Is ZoomInfo in trouble? Here’s why competition and customer sentiment may decide the company’s fate

ZoomInfo is a B2B data and intelligence platform mostly known for its large collections of information on more than 14 million companies, and 235 million business professionals, including more than 145 million contacts in markets outside of the United States.

Using its proprietary technology, ZoomInfo gathers and analyzes data from a wide range of sources, including public records, company websites, job postings, social media, and other online sources.

The $9.3 billion company is also a leader in the go-to-market (GTM) intelligence space. the company has grown its revenue year-over-year (YoY). In 2022, ZoomInfo has a 47% YoY revenue growth. In contrast, the company’s share price has been going in the opposite direction. Its share price fell by 53% from a year ago.

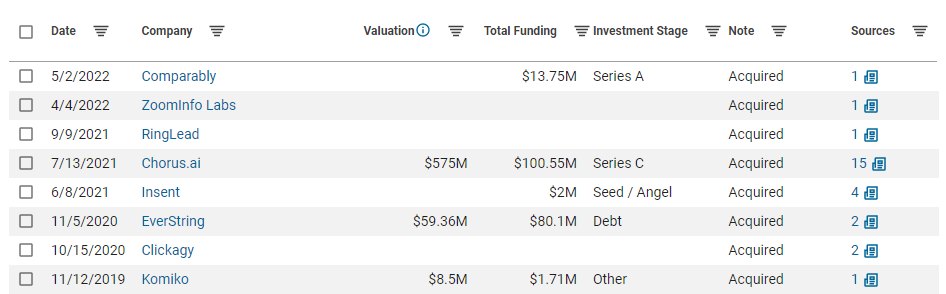

Over the years, however, ZoomInfo has aggressively acquired or merged with most of its competitors, including Comparably (talent acquisition), RingLead (data orchestration), Chorus.ai (conversation intelligence), and Insent (conversational marketing), among others. Below is a snapshot of its M&A activity from ZoomInfo, according to research firm CB Insights.

The most notable acquisition was that of Chorus.ai, a tech startup ZoomInfo bought for $575M in 2021 at a time when AI began to shake up the sales market. Before the transaction, ZoomInfo was valued at just under $21 billion, at least $11 billion below its current value of $9.5 billion.

Explaining the deal, ZoomInfo CEO and founder Henry Schuck said in a blog post: “With Chorus, the entire organization can make better decisions by surfacing insights and analytics that you would only get if you sat in on every sales or customer success call.”

The idea back then was to use Chorus as an opportunity to integrate different parts of the sales process in a single platform by “combining ZoomInfo’s historic top-of-the-funnel strength with insights driven from the middle of the funnel in the customer conversations that Chorus captures,” the company said in a press release.

Is ZoomInfo in trouble?

With the company becoming a leading platform in the go-to-market (GTM) intelligence space, ZoomInfo has also expanded from its data root into a full-blown sales workflow management solution that offers a “suite of modern go-to-market software, data, and intelligence enables sales, marketing and recruiting teams to uncover opportunities and hit their number through insight-driven engagement,” according to its About Us page.

In addition, while ZoomInfo has been busy with acquisitions and integrations, one of its customers said the company’s core product has remained in stand still.

But according to the latest findings from CB Insights, it appears customer sentiments about ZoomInfo are beginning to change. The customers cite a range of challenges for the company ranging from pricing to product innovation.

“But as it expands from its data roots to a full-blown sales workflow management solution, it appears customers have mixed feelings — citing challenges ranging from pricing to product innovation. Add in a growing cohort of challengers like Apollo.io, Lusha, and Cognism and the situation looks a bit dicey,” CB Insights explained.

To uncover what’s really going on at ZoomInfo, CB Insights recently partnered with Pavilion, a community of GTM leaders and their teams, and spoke to their members about their views on sales intelligence and data enrichment vendors.

Based on interviews with software buyers who recently evaluated data enrichment solutions, the vendor Scorecard shows that ZoomInfo scored the lowest on CSAT (customer satisfaction). You can find the detailed scorecard in the PDF file at the bottom of this article.

Below are the excerpts of what buyers are saying about ZoomInfo and the competition.

