Bitcoin’s House of Cards: Cornell University Professor warns Bitcoin ‘may not last that much longer’

Bitcoin is the world’s most popular cryptocurrency that many have speculated that will soon replace US dollars. However, Bitcoin is not backed by anything. After a careful analysis of bitcoin, it won’t take long to see that Bitcoin is just a bunch of code on the blockchain with no intrinsic value, no utility, but a solution looking for a problem.

Some have argued that the code on which Bitcoin is based does give it scarcity value because only 21 million Bitcoin will ever be created. However, the very scarcity on which Bitcoin is based might also be its undoing and ultimately render Bitcoin worthless. We live the discussion about scarcity for another day.

Students of history and Academics are now warning that Bitcoin ‘may not last that much longer.’ Back in summer, Gravel Institute released a video warning that Bitcoin is a speculative asset with no intrinsic value. He went as far as calling it ‘a scam’ similar to a Ponzi scheme.

Today, Eswar Prasad, senior professor of international trade policy at Cornell University, is also warning that “Bitcoin itself may not last that much longer.” Professor Prasad, who is the author of ’“The Future of Money: How the Digital Revolution is Transforming Currencies and Finance, told CNBC in an interview that “Bitcoin’s use of the blockchain technology is not very efficient.”

The cryptocurrency “uses a validation mechanism for transactions that is environmentally destructive” and “doesn’t scale up very well,” he explained. There are several reports out there that say bitcoin’s carbon footprint is bigger than the whole of New Zealand.

However, Professor Prasad said he believes blockchain, the underlying technology behind bitcoin, will be “fundamentally transformative” in the way that finance is done and in the way we conduct our day-to-day transactions, like buying a house or buying a car.

“Given that bitcoin is not serving well as a medium of exchange, I don’t think it’s going to have any fundamental value other than whatever investor’s faith leads it to have,” Prasad said.

More generally, cryptocurrencies have “lit a fire under central banks to start thinking about issuing digital versions of their own currencies,” Prasad said.

The History of Bitcoin and What We Can Learn from History

The idea behind bitcoin originally started on 18 August 2008 when bitcoin creator Satoshi Nakamoto published a paper on the site titled: “Bitcoin: A Peer-to-Peer Electronic Cash System.” The 9-page whitepaper was written as part of Nakamoto’s response to the collapse and the fallout from the 2008 banking institutions.

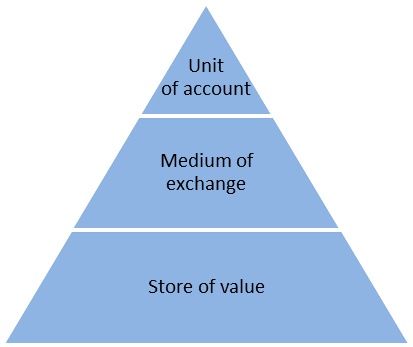

So far, Bitcoin has not been able to achieve that simple goal. As of 2021, Bitcoin has not performed better than the fiat money it aims to replace. Pointing to the current inflation and excessive money printing by the Federal Reserve, supporters of bitcoin may disagree with this assertion. However, we all know for any object to function as money, it has to meet the following three criteria: Unit of account, Medium of exchange, Store of value.

So far, Bitcoin has not been able to achieve that simple goal. As of 2021, Bitcoin has not performed better than the fiat money it aims to replace. Pointing to the current inflation and excessive money printing by the Federal Reserve, supporters of bitcoin may disagree with this assertion. However, we all know for any object to function as money, it has to meet the following three criteria: Unit of account, Medium of exchange, Store of value.

Bitcoin has not met any of the three criteria. Bitcoin fails to act as a ‘store of value.’ The roller coaster of this month is a reminder that Bitcoin is far too volatile to act as a reliable store of value. Bitcoin tumbles from its peak of $69,000+ to $46,556.70 as of the time of writing. Now imagine you had $69,000 in your bank account a month ago and today it is now only worth $46,000. The only people profiting from bitcoin today are the whales who bought it when it was almost worth nothing.

Finally, Bitcoin is not used as a unit of account. When was the last time you saw something priced in terms of Bitcoin? The problem with Bitcoin is, unlike traditional fiat currency like the US dollar or British pound, Bitcoin isn’t used to price things other than itself.

In the end, Bitcoin is based on greater fools theory: The idea that someone will buy bitcoin with the hopes that someone else ( a fool) will pay more for it.

In closing, Doug Henwood of Gravel Institute and Professor Prasad are not the only two people warning about Bitcoin’s house of cards that is about to collapse.

“Black Swan” author Nassim Nicholas Taleb also warned in April that Bitcoin is a “gimmick” and a “game.” Taleb said bitcoin has features of what he calls a Ponzi scheme that’s right out in the open. Taleb said he believes Bitcoin is “too volatile to be an effective currency and it’s not a safe hedge against inflation.”