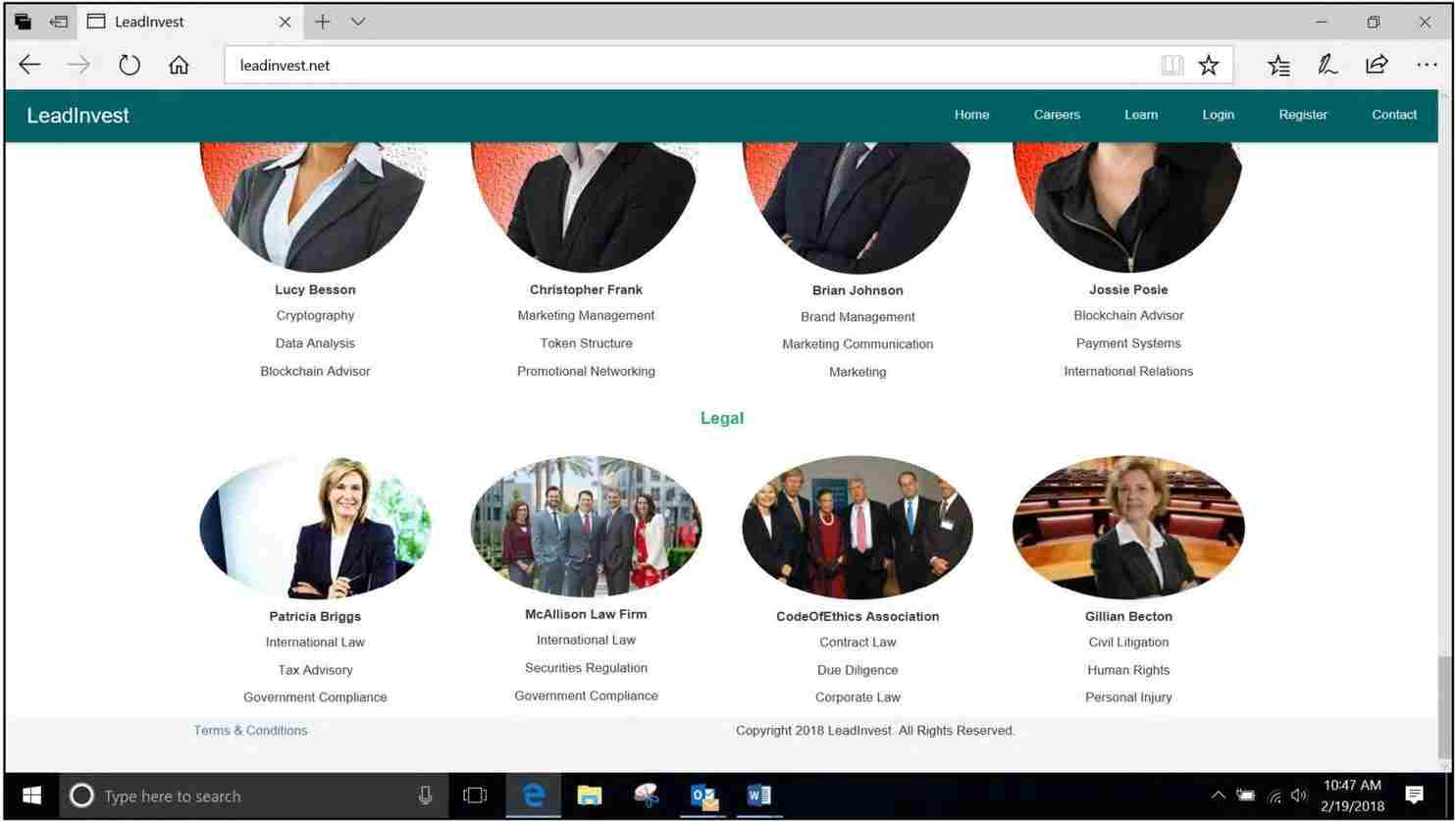

One of the fake site is LeadInvest.Net. The site used unauthorized photos of high-profile individuals, such as Supreme Court Justice Ruth Bader Ginsburg, to prove their legitmacy.

A website targeted by the Texas State Securities Board for enforcement. The site is accused of using a deceptive image of Supreme Court Justice Ruth Bader Ginsburg as part of its Code of Ethics Association. (Texas State Securities Board)

“The market for cryptocurrency investments is saturated with fraud, and our work is only revealing the tip of the iceberg,” says Joseph Rotunda, director of enforcement at the Texas State Securities Board.

However, Borg also stated that: “Not every ICO or cryptocurrency investment product is fraudulent.” In the meantime, has a page on its site to educate and warn potential investors about the danger of investing in cryptocurrency. You can find the page here.

State regulators launch 'Operation Crypto-Sweep' to police cryptocurrency investment schemes https://t.co/jkLs5pquUK

— CNBC (@CNBC) May 21, 2018

![How much data do we create every day? [Infographic]](https://techstartups.com/staging/wp-content/uploads/2018/05/How-much-data-do-we-generate-every-minute-700x466.jpg)