Coinbase wins approval to offer cryptocurrency futures to U.S. retail customers

Crypto exchange Coinbase has been facing some challenges over the last two years. However, amidst a string of legal battles, there’s finally some good news for the world’s second-largest crypto exchange.

In a significant development today, Coinbase Global announced Wednesday that it had secured approval to offer cryptocurrency futures to retail customers in the United States. This is a major regulatory victory for Coinbase even as the crypto exchange is currently entangled in a legal dispute with the Securities and Exchange Commission (SEC).

The newly introduced cryptocurrency futures will be made available through a division of Coinbase called Coinbase Financial Markets. The news of the approval sent Coinbase shares soaring from 5.5% to $83.52 in premarket trading.

The approval was granted by the National Futures Association (NFA), a self-regulatory body designated by the Commodity Futures Trading Commission (CFTC), Reuters reported.

In a statement, Coinbase said: “This is a critical milestone that reaffirms our commitment to operate a regulated and compliant business.”

As we reported early this year, Coinbased openly criticized the SEC for its unlawful operations due to its failure to register as an exchange. In April, Coinbase sued the SEC after months of silence from the federal regulator. The crypto exchange asked a federal judge to force the SEC to share its answer on the company’s July 2022 petition on “whether existing securities rule-making processes could be extended to the crypto industry

But two months later, the SEC also sued Coinbase for illegally operating as an unregistered securities exchange just a day after suing the world’s largest crypto exchange, Binance

