Rivian lost nearly all its IPO gains after the EV-truck startup said it’s not working with Ford Motor to develop electric vehicles together

Eleven days ago, we wrote about Rivian after the Amazon-backed electric vehicle-truck startup made its Wall Street debut as a public company. Rivian opened at $106.75 per share after being priced at $78. By the time the market closed, shares of the Plymouth, Michigan-based Rivian rose by 2%.

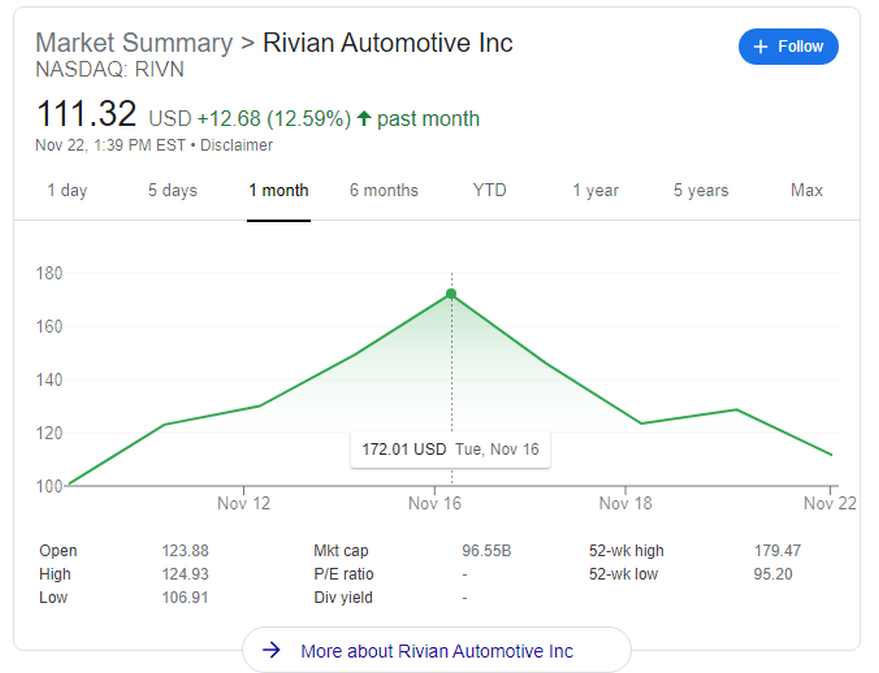

Over the next three trading days, shares of Rivian climbed up reaching $172 per share at a market cap of $146.7 billion, valuing Rivian more than either GM, with a market cap of $88.8 billion mid-morning Thursday, or Ford’s at $78.9 billion.

Today, however, the trajectory is going in the opposite direction. Almost all the massive IPO gains evaporated after the EV-truck startup announced Friday it’s not working with Ford Motor to develop electric vehicles together. Shares of Rivian plunged by more than 13% after the partnership with Ford falls through.

At one point during the trading session, Rivian stock was down about 15% to $108.50, which was $2 above the level of $106.75 where the stock began trading in its debut on the public market on Nov. 10.

Meanwhile, Amazon, one of the major investors in the company, said it plans to use Rivian vehicles in its delivery fleet, having ordered 100,000 to be handed over by 2030. Amazon expects to have 10,000 Rivian vehicles delivering Amazon packages as early as next year.

Rivian is just one of the many EV startups going public this year. In July, Tesla’s rival Lucid Motors went public via SPAC in a $24 billion mega-deal. The company was able to raise an eye-watering $4.5 billion in new capital infusion.

Founded in 2009 by Robert J. Scaringe, Rivian is the world’s first electric adventure vehicle. The company is developing vehicles, technology, and services that inspire people to get out and explore the world. Rivian is an automotive technology company that develops products and services to advance the shift to sustainable mobility.

“As we near the start of vehicle production, it’s vital that we keep looking forward and pushing through to Rivian’s next phase of growth,” Rivian CEO RJ Scaringe said in a statement.

Rivian originally planned to launch its R1T pickup truck and R1S sport utility in the U.S. in 2020 but was later delayed. Last week, Rivian notified buyers it is delaying deliveries of the R1T pickup until September and the R1S SUV until later in the fall. Now the company plans to test its electric delivery vans in 16 cities by the end of 2021.

Below is a chart of Rivian at its peak when the stock was trading at an all-time high of $172.