The rise and fall of Beyond Meat: How a Hollywood-backed fake meat company lost its sizzle and 95% of its value

It’s been two years since we last covered Beyond Meat, the plant-based meat company once hailed as the “Tesla of the food industry.” Backed by Hollywood celebrities and positioned as a solution to climate change, Beyond Meat aimed to reshape how the world consumed protein.

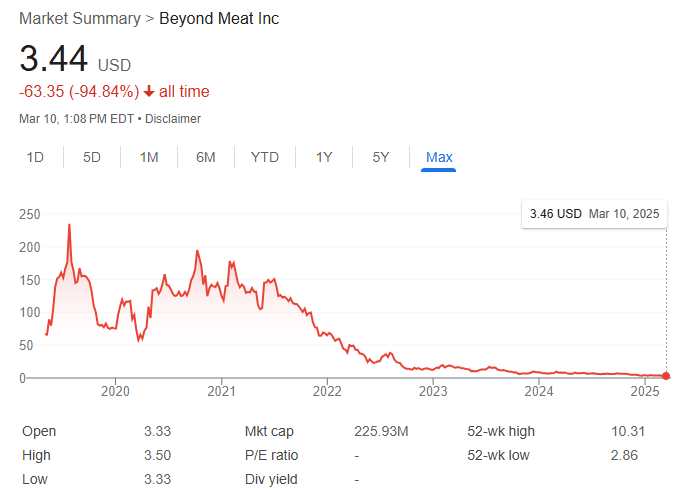

But by 2022, the company had lost 80% of its value and was struggling to stay afloat. Fast forward to today, Beyond Meat has seen about 95% of its market capitalization vanish. So, what happened?

The Rise and Fall of Beyond Meat

A Hot Start

Founded in 2009 by Ethan Brown, Beyond Meat set out with a mission to create sustainable and nutritious plant-based meat alternatives. The company aimed to address global challenges like human health, climate change, resource constraints, and animal welfare.

In May 2019, Beyond Meat went public with a bang. Its shares more than doubled on the first day of trading, signaling strong demand for plant-based options. At its peak in July 2019, the stock hit $234.90. Today, it sits at just $3.44 as of the time of writing, marking a 95% drop in value.

Not Even Hollywood Celebrities Could Save Beyond Meat from Its Collapse

During its public debut, Beyond Meat was a success story. It had raised $241 million on its IPO day, with backing from big names like Bill Gates and Leonardo DiCaprio.

Beyond Meat even brought Kim Kardashian onboard as an ambassador and Chief Taste Consultant. But as the economy weakened, so did Beyond Meat’s sales. McDonald’s ended its test of Beyond’s meatless patties, dealing a significant blow to the company. Their partnership, announced in early 2021, was quietly shelved by June, and Beyond’s stock took a 6% hit.

Adding to the company’s woes, in 2022, Beyond Meat’s then-COO, Doug Ramsey, was arrested for reportedly biting a man’s nose after an Arkansas college football game. The bizarre incident sparked widespread media coverage and further dented the company’s public image.

Some argue that taste played a role in the decline. Critics noted that Beyond Meat’s products didn’t quite deliver on flavor. In fact, Scott Shafer suggested in a video analysis that Beyond Meat could be facing bankruptcy by 2024.

What Went Wrong?

Falling Stock and Sales

- The stock plummeted from $239 in 2019 to just above $3 today.

- Sales dropped, leading to layoffs and factory closures.

- Consumer interest waned as expectations around taste and experience weren’t met.

- The 2022 COO scandal added to the company’s mounting challenges.

“This was made to be a major disruption of the food supply and a major threat to the beef industry. It didn’t work out that way.”

Industry Challenges

Plant-based meat evolved from traditional bean burgers to more advanced products like Beyond Burger and Impossible Foods. Beyond Meat’s IPO rode the wave of growing interest in meat alternatives, with sales reaching $1.3 billion by 2020—a 46% increase from the year before.

But growth hit a wall. Why?

- Price Disparity: Plant-based meats were consistently pricier than traditional options, costing about $4.20 more per pound. Inflation made consumers even more price-sensitive.

- Restaurant Struggles: While European markets fared better, U.S. fast-food chains faced challenges. Drive-through complexities and low demand hampered progress.

- Taste and Health Concerns: Initial marketing framed these products as healthier, but consumers questioned the highly processed ingredients. Social media backlash added to the skepticism.

“Processed to a lot of consumers is antithetical to wellness, health, and ‘better for you’.”

The Path Forward

Despite these hurdles, Beyond Meat isn’t giving up.

- Product Reformulation: The company is working on improving taste and texture, with plans to introduce a new steak alternative.

- Health Focus: Beyond is collaborating with health experts and seeking endorsements from organizations like the American Heart Association.

- Cost Reduction: By improving production efficiency, they aim to bring prices closer to traditional meat.

“Over time, we will underprice animal protein by leveraging efficient production processes.”

Long-Term Outlook

- Innovations in processing could enhance taste and texture.

- Lower prices may attract a broader audience.

- As global meat consumption grows, sustainable alternatives could find new momentum.

Final Thoughts

Beyond Meat has faced significant challenges but remains determined to adapt. Its focus on innovation, health, and affordability could be the key to winning back consumers and ensuring its place in the future of food.

“We’ve fought through COVID, high inflation, and industry backlash. We’re still standing and getting stronger.”

Below is a video from CNBC about “why Beyond Meat and the plant-based meat industry couldn’t live up to the hype.”