SWIFT Banking System Explained. Spoiler Alert: SWIFT is NOT a payment system

Russia’s invasion of Ukraine has led many leaders from western nations including the United States to impose several sanctions on Russia. One of those sanctions is cutting away Russian banks from the SWIFT banking system.

As the war intensifies between Russia and Ukraine, SWIFT has become a hotly debated topic as everyone is talking about cutting Russian banks’ access to further isolate Russia from the global financial community, and put more economic pressure on Moscow to withdraw its troops from Ukraine.

Now everyone following the war in Ukraine seems to be talking about SWIFT, but most don’t even know what it is and what it does. An average American is hearing about SWIFT for the first time this week. In addition, the so-called experts on social media, especially crypto enthusiasts, see bitcoin and other cryptocurrencies as a replacement for SWIFT.

Some even went as far as calling SWIFT a payment system, which is not true. Stephen Diehl, a crypto skeptic, said in a tweet, “God, everyone is an expert on SWIFT right now. And so many bad takes on this subject.” So, what is SWIFT?

What is SWIFT?

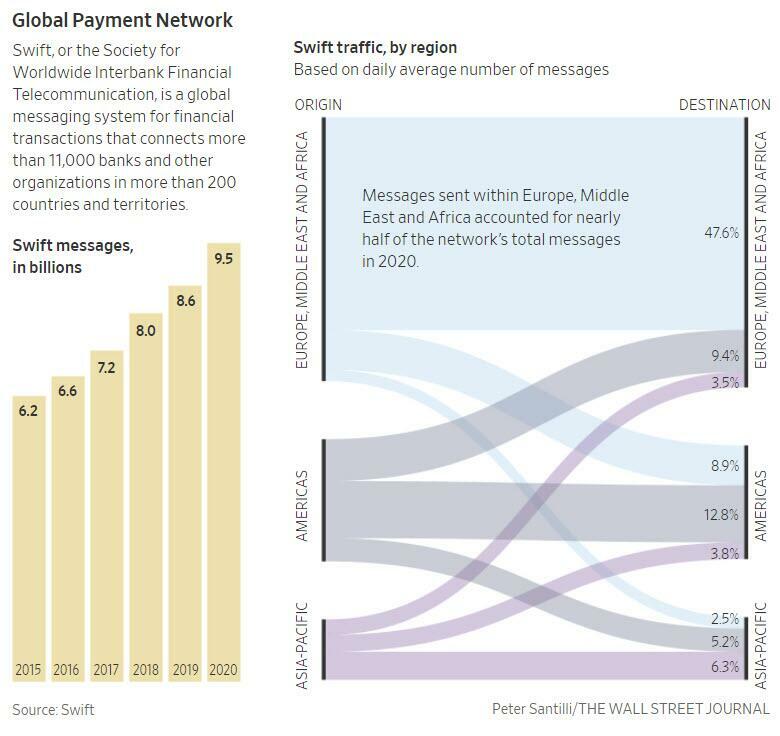

SWIFT, which stands for The Society for Worldwide Interbank Financial Telecommunication, is a global financial artery that connects banks, financial institutions, and governments around the world. SWIFT financial network is used by banks to send secure messages about transfers of money and other transactions.

Founded on May 3, 1973, in Belgium, SWIFT is a global financial messaging system that “carries over five billion financial messages a year,” according to the information on its website. The main point here is that SWIFT is a financial messaging system and NOT a payment contrary to what most people think.

Although SWIFT is used to facilitate trillions of dollars worth of financial transactions each year, SWIFT is NOT actually responsible for transferring funds. Instead, SWIFT is a messaging and routing system that sends and facilitates payment commands.

Today, more than 11,000 financial institutions in nearly 200 countries use SWIFT, making it the backbone of the international financial transfer system. To further explain what SWIFT is in a layman’s term, we turn to Frances Coppola, a banking expert.

In her interview with LBC, Coppola provides a simple straightforward overview of the system. Enjoy.

Yesterday's sanctions against Russian banks are more powerful than excluding them from the SWIFT system, argues financial expert Frances Coppola.@mrjamesob | @Frances_Coppola pic.twitter.com/0YrSpQcstz

— LBC (@LBC) February 25, 2022