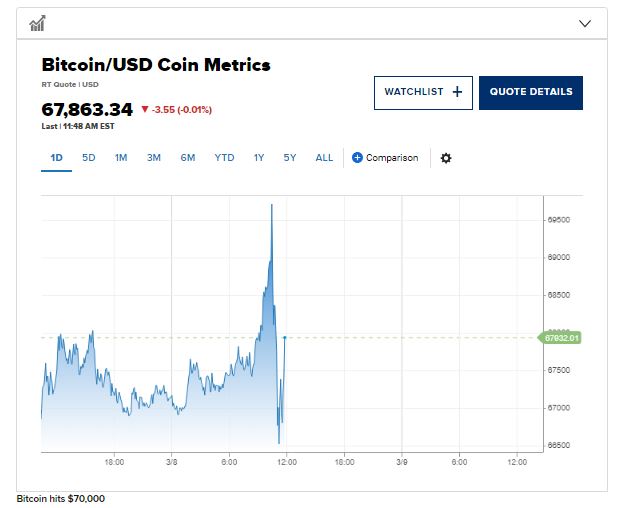

Bitcoin surges past $70,000 for the first time ever, setting new all-time record

The price of Bitcoin soared to a new all-time high, breaching the $70,000 mark amidst a flurry of volatile trading. However, the world’s most popular cryptocurrency later retraced some of its gains, settling down over 1% at $66,943.70, according to data from Coin Metrics. Nevertheless, its peak reached an impressive $70,170.00, surpassing its previous record set just days ago.

This surge comes amidst the backdrop of the U.S. stock market opening, with the recent introduction of spot bitcoin exchange-traded funds (ETFs) in the U.S. amplifying the impact of major crypto movements during traditional trading hours. The $70,000 record came just two days after Bitcoin surged past $69,000 for the first time since November 2021.

Credit: CNBC

Analysts suggest that the initial spike may have been fueled in part by investor reactions to the February jobs report. Many are hopeful that a higher unemployment rate and cooler-than-initially-reported employment growth in previous months will pave the way for the Federal Reserve to initiate interest rate cuts later this year, CNBC reported.

However, the crypto market has experienced notable volatility this week. Following Tuesday’s record-breaking ascent, bitcoin swiftly plunged by as much as 10%, dragging other cryptocurrencies and related stocks down with it, before reclaiming much of those losses the following day. The bitcoin historical volatility index, as reported by TradingView, is currently at its highest level in nearly a year.

Antoni Trenchev, co-founder of crypto exchange Nexo, remarked, “Navigating old highs is notoriously tricky, and the bitcoin dam doesn’t tend to burst at the first time of asking. Tuesday’s sharp bitcoin sell-off was healthy, necessary, and a prelude to further gains. Volatility defines bitcoin bull markets, and 2024 will be littered with sudden and gut-wrenching 10%-20% plunges.”

According to CoinMarketCap data, bitcoin has surged over 60% this month and approximately 205% year-on-year. The total cryptocurrency market cap, encompassing all tokens, has risen by 18% to $2.55 trillion, with bitcoin accounting for 52% of this total.

This latest milestone comes ahead of Bitcoin’s highly anticipated halving event, projected to occur in mid-April and recurring approximately every four years.

Often dubbed “the halvening,” bitcoin halving entails a periodic reduction in bitcoin mining rewards, halving the number of bitcoins miners can potentially earn for each block mined. This mechanism is designed to control the supply of Bitcoin over time, with the total supply capped at 21 million bitcoins. Notably, the last halving event is not expected to transpire for over a century.

Historically, bitcoin halvings have generated increased interest in the asset, as demand typically outstrips supply, leading to a surge in price in the months following the event.

Meanwhile, there’s optimism among investors regarding the potential approval of applications for exchange-traded funds (ETFs) tied to spot ether by U.S. regulators. Edwards weighed in on Ethereum’s steady ascent, highlighting a sense of FOMO (fear of missing out) among investors, although the overall sentiment remains cautious.

On another front, Bernstein analysts have made a bold projection about Bitcoin’s trajectory. They foresee a surge to $150,000 by 2025. This prediction hints at the possibility of Bitcoin surpassing its previous peak of $69,000, reached back in November 2021, potentially more than doubling its previous high.