The State of DeFi 2024: Entering a New Era of Growth

- Staking Supremacy: Staking has emerged as the backbone of DeFi, capturing over 80% of the total value locked (TVL). This surge in staking activity, especially through restaking mechanisms, underscores investors’ growing appetite for low-risk, high-reward opportunities.

- Lending Renaissance: Despite concerns over impermanent loss, the lending sector is experiencing a renaissance. Innovations like Ethena, blending staking returns with futures contracts, are driving higher yields while bolstering security measures, attracting a broader user base.

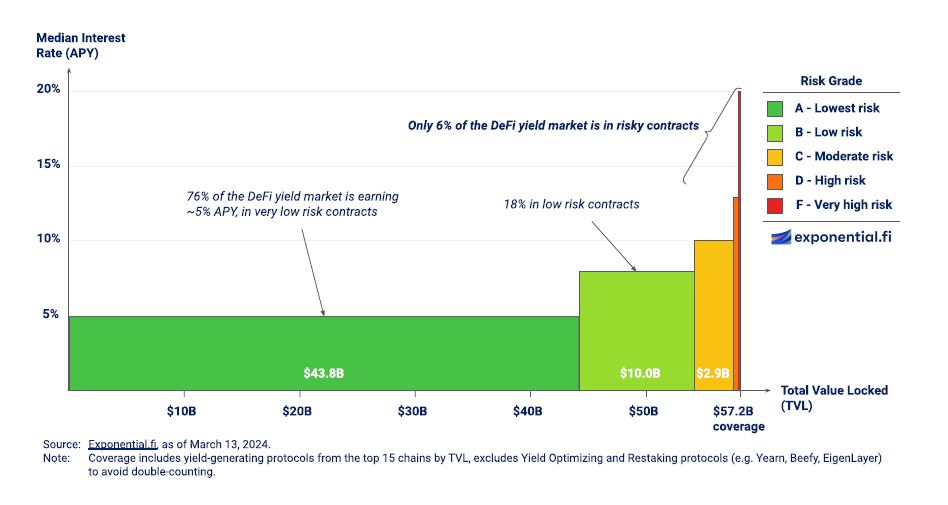

- Market Maturity: The DeFi market is maturing rapidly, prioritizing rationality, efficiency, and risk awareness. Notably, a staggering 75% of DeFi TVL is now parked in pools offering conservative APY rates of 0-5%, signifying a significant departure from the earlier “degen” mindset.

Renewed Confidence and Bridging Advances:

- Optimism Returns: Confidence and liquidity are on the upswing in DeFi, particularly evident in the increasing TVL within yield-generating protocols. This resurgence points towards a renewed optimism among investors, signaling a shift towards stability and reliability.

- Bridging Innovations: The bridging sector is witnessing a paradigm shift with the advent of trustless models and Layer 2 rollups. This evolution promises a more seamless and secure interconnectivity within the DeFi ecosystem, setting the stage for further growth and innovation.

Analysis:

The DeFi lending sector has witnessed a surge in activity, propelled by groundbreaking innovations such as Ethena. By amalgamating staking returns with futures contracts, platforms like Ethena have managed to offer enticingly high annual percentage yields (APY), thereby injecting newfound vigor into the lending landscape. Moreover, the introduction of newer lending models has not only bolstered security measures but also succeeded in drawing in a broader spectrum of users.

A notable trend emerging within the DeFi ecosystem is the paradigm shift towards safety-first investment strategies. Investors, once enamored by the allure of sky-high yields, are now gravitating towards protocols that prioritize predictability and security. This shift in sentiment is exemplified by the overwhelming majority of DeFi value locked in pools offering modest APY rates, with a striking 75% now allocated to pools boasting 0-5% APY. This shift in behavior, particularly discernible in Ethereum staking pools, underscores a profound evolution in investor mindset towards prudence and risk mitigation.

“Our insights reveal a strong preference by investors for security over the pursuit of high yields. An overwhelming 75% of DeFi total value locked (TVL) is now in pools offering a modest 0-5% APY. This conservative allocation, particularly evident in Ethereum staking pools, signifies a profound change in investor behavior. The trend towards established protocols like Lido marks a significant shift from mere yield chasing to a preference for predictability and safety.”

Furthermore, the resurgence of confidence and liquidity within DeFi is palpable, notably evidenced by the escalating total value locked in yield-generating protocols. This newfound optimism is further buoyed by the growth witnessed in the bridging sector, spearheaded by advancements such as Layer 2 rollups and the adoption of trust-minimized bridging models like optimistic bridges and zero-knowledge (ZK) proofs. These developments promise a more streamlined and secure DeFi ecosystem, poised for sustainable growth and innovation.

However, amidst these optimistic developments, decentralized exchanges (DEXs) have encountered hurdles to their growth trajectory. Concerns surrounding impermanent loss and negative media portrayal have hindered the growth of DEXs, resulting in a decline in total value locked for most platforms. Nonetheless, strides in capital efficiency through concentrated liquidity models offer a silver lining, presenting higher yields with reduced capital outlay despite the inherent risk of impermanent loss.

In sum, the DeFi landscape is undergoing a profound transformation characterized by rationality, efficiency, and heightened risk awareness. As investors pivot towards security-centric investment strategies, the future of DeFi appears promising, with a burgeoning emphasis on stability, security, and innovative financial solutions. This maturation of the DeFi market signals a shift towards activity-driven yields and a discerning investor community, laying the groundwork for sustained growth and innovation in the realm of decentralized finance.

Check out the full report below.

State of DeFi 2024