US debt hits $35 trillion milestone: Took 200 years to reach $1 trillion but only 4 years to add $12 trillion in new debt

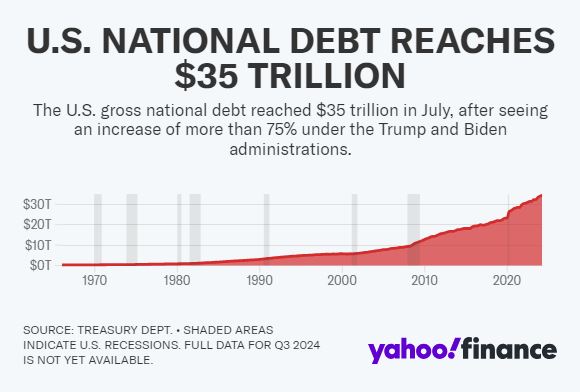

In 2021, we wrote a piece highlighting a startling fact: “80% of all US dollars in existence were printed in the last 22 months.” Back then, the money supply surged from $4 trillion in January 2020 to $20 trillion by October 2021. Fast forward to today, and the financial landscape has shifted dramatically. According to a recent Yahoo Finance report, the US national debt has surged past a critical milestone, now exceeding $35 trillion.

This report, based on daily Treasury Department data and released late Monday, shows the gross debt level at $35.001278 trillion. Since January alone, the debt has increased by $1 trillion, climbing at an alarming rate of nearly $5 billion per day in 2025.

Credits: Yahoo Finance

“The US national debt topped a psychologically important milestone of $35 trillion in recent days and has risen by $1 trillion since January — mounting by nearly $5 billion every day so far in 2025,” Yahoo Finance reported.

US National Debt Took 200 Years to Reach $1 Trillion But Only Four Years to Add $12 Trillion In New Debt

The situation becomes even more concerning when considering the broader timeline. Since President Joe Biden took office in January 2020, the national debt has skyrocketed by 50%, soaring from $23 trillion to $35 trillion. To put this in perspective, it took the US 200 years to accumulate $1 trillion in debt, yet just four years to add an additional $12 trillion.

“It took 200 years for US debt to reach $1 trillion but only four years to add $12 trillion in new debt.”

The burden of this debt is exacerbated by rising interest rates, which now average around 5%. Interest payments are projected to reach $1.5 trillion next year, consuming about 30% of all government revenue.

“This is crazy,” Elon Musk remarked on X, responding swiftly to the news.

This is crazy https://t.co/K9zknirh7U

— Elon Musk (@elonmusk) July 30, 2024

The ballooning national debt is a result of both new spending and longstanding obligations. Under former President Donald Trump, the debt increased by nearly $8 trillion. But President Joe Biden made the debt situation worse by adding $12 trillion in under four years.

But debt is just one of the issues we have to worry about. The Federal Reserve’s aggressive money printing to finance the debt has contributed to inflation, pushing interest rates from nearly zero two years ago to the current 5.5%.

While money printing isn’t new, its consequences are well-documented throughout history. During Germany’s Weimar Republic from June 1921 to November 1923, hyperinflation reached a staggering monthly rate of over 30,000%. Zimbabwe has also faced similar hyperinflation crises.

Since 1971, when President Nixon ended the convertibility of U.S. dollars to gold, the Federal Reserve has continued to print money. In his August 15, 1971, address, Nixon stated, “I have directed [Treasury] Secretary Connally to suspend temporarily the convertibility of the dollar into gold or other reserve assets, except in amounts and conditions determined to be in the interest of monetary stability and in the best interests of the United States.”

In 1970, the average income was $9,400, and a new house cost $23,400. Today, the average home price exceeds $200,000.

Historically, excessive money printing leads to a loss of faith in a currency. As the Federal Reserve continues to inject trillions into the economy without corresponding productivity gains, global confidence in the US dollar may erode, undermining its status as the world’s reserve currency.

The Federal Reserve’s current actions echo the infamous hyperinflation of 1923 Germany’s Weimar Republic, highlighting the dangers of unchecked money printing.