GameStop, a flailing video game chain went from losing $470 million to become a $7.05 billion company by market cap. Stock surges over 300%; thanks to Reddit army

GameStop is a company everyone is talking about on Wall Street. Just about eight months ago, GameStop was a struggling video game chain brick-and-mortar game stores across the U.S. A lot has been written about the demise of Gamestop after it decided to close some of its stores. Then a few months later, the company even attempted to reinvent and redesign its brick-and-mortar stores by making the in-store experience as much about the gaming lifestyle as the games themselves.

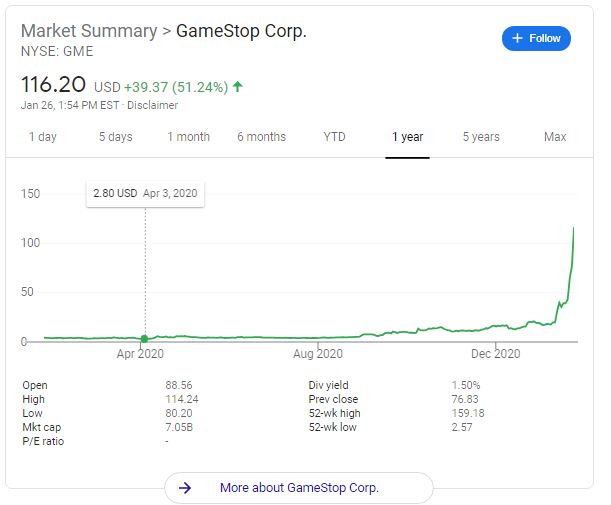

But all the effort to turn the company around failed. Just eight years ago, GameStop reported a $340 million profit. Things started to go south for GameStop as more people prefer to play games online instead of going to physical stores. In April 2019, the company posted $470 million in losses. Coronavirus pandemic was the last nail in the coffin as consumer trends shift online. Immediately after the pandemic hit, GameStop announced it would permanently close 300 of its store locations permanently. Its stock price on April 3 was $2.80.

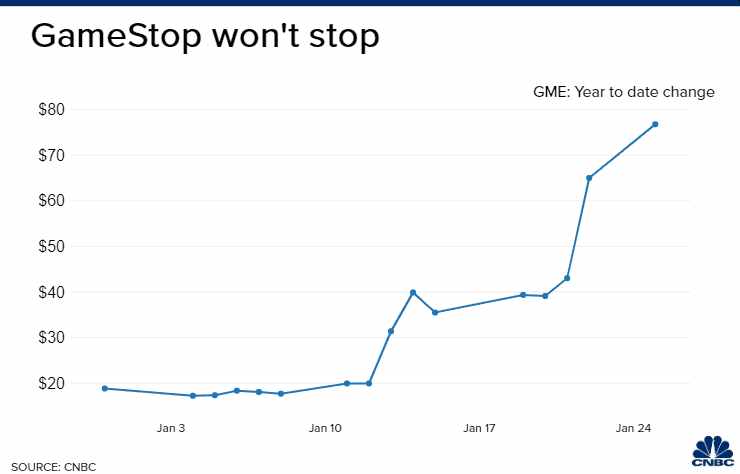

Then at the beginning of this year, the fate of GameStop’ changed after an army of Reddit users started to promote GameStop stock. GameStop opened 2021 with its stock priced at $17.25 on January 4. GameStop’s shares skyrocketed the buying frenzy among individual investors active in online forums. It all started in a subreddit chat room called r/WallStreetBets. The group, with its 2 million subscribers, massively inflated the price of GameStop to stick it to Wall Street. One of the trending posts on Tuesday in the group features a screenshot of the user’s portfolio showing an over 1,000% return on GameStop’s stock. On Friday, trading of GameStop stock was halted after the Reddit drama.

On Monday, January 25, GameStop stock surged again to $76.79—four times its price to end 2020 and 23 times its price from the early days of the pandemic. The stock then jumped to $96.67 on Tuesday morning before dropping into the 80s as its roller-coaster run continued onward.) In a rollercoaster trading on Tuesday, shares of GameStop jump again after a day that saw the stock more than double and turns negative within hours. Trading of GameStop stock was halted nine times on Monday and five times on Tuesday due to high volatility.

Source: CBC

Founded in 1984, the Grapevine, Texas-based GameStop operates 5,509 retail stores throughout the United States, Canada, Australia, New Zealand, and Europe as of February 1, 2020.