Pricing is high

“The biggest challenge ZoomInfo faces each and every year when it comes to renewal is the price tag; especially for the additional intent services, which are in the five-digit range. Pricing is definitely the highest challenge,” VP, Fortune 500 subsidiary.

Read the full transcript here.

ZoomInfo’s core product at a standstill?

“We know ZoomInfo has been busy on big acquisitions and integrations, offering different capabilities. However, the core product we bought from them has stood still,” C-level executive, $10M+ funded training platform.

Read the full transcript here.

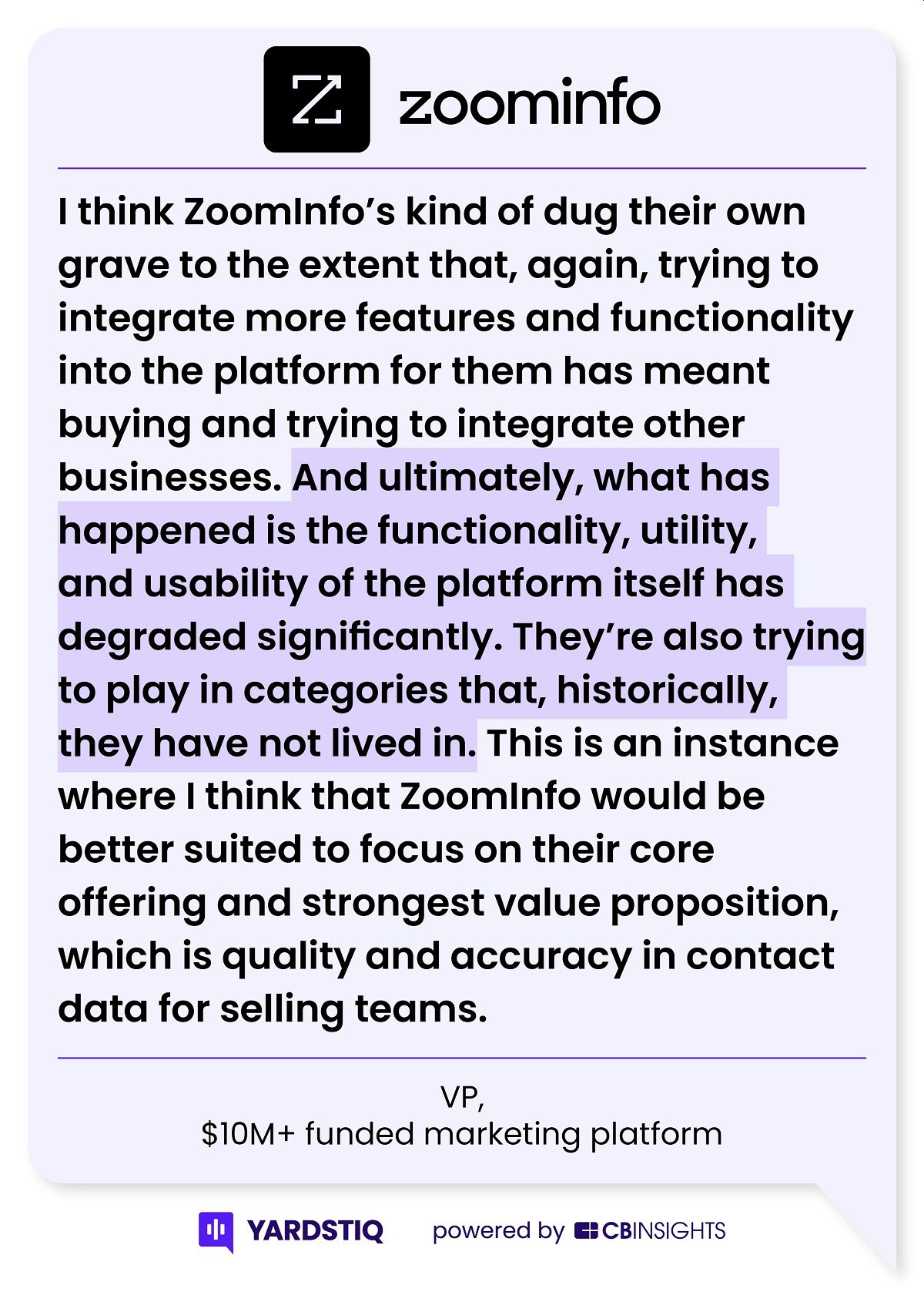

Buyer that churned off of ZoomInfo has similar concerns

Read the full transcript here.

