Prosus cuts Indian EdTech startup Byju’s valuation by 86%, from $22 billion a year ago to under $3 billion

Byju’s has just undergone an expensive haircut after its valuation was slashed by over 80 percent. In a significant setback for Indian education tech startup, investment giant Prosus NV announced on Wednesday it was valuing Byju’s at under $3 billion, marking an 86% decline from the company’s peak valuation of $22 billion last year.

The revelation, made by interim CEO Ervin Tu during Prosus earnings call, is the latest cut to Byju’s valuation following the departure of multiple departures of executives and board members, as well as a one-year delay in filing its financial results for the 2021/22 period, Reuters reported.

This substantial adjustment reflects mounting concerns surrounding Byju’s business model and its capacity to sustain its rapid growth, which has been plagued with governance issues and cash-flow problems.

Prosus, which holds a 9.6% stake in Byju’s parent company Think & Learn Pvt Ltd, attributed this decision to the company’s “challenges” and the necessity to reevaluate its financial performance. The recent downgrade comes after Prosus publicly criticized Byju’s for not taking advice on improving operational efficiency and handling growth effectively.

Last year alone, Byju’s valuation witnessed successive reductions by shareholders, including Prosus and BlackRock. It went down to $11 billion in March, followed by further decreases to $8 billion in May and $5 billion in June.

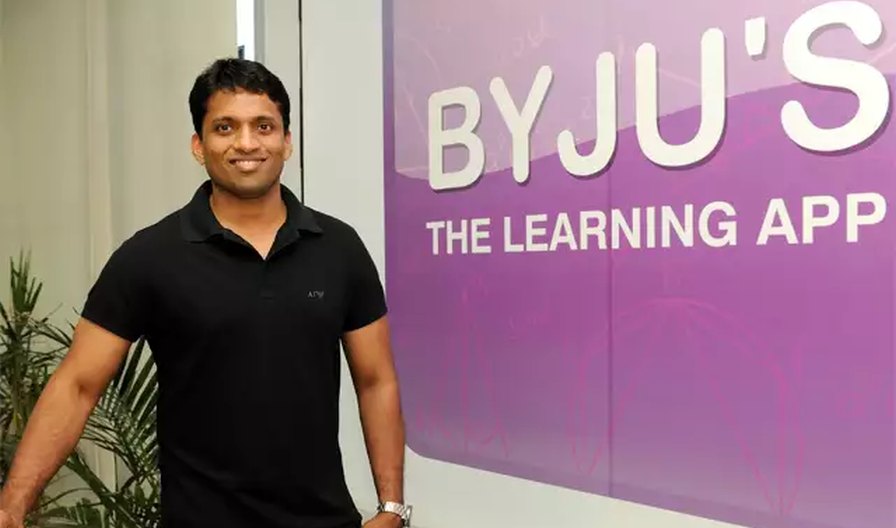

Founded in 2011 by Byju Raveendran and Divya Gokulnath, Byju’s provides educational solutions to more than 150 million students around the world. Its rapid ascent in the EdTech sector was driven by ambitious expansion plans and a focus on attracting sizable paying subscribers. However, questions about the sustainability and potential profitability of the company’s aggressive growth strategy have emerged. Reports of decreasing enrollment rates, growing losses, and a high customer churn rate have cast doubt on Byju’s ability to generate consistent revenue.

Prosus’ valuation cut serves as a stark reminder of the challenges confronting the entire EdTech sector. The swift growth of online education during the pandemic has intensified competition, blurring the lines between traditional educational institutions and tech-driven platforms. Investors are adopting a more cautious approach, prioritizing profitability and sustainable growth over sheer market potential when evaluating EdTech companies.

The future of Byju’s is now uncertain as it grapples with the repercussions of this valuation downgrade. The company must showcase its capability to address operational inefficiencies, improve profitability, and rebuild trust among investors and stakeholders. Only then can it aspire to recover its previous valuation and reaffirm its standing as a leader in the Indian EdTech landscape.