The Biggest Electric Vehicle Scam in History: Lordstown Motors, an EV startup once valued at $5.3 billion, is now under SEC investigation for an alleged 100,000 in fake preorders and zero car delivery

Another day, another electric vehicle scam story. Remember Tesla rival Nikola Motors? We wrote about Nikola after the Salt Lake City-based electric car company came under Securities and Exchange Commission (SEC) investigation over short seller’s claims that the electric truck maker misled investors. A week later, its founder Trevor Milton resigned.

Now, in what many are calling Nikola 2.0, Lordstown Motors is an Ohio, Illinois-based electric SPAC company founded in 2019 to offer Americans a glimpse into the future of all-electric truck vehicles. The company currently has no revenue and zero delivery.

Lordstown Motors was founded by Steve Burns, who previously served as the CEO WorkHorce, another electric car company. Lordstown Motors CEO Steve Burns once said that the goal of the company is “to become the first electric truck to finish the race and to prove the capability of its unique design, which features four in-wheel hub motors that are the drivetrain’s only moving parts.” Lordstown Motors even caught the attention of former President Trump.

It all started on November 26, 2016, when a company called Workhorse Group revealed its plan to create an all-electric pickup truck called the Workhorse W15 pickup capable of 80 mile-range at a price tag of $50,000. Steve Burns later left the Workhorse Group in February 2019 after he purchased the IP of Workhorse W15 pickup and started his own company–Lordstown Motors.

On June 25, 2020, Lordstown unveiled Lordstown Endurance, a truck the company claimed will “be the first electric pickup on market.” As you can see, the truck looks identical to the Workhorse W15 pickup.

Lordstown Motors was assembled out of nowhere and quickly became the darling of Wall Street. On October 26, 2020, Lordstown made its public debut on Nasdaq via a SPAC offering after closing a reverse merger with DiamondPeak Holdings Corp., a special purpose acquisition company. Lordstown stock popped as high as $21.75 before leveling off to close under $19. At one point, Lordstown once traded at a valuation as high as $5.3 billion. Today, Lordstown still trades under the ticker symbol RIDE.

Now, according to reports from Hindenburg Research, the story of Lordstown Motors is turning out to be the largest stock market fraud in U.S. history. The fraud is so large that it rivals other promises such as Theranos, Nikola Motors, and Enron.

For some of our audience who may not be familiar with Hindenburg Research, it’s a research publication published by the short-seller who previously released a well-researched investigative report into Nikola that ultimately led to the resignation of its CEO and co-founder, the dissolution of a major deal inked with General Motors, and an SEC investigation.

On March 12, 2021, Hindenburg issued a damning report targeting Lordstown. Hindenburg pointed to series of claims made by Lordstown CEO Steve Burns where he talked about the company booking of 100,000 pre-orders as proof of deep demand for the company proposed EV truck. For example, according to Hindenburg, “Lordstown recently announced a 14,000-truck deal from E Squared Energy, supposedly representing $735 million in sales. E Squared is based out of a small residential apartment in Texas that doesn’t operate a vehicle fleet.”

“Another 1,000-truck, $52.5 million order comes from a 2-person startup that operates out of a Regus virtual office with a mailing address at a UPS Store. We spoke with the owner who acknowledged it won’t actually order any vehicles, instead describing the “pre-order” as a mere marketing relationship.”

The report that Lordstown misled investors, specifically by exaggerating the supposed 100,000 pre-order, has reached the SEC and the agency immediately announced an investigation. Just weeks before the Hindenburg report came out, “Lordstown CEO Steve Burns boasted to Yahoo Finance of having “pre-sold” 100,000 vehicles, representing over $5 billion in future revenue and a huge vote of confidence from a slew of top-tier fleet customers.”

Meanwhile, Steve Burns has pledged full cooperation. However, in a company filing, Lordstown indicates the SEC was already suspicious of the company weeks before the Hindenburg report was issued on March 12. Below are excerpts from the filing:

“On February 17, 2021, the Company received a request from the SEC for the voluntary production of documents and information, including relating to the merger between DiamondPeak and Legacy Lordstown and pre-orders of vehicles. The Company is responding to the SEC’s requests and intends to cooperate with its inquiry.”

Misleading investors is the least of Lordstown’s problems. According to Hindenburg, citing reports from Workhorse employes, a bigger concern is possible exposure to liability for infringing upon other companies’ intellectual property rights, though the report states the company is “not aware of any patents and trademarks which would cause our products or their use to infringe on any third parties… we cannot be certain that infringement has not or will not occur.”

That’s not all. In an interview on Yahoo Finance on February 23, 2021, Burns focused on this point, declaring:

“We have pre-sold 100,000 of these vehicles to various fleets across America — really a big appetite.”

Contrary to those claims, Hindenburg research “found that Lordstown’s fleet truck “orders” are a mirage, and instead:

- Are non-binding letters of intent.

- Require $0 as a reservation payment.

- Do not require an actual purchase.

- Are from customers that generally DO NOT operate fleets.

- Are from customers that often DO NOT have the means to make the purchases.

- Include a clause encouraging a press release to announce the deal.”

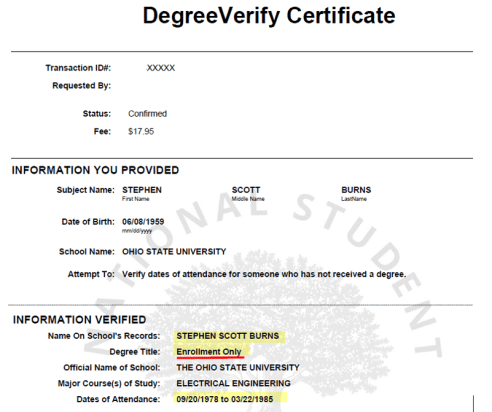

Meanwhile, according to Hindenburg, “Burns has been described in media and personal publications as having gone to Ohio State University and earning a degree in electrical engineering or as a “graduate” of Ohio State. [Pg. 17]

These reports have been imprecise. Hindenburg’s review of college enrollment records shows that Burns attended OSU for 6.5 years but never graduated.

Following his college experience, Burns launched a variety of startups with a record of several modest successes and failures. All appeared to be companies that developed software without any direct relation to the auto industry, let alone manufacturing or advanced hardware development:

Below is a video from a local NBC News affiliate describing the allegation against Lordstown Motors.

Here is a detailed video of how it all started.