Andreessen Horowitz raises $7.2 billion for new venture funds to invest in late-stage tech startups

In a sign of resurgence in the tech startup scene, renowned venture capital firm Andreessen Horowitz announced Tuesday it has raised $7.2 billion across five diverse funds. The massive capital not only underscores the firm’s bullish stance on the tech startup landscape but also serves as a promising harbinger following a period of funding slowdown.

The announcement of this funding arrives on the heels of a strategic move by the firm two years ago, when it launched a $4.5 billion fund to invest in crypto and blockchain tech startups. However, amid a broader slowdown within the crypto industry, this latest fund represents a strategic pivot, redirecting the firm’s focus squarely back to the core of tech innovation.

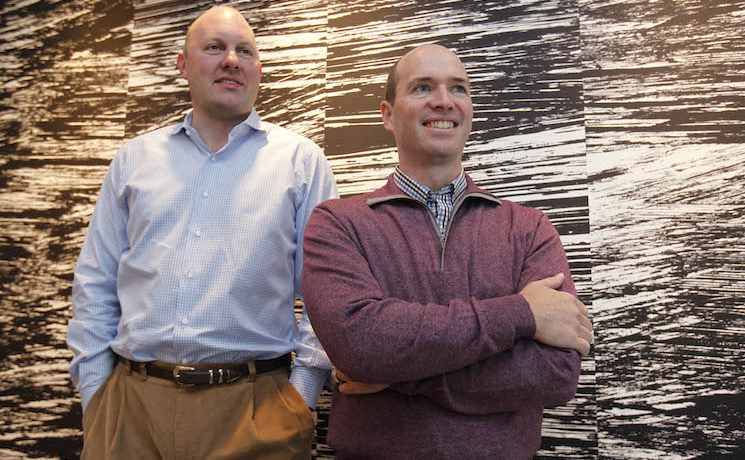

Ben Horowitz, co-founder alongside Marc Andreessen in 2009, took to the firm’s blog to express the significance of this development, highlighting it as a pivotal moment for their trajectory. “This marks an important milestone for us,” Horowitz wrote in a blog post.

A substantial portion of the newly secured funding, totaling $3.75 billion, has been channeled into Andreessen Horowitz’s growth fund. This fund primarily targets later-stage enterprises poised for imminent public offerings or those necessitating substantial financial injections due to their capital-intensive nature.

Horowitz’s blog post also outlined the allocation of the remaining funds, with $1.25 billion designated for infrastructure, encompassing pivotal investments in artificial intelligence. Another $1 billion is set aside for app investments, while $600 million each is apportioned for games and a category the firm dubs “American Dynamism,” covering sectors vital to national interest such as aerospace, defense, education, and housing.

Initially eyeing a fundraising target of $6.9 billion across various funds, including two with a dedicated focus on artificial intelligence, Andreessen Horowitz’s ambitions were bolstered by the interest in AI investments, which have shown no signs of slowing down despite broader market fluctuations.

“Shortly after we started the firm, all that began to change. My partner Marc saw the new world coming and wrote about it in 2011 in a piece called, “Software is Eating the World.” What he predicted then came true. In the past 10 years, nearly every significant business has been reimagined as a software company, and the market for these companies has, as a result, increased dramatically. Along the way, each submarket – American Dynamism, Apps (Consumer, Enterprise, Fintech), Bio+Health, Crypto, Games, Growth, and Infrastructure – has become as big as the original entire Venture Capital market.”

Following a record surge in tech IPOs and startup investments in 2021, the venture investment landscape saw a stark reversal, with investors exhibiting a cautious approach amidst rising inflation and interest rates in 2022. This caution has translated into a significant downturn in venture deals, with U.S. venture investment deal volume plummeting to its lowest since 2017, according to PitchBook data.

Despite the market slowdown, Andreessen Horowitz remains steadfast in its commitment to tech innovation. However, notably absent from Horowitz’s post was any mention of cryptocurrency investments, an area where the firm had previously shown keen interest during the crypto frenzy of 2021.

While the firm continues to explore opportunities in the crypto space, alongside plans for a biotechnology fund, it remains poised to steer the course amid evolving market dynamics. Noteworthy among the firm’s recent investments is a substantial $350 million injection into Flow, a startup helmed by controversial WeWork co-founder Adam Neumann, signaling a continued appetite for disruptive ventures.

With the tech startup landscape showing signs of resurgence, Andreessen Horowitz’s latest funding coup not only bolsters its position as a key player in the venture capital arena but also underscores its unwavering commitment to fueling innovation in the tech ecosystem.

Funded in 2009 by Marc Andreessen and Ben Horowitz, Andreessen Horowitz (also called a16z) is one of the most influential investors in the world. The firm invests in both early-stage start-ups and established growth companies. Its investments span the mobile, gaming, social, e-commerce, education, and enterprise IT (including cloud computing, security, and software as a service) industries.

In 2011, for example, Andreessen Horowitz invested $80 million in Twitter, becoming the first venture firm that held stock in all four of the highest-valued, privately held social media companies including Facebook, Groupon, Twitter, and Zynga. The firm also invested in Airbnb, Lytro, Jawbone, Belly, Foursquare, Stripe, and other high-tech companies.

In addition to these popular tech companies, Andreessen Horowitz is also known for its early bets on Instagram, Lyft, Pinterest, and Slack, and made its first major crypto investment with Coinbase in 2013. The firm has since backed many startups in the crypto and NFT space, including Alchemy, Avalanche, Dapper Labs, OpenSea, Solana, and Yuga Labs.