UK fintech startup Revolut seeks $40 billion valuation following a $553.81 million profit

British digital banking startup Revolut announced on Tuesday a record pretax profit of £438 million ($553.81 million) for 2023, driven by robust user growth and a significant rise in interest-related income. This marks a significant milestone as the company aims to solidify its position as Europe’s most valuable fintech startup.

The timely release of these results, ahead of a September deadline, is particularly noteworthy. Revolut had previously delayed the publication of its 2021 and 2022 accounts, making this the first on-time filing in three years. This announcement follows a turbulent period for the company, highlighted by the departure of its CFO last year after auditors found the fintech startup ‘misstated’ its revenues.

Despite these past challenges, Revolut is now looking ahead. The company has expressed interest in going public, though interim CFO Victor Stinga refrained from providing a specific timeline for an IPO.

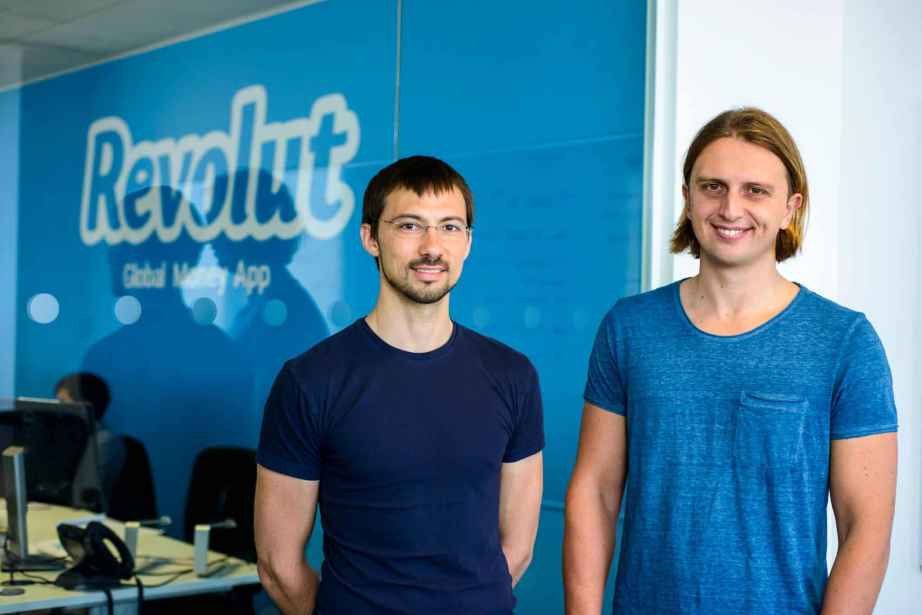

Founded in 2015 by Nikolay Storonsky, a former trader at Credit Suisse and Lehman Brothers, and Vlad Yatsenko, a former developer at Credit Suisse and Deutsche Bank, Revolut aimed to create a platform that offered transparent, fee-free financial services. Their vision was to simplify global financial management by removing hidden fees and providing interbank currency rates.

Based in London, Revolut offers a range of digital banking services, including pre-paid debit cards, currency exchange, and peer-to-peer payments, tailored for a global audience.

“Improving financial controls and making sure we bolster our team, being able to release these results within six months, is part of that journey. So we are taking steps in making sure that our control environment trends towards the level you require as a public company,” Stinga told Reuters.

Revolut’s annual report highlights a near doubling of revenue to £1.8 billion in 2023, significantly exceeding forecasts. Interest income surged to £500 million from £83 million in 2022. This growth follows a pretax loss of £25.4 million in 2022, contrasting with a pretax profit of £40 million in 2021, Reuters reported.

This financial uptick comes as Revolut seeks a valuation exceeding $40 billion in a planned $500 million share sale, up from its $33 billion valuation in a 2021 funding round.

The company’s application for a UK banking license, submitted three years ago, remains pending. UK CEO Francesca Carlesi noted that while the process is advancing, it involves numerous steps. “We are optimistic but cautious about setting a timeline,” she told Reuters. CEO Nikolay Storonsky expressed confidence in securing the license during a CNBC interview.

Revolut’s mobile app supports spending and ATM withdrawals in 120 currencies and allows users to send money in 29 currencies directly from the app. It also enables access to cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and XRP through exchanges with 25 fiat currencies.

Credit: Revolut