WeWork exits Bankruptcy with new leadership, names John Santora as new CEO

WeWork, once a $47 billion shared office space giant, has emerged from bankruptcy and is setting a new course for its future. The company exited bankruptcy on Tuesday after reducing its debt and appointed John Santora, a veteran from Cushman & Wakefield, as its new CEO.

The announcement comes just two months after WeWork’s co-founder and former CEO Adam Neumann made an unsolicited bid to buy back the company he co-founded 14 years ago company for $500 million. However, the specifics of how Neumann plans to finance this offer were murky, adding a layer of complexity to WeWork’s bankruptcy proceedings

Meanwhile, Santora is WeWork’s fourth permanent CEO in five years, succeeding David Tolley, who served as interim CEO from May 2023 before taking on the role permanently in October. The company missed its initial exit date of May 31, but the leadership transition marks a significant milestone. Additionally, WeWork has introduced a new board, featuring Anant Yardi, CEO of Yardi Systems, a property management software company.

Under Tolley’s brief leadership, WeWork entered bankruptcy protection. Since then, the company has renegotiated over 190 leases and exited more than 170 unprofitable locations, streamlining operations significantly.

Santora, who has 40 years of experience in commercial real estate, previously held the position of Tri-State chairman at Cushman & Wakefield.

WeWork filed for Chapter 11 bankruptcy in November, with liabilities totaling $18.65 billion against assets of $15.06 billion, CNBC reported. The company’s troubles were exacerbated by the COVID-19 pandemic, which led to increased vacancies, an economic downturn, and a steep decline in tech valuations.

The strategic downsizing of WeWork’s real estate portfolio has reduced annual rent and tenancy expenses by over $800 million. Additionally, the company secured $400 million in new equity capital. As of last week, WeWork’s portfolio comprises approximately 45 million square feet in 600 locations across 37 countries.

Founded in 2010 by Adam Neumann and Miguel McKelvey, WeWork offers members around the globe space, community, and services through both physical and virtual platforms. The company’s mission is to enable people to work towards a fulfilling life, not just a livelihood. By Q2 2019, WeWork had expanded to 528 locations in over 111 cities across 29 countries. In 2019, the company reported a third-quarter loss of $1.3 billion from $934 million in revenue. Before its bankruptcy, WeWork had about 650,000 subscribers, with ambitions to reach 1 million by early 2021.

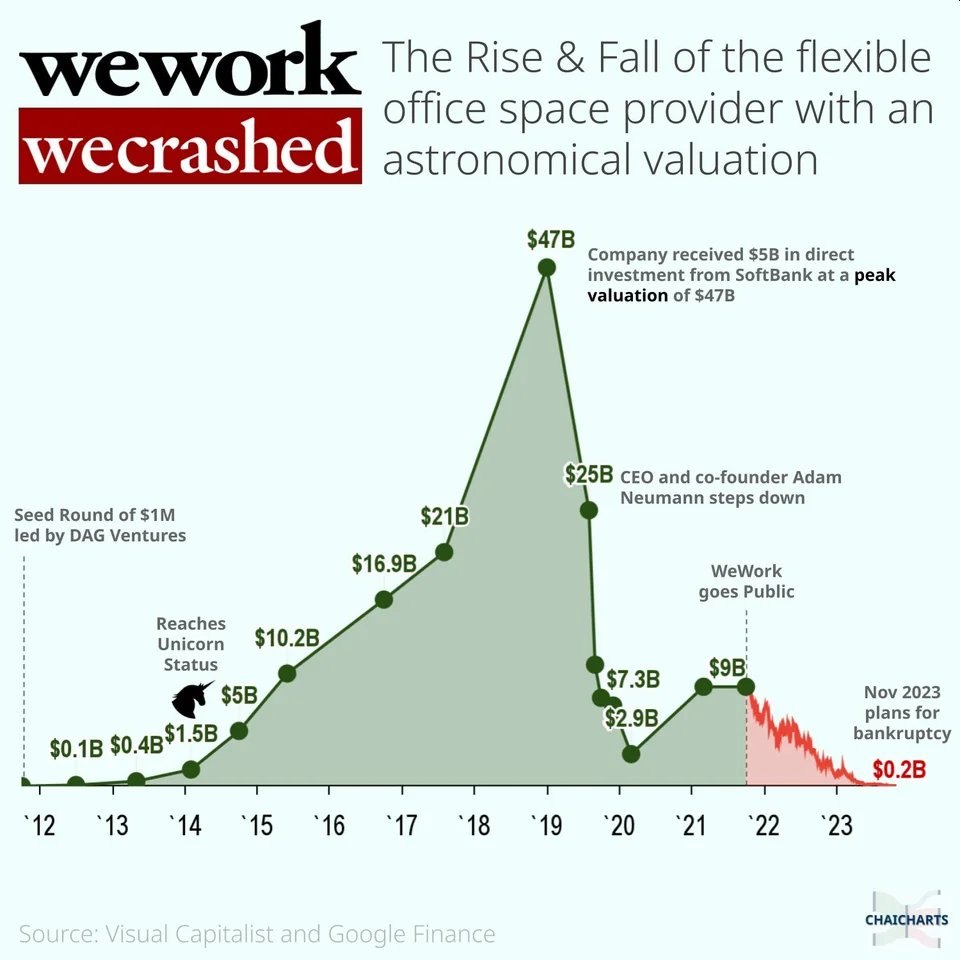

WeWork’s downfall began with the cancellation of its IPO, which exposed its financial vulnerabilities and the extensive control exerted by its eccentric founder, Adam Neumann. The aggressive expansion and commitment to costly leases in its bid to go public via SPAC further compounded its challenges.

Neumann, who led WeWork’s rapid growth and secured substantial financing rounds, was ousted in 2019 following the release of the company’s IPO prospectus. WeWork eventually went public in 2021 through a special purpose acquisition company (SPAC), but equity holders were wiped out two years later.

At its zenith, WeWork was valued at $47 billion. However, the company has faced continuous decline, with its stock plummeting by 98% this year, bringing its valuation down to approximately $45 million as of late last year.