Toyota-backed self-driving startup Pony AI raises $260M in U.S. IPO, valued at $4.55 billion

In October, Pony AI revealed plans to go public, marking a significant milestone after eight years of development. Just two weeks ago, the Toyota-backed self-driving startup filed for a U.S. initial public offering (IPO), aiming for a valuation above $4 billion.

Today, Pony AI confirmed it raised $260 million in its U.S. IPO, bringing its valuation to $4.55 billion. The move highlights renewed investor confidence in U.S.-listed tech firms and represents a pivotal moment for the autonomous driving industry.

The offering comes at a time when investor confidence in China-based firms remains uncertain under the current U.S. administration. Both nations are racing to lead in autonomous driving technology, and Pony AI’s listing could offer insights into how U.S. investors are approaching these companies.

The company plans to list on Nasdaq under the ticker symbol “PONY.” Goldman Sachs, BofA Securities, Deutsche Bank, Huatai Securities, and Tiger Brokers are underwriting the offering. Toyota, a significant investor, holds a 13.4% stake in Pony AI.

Two key investors, including Chinese automaker BAIC, have committed to purchasing $74.9 million worth of shares during the IPO. Additionally, private placements are expected to bring in another $153.4 million.

The IPO follows years of turbulence for China-based firms listed in the U.S., including Didi Global’s delisting after regulatory pressure in China. Tensions have eased somewhat, with Beijing resolving a key audit dispute with U.S. regulators in late 2022, paving the way for Chinese firms to reenter the market.

Despite this progress, Pony AI faces obstacles. Public skepticism toward autonomous vehicles, concerns over data privacy, and competition from players like Tesla—promising its own driverless ride-hailing services in California and Texas—pose significant challenges.

According to Reuters, Pony AI has stated its U.S. operations will remain “limited in scope” for now. Other Chinese firms, such as EV maker Zeekr and autonomous tech company WeRide, have also pursued IPOs in the U.S. this year, riding a wave of renewed interest in tech startups as the IPO market recovers.

The company sold 20 million American depositary shares at $13 each and secured an additional $153.4 million in a private placement. Backed by Toyota, Pony AI’s valuation has dropped significantly from $8.5 billion two years ago.

Pony AI’s shares are set to begin trading on the Nasdaq on Wednesday. Analysts, however, caution that the adoption of robotaxis could take years due to ongoing safety and reliability concerns, even as China moves faster than the U.S. to approve trials.

Meanwhile, the company remains unprofitable as it continues to channel resources into expanding its operations.

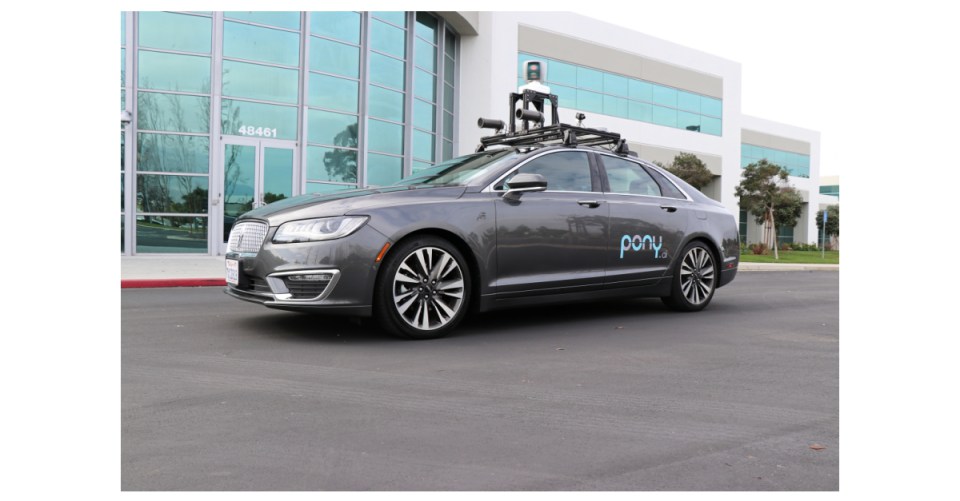

Founded in 2016 by James Peng and Tiancheng Lou, Pony AI operates in both California and Beijing. It aims to enhance safety and reliability in autonomous mobility while competing for leadership in the Chinese market.

In April 2022, Pony.ai became the first autonomous-driving taxi company in China to secure a taxi license in China. A year later, it partnered with Toyota to mass produce robotaxis in China, setting up a venture this year that will build cars that employ the startup’s autonomous driving technology and ride-hailing services.