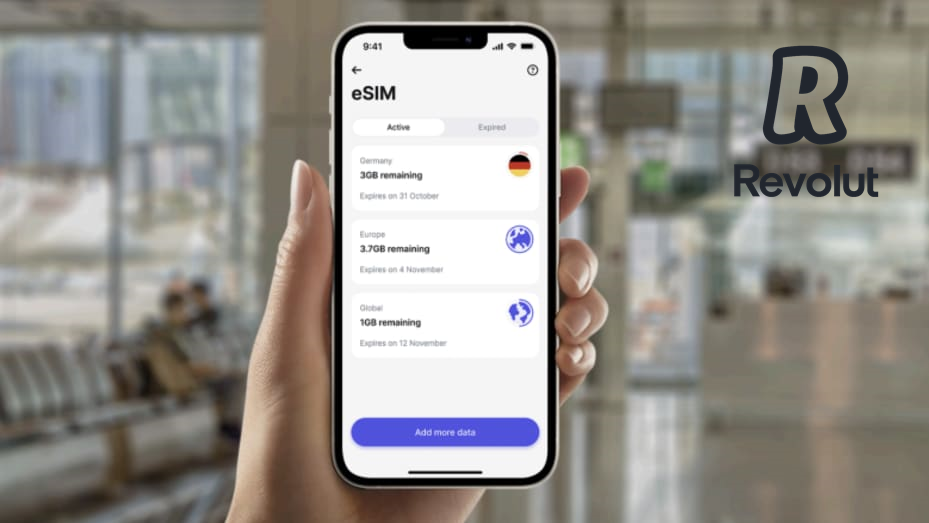

Digital banking startup Revolut launches eSIMs for data abroad without roaming fees

In a rare move for a fintech company, UK-based digital banking startup Revolut revealed on Tuesday its plans to introduce travel eSIM plans in the United Kingdom. This initiative is aimed at providing users with access to data while abroad, without the burden of roaming charges. With this launch, Revolut becomes the first financial services firm in the country to offer such telecom plans, marking a significant milestone not only nationally but also globally.

In an exclusive interview with CNBC, Revolut said the offering is part of its long-term vision of becoming a “super app” that includes a range of services spanning both finance and travel. Subscribers to Revolut’s Ultra subscription tier will now enjoy access to 3GB of data usable across various countries, with the allocation resetting every month.

The digital banking and payments unicorn is set to roll out eSIMs, which are SIM cards stored virtually rather than physically in the device, starting this week. The plans will gradually become available to users in the upcoming days.

For customers using Revolut’s basic app without any subscription, a standard eSIM plan will be accessible. This plan allows them to access the Revolut app, enabling them to top up their phone whenever necessary. For instance, if a Revolut user runs out of data with their current SIM provider upon arriving at an airport, they can still access features on their Revolut app without incurring charges and top up their data as usual.

Revolut customers enrolled in the company’s premium Ultra package, priced at £55 ($69.47) per month, will benefit from 3GB of global data usage, refreshing every month. This means they can travel without concerns about unexpected roaming charges.

The cost of mobile data usage overseas has risen for UK residents in recent years, with several carriers reintroducing roaming charges since the UK’s departure from the European Union. Revolut aims to address this concern by offering a solution that ensures its users can travel globally without the fear of incurring additional charges.

Revolut has partnered with UK mobile network operator 1Global (formerly known as Truphone) to launch its eSIM.

Tara Massoudi, the general manager of premium products at Revolut, explained that the decision to introduce eSIMs is part of the company’s broader strategy to evolve into an all-encompassing “super app” offering services such as bank accounts, currency exchange, insurance, travel bookings, and airport lounge passes. Massoudi emphasized Revolut’s ambition to be the ultimate financial super app, saying:

“Our ambition is very much to be the financial super app. This is really in that direction.” She added, “Travel is a huge value prop that we’ve always had, and it’s still remained super important for our users. So it’s important that we continue to innovate in that space.”

While financial services firms rarely enter the realm of phone plans, Revolut’s move aligns with the strategy of many challenger banks that bundle new services into their apps, aiming to create a more compelling reason for consumers to choose them over alternative options.

In Revolut’s case, this strategic move is crucial as the company, valued at $33 billion in 2022, seeks to build a loyal user base and expand its line of paid subscriptions to diversify revenue streams. The ultimate goal is to become a permanent banking provider for users’ comprehensive financial needs, rather than just a low-fee travel account for occasional international trips.

Revolut was founded in 2015 by Nikolay Storonsky and Vlad Yatsenko. Revolut was launched to the public in July 2015 with the aim of “building a fair and frictionless platform to use and manage money around the world” by removing hidden fees and offering interbank currency rates. Nikolay Storonsky is a former trader at Credit Suisse and Lehman Brothers. Vladyslav Yatsenko is a former Credit Suisse and Deutsche Bank developer.