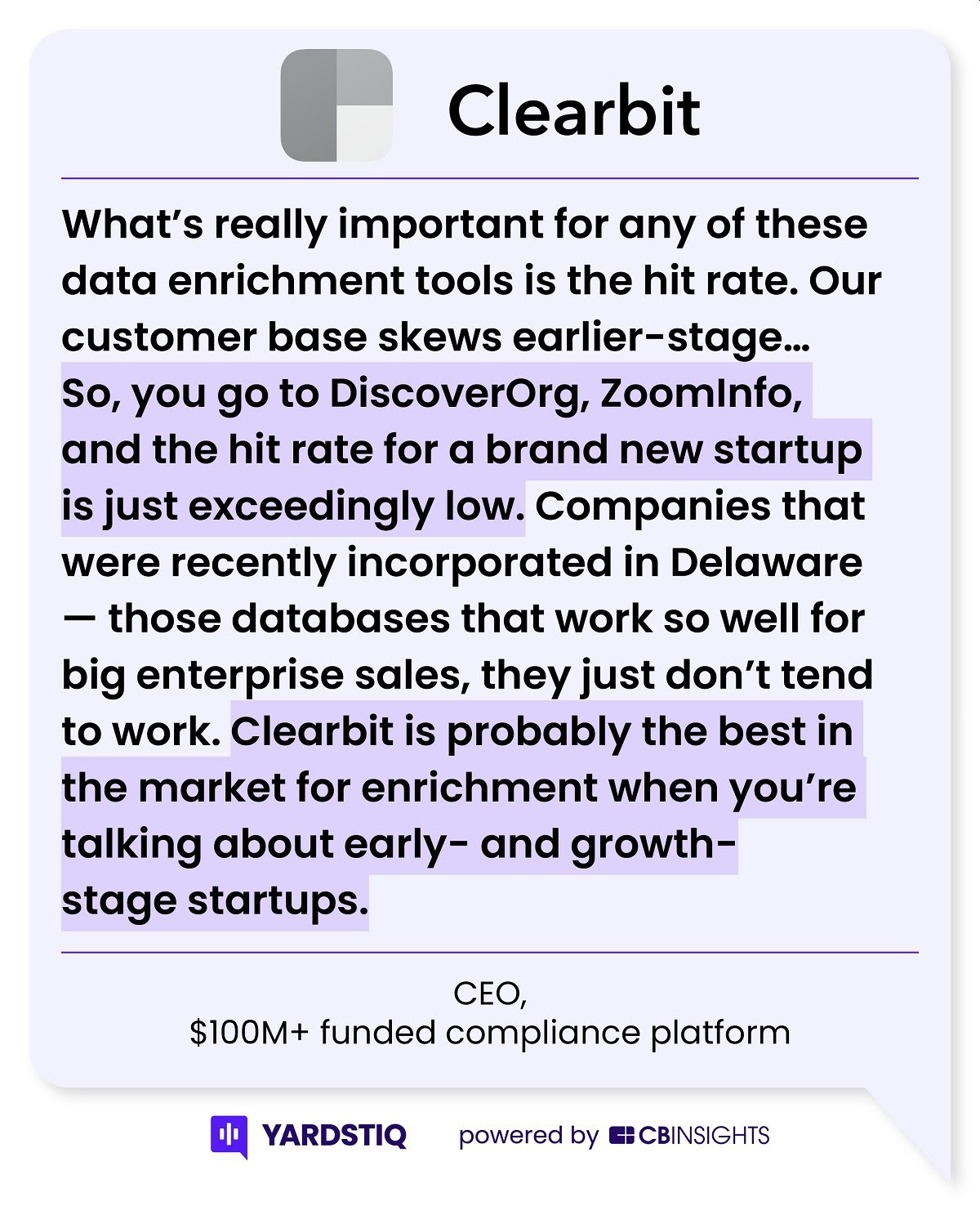

Clearbit has an edge with its startup coverage

Read the full transcript here.

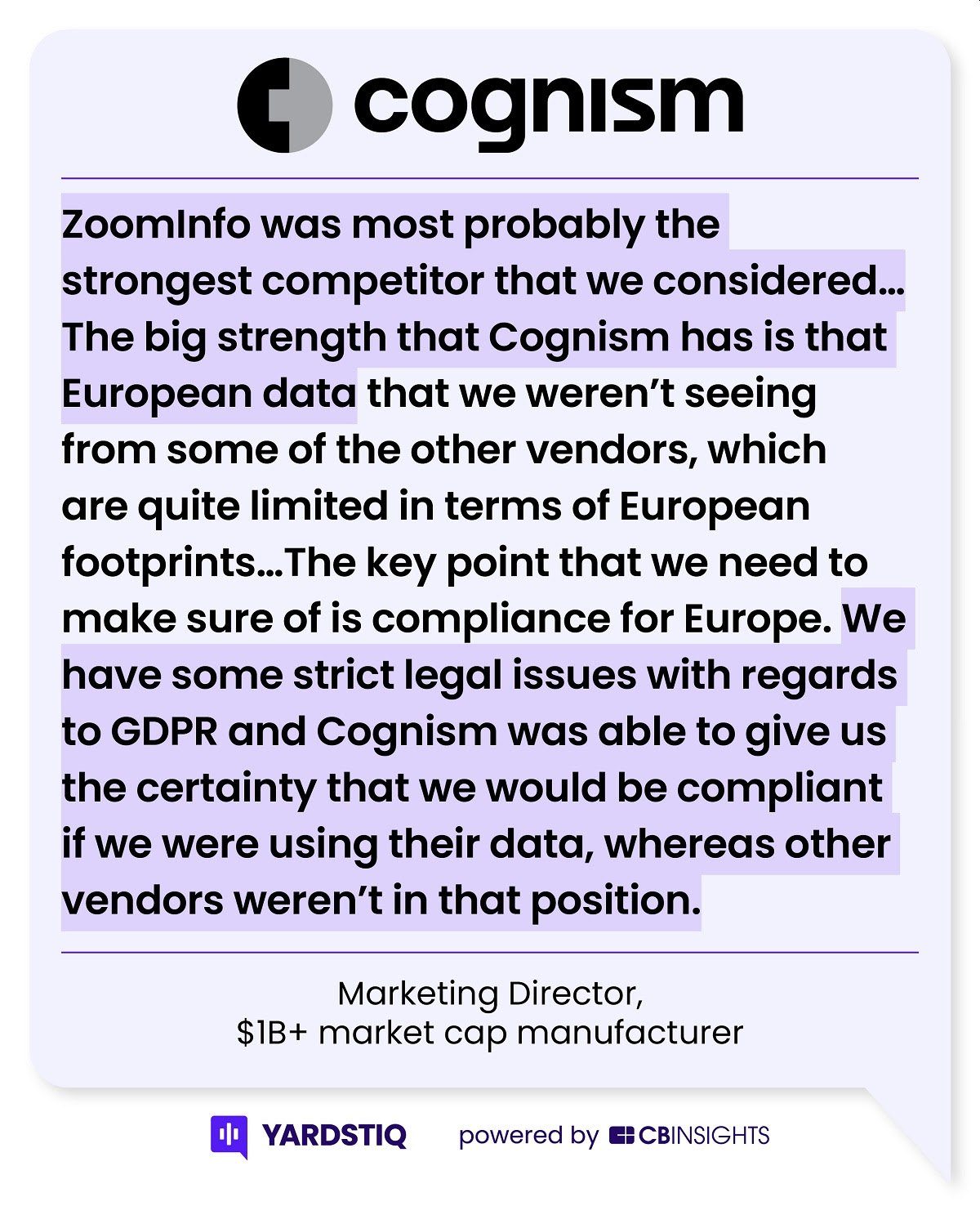

UK-based Cognism wins out for its European data & GDPR compliance

Read the full transcript here.

Formerly known as DiscoverOrg, ZoomInfo was founded in 2007 by Henry Schuck to “help the millions of sales, marketing, and recruiting professionals who wake up every morning with one goal: hitting their number.” The company went public on the NASDAQ stock exchange in June 2020. Headquartered in Vancouver, Washington, ZoomInfo also has additional offices in Waltham, Massachusetts, and Grand Rapid, Michigan,

CB-Insights_vendor-scorecard-data-enrichment