Tech startup funding plunges by 55%, deepening fear of another dot-com bubble burst

The fallout of the sudden collapse of the Silicon Valley Bank in March is slowly beginning to ripple across the tech ecosystem as venture capital firms pulled back on funding technology startups. The funding slowdown can be felt far and wide as startups here in the US and around the world struggle to raise new funding amid global economic uncertainty. Is the dot-com bubble 2.0 about to bust?

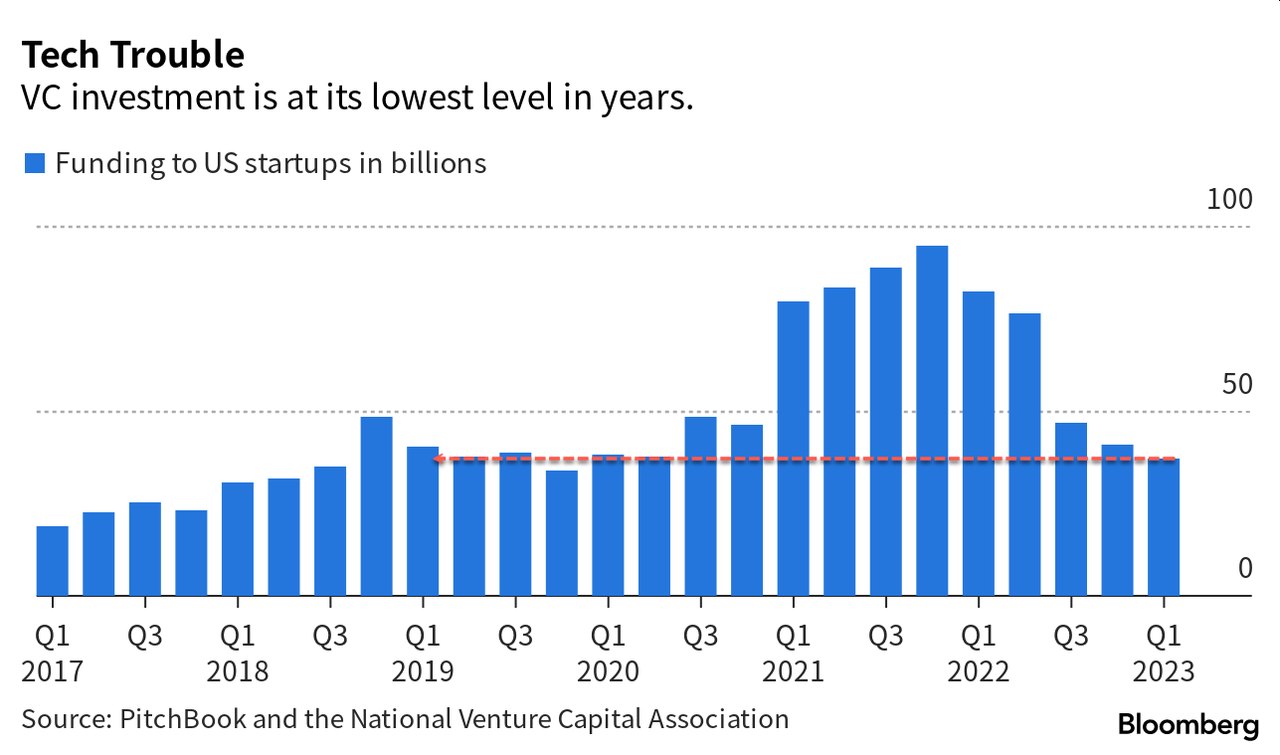

According to a recent report by Bloomberg, startups in the US raised only $37 billion from VCs in the first quarter, the lowest in 13 consecutive quarters. Citing new data from research firm PitchBook and the National Venture Capital Association, the report stated that the first quarter marked the lowest number of deals, fewer than 3,000, in five years as nervous investors reduced the size of their checks to startups.

“The whole market is taking much more caution toward investment,” said Kyle Stanford, a VC analyst at PitchBook. He warned, “It’s not going to be easy for companies to raise capital even if they’re growing at a pace they set in their last round.”

The collapse of Silicon Valley Bank crippled the already fragile startup funding market as early and mid-stage startups faced a heightened risk of running into cash crunches due to the aggressive rising interest rates by the Federal Reserve. The death of Silicon Valley Bank is the final nail in the coffin as funding pipelines almost entirely dry up for many startups.

VC Funding for Startups Down

Bloomberg is not alone. Another report from the funding tracker website Crunchbase also found that year-over-year (YoY) global VC funding dropped abruptly in the first quarter of 2023, with at least only $76 billion invested in startup companies at all stages. The amount may seem like a but it’s a 53 percent drop from the same time a year ago, Crunchbase said.

Of the $76 billion invested in all the startup companies in the first quarter, $10 billion of that went to OpenAI, and another $6.5 billion in funding was awarded to Stripe, meaning the remaining VC funding pool in the first three months of the year was closer to a measly $60 billion, Crunchbase reported.

While VCs aren’t spending, that doesn’t mean they don’t have the cash. Crunchbase said VCs are still sitting on billions of dollars in the war chest, but it’s just that they aren’t making the deals they were before the pandemic when the country was awash with trillions of dollars in money printing by the Federal Reserve. As we reported back then, 80% of all US dollars in existence were printed in the last 22 months (from $4 trillion in January 2020 to $20 trillion in October 2021)

Meanwhile, PitchBook warned the sudden slowdown in VC funding could soon hit later-stage tech startups and growth companies in the second half of this year, and even companies that have already introduced several cut-cutting measures including layoffs and hiring freeze.

“Companies are trying to lengthen their runways,” he said, adding VCs might not be able to support all the early-stage startups that burn cash.

Andrea Lamari, the general partner at Manhattan Venture Partners, suggests that a wave of startups might be on the brink of shutting down, adding: “There has not been this level of uncertainty in nearly a decade surrounding what the macro environment impact will be on startups.” She warned, “It’s as if everyone’s waiting for the next shoe to drop.”

Dot-com Bubble 2.0?

Let’s take a quick trip back in time to the late 90s and early 2000s, when the internet was booming and investment in internet-related startup companies was at an all-time high. It was the era of the dot-com bubble, where new internet startups were popping up left and right, and venture capitalists were throwing money at them like there was no tomorrow.

However, as we all know, what goes up must come down. The bubble eventually burst in the early 2000s, resulting in a significant decrease in the value of internet companies and a wave of startup failures. The aftermath of the crash was catastrophic, with thousands of internet startups going under and leaving investors in the lurch.

Although it’s tough to provide an exact number, it’s estimated that the number of startups that collapsed during the dot-com bubble was in the thousands. According to CB Insights, more than 2,000 venture-backed companies failed between 2000 and 2003 alone. And just to give you a sense of the scale of the decline, the total amount of venture capital invested in internet startups went from a whopping $105 billion in 2000 to a measly $19 billion in 2003.

Some of the biggest names that emerged during the bubble, such as Pets.com, Webvan, and Boo.com, became synonymous with failure after going bankrupt and shutting down. It was a tumultuous time for the Internet industry, but it also taught us valuable lessons about investing, entrepreneurship, and the ever-changing nature of technology.

So, is this the beginning of another dot-com bubble? Time will tell.