Adam Neumann is trying to buy back bankrupt WeWork, a real-estate startup he co-founded 14 years ago

Adam Neumann, the ousted co-founder of WeWork, is aiming to buy the real-estate company he co-founded in 2010 out of bankruptcy, CNBC reported. Citing the support of “well-known capital sources,” Neumann is reportedly backed by prominent investors, including Third Point managed by Dan Loeb.

However, Third Point clarified to CNBC that while they’ve had initial discussions with Neumann, they haven’t committed to providing any financing yet. The story of Neumann’s bid to buy back the company was first reported on Tuesday by DealBook, citing a letter sent by Neumann’s counsel.

“Third Point has had only preliminary conversations with Flow and Adam Neumann about their ideas for WeWork, and has not made a commitment to participate in any transaction,” the hedge fund told CNBC.

Neumann’s interest in reclaiming WeWork dates back to December 2023, as indicated in a letter from his legal representative, Alex Spiro, obtained by DealBook. He and his startup, Flow, have been actively pursuing the purchase of WeWork or providing financing since then. However, attempts to secure financing, including a $1 billion arrangement in October 2022, were previously rebuffed.

A WeWork spokesperson told CNBC that “WeWork is an extraordinary company. As such, we receive expressions of interest from external parties on a regular basis. We and our advisors always review those approaches with a view to acting in the best interests of the company.”

WeWork’s response to Neumann’s bid highlights their ongoing evaluation of various offers to ensure the best outcome for the company. It’s worth noting that Neumann’s efforts to reacquire WeWork have faced resistance from the company’s advisors, who suggested DIP financing instead of a traditional term sheet.

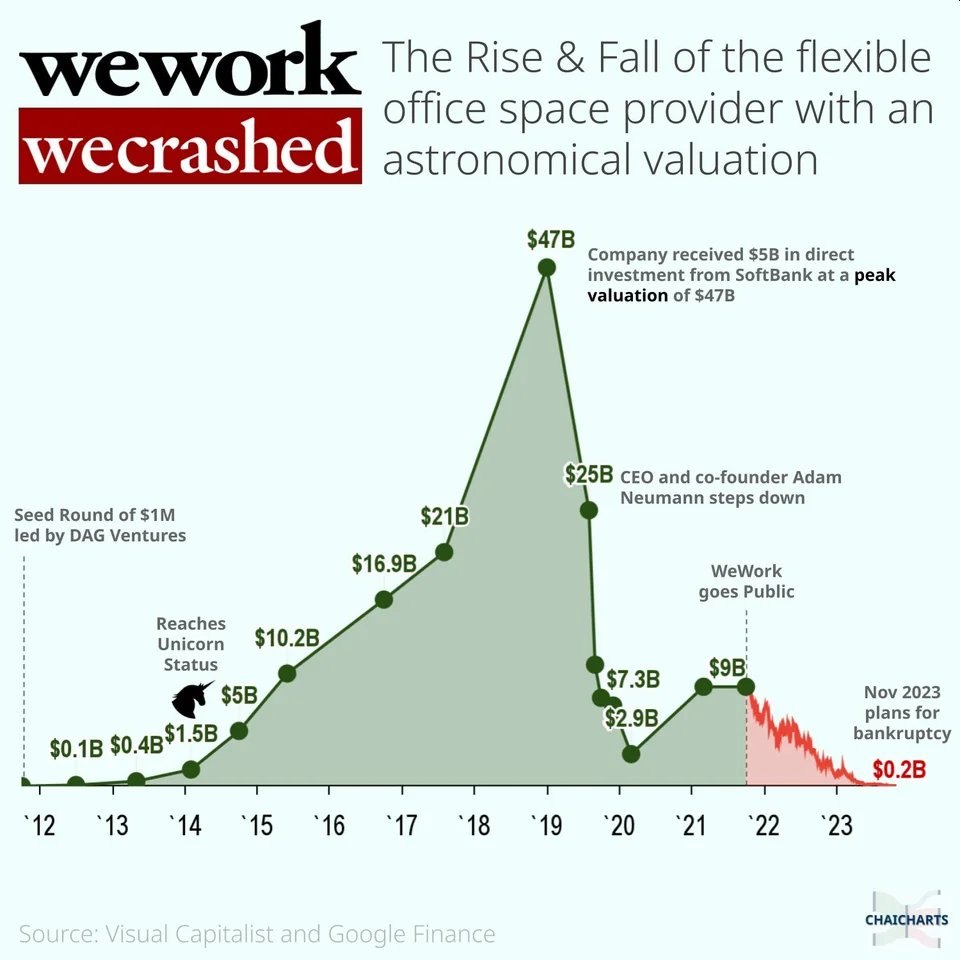

WeWork filed for bankruptcy in November 2023 amidst financial difficulties, with Neumann having stepped down from his role in 2019 due to concerns over corporate governance and valuation. Neumann and Spiro have yet to respond to CNBC’s request for comment.

Despite Neumann’s interest, WeWork remains focused on its current restructuring efforts to ensure its long-term sustainability as an independent and financially robust entity. Details regarding Third Point’s involvement with Neumann were initially reported by the Financial Times.

We’ve covered WeWork extensively in the past five years. The once-celebrated co-working unicorn startup filed for Chapter 11 bankruptcy protection in November 2023 in New Jersey following years of struggles that started with a failed IPO in 2019.

The SoftBank-backed WeWork has reshaped the global office sector with its rapid ascent and subsequent fall. Seeking U.S. bankruptcy protection on Monday, WeWork’s prospects dimmed as the companies it hoped would utilize its office-sharing spaces did not meet expectations.

WeWork’s troubles began after scrapping the IPO, revealing its financial state, and highlighting the immense control held by its eccentric founder, Adam Neumann. Subsequently, in its rush for growth before going public via SPAC, WeWork committed to costly leases, resulting in ongoing challenges.

At its peak, the company was valued at $47 billion. However, it has experienced a continuous decline, with its stock plummeting by 98% this year, culminating in an approximate value of just $45 million as of late last year.

WeWork was founded in 2010 by Adam Neumann and Miguel McKelvey. It provides members around the world with space, community, and services through both physical and virtual offerings. Its mission is to create a world where people work to make a life, not just a living. As of Q2 2019, WeWork had 528 locations in over 111 cities and 29 countries. WeWork reported a third-quarter loss of $1.3 billion from a revenue of $934 million in 2019. The office-sharing startup currently has about 650,000 subscribers worldwide and hopes to hit 1 million by early 2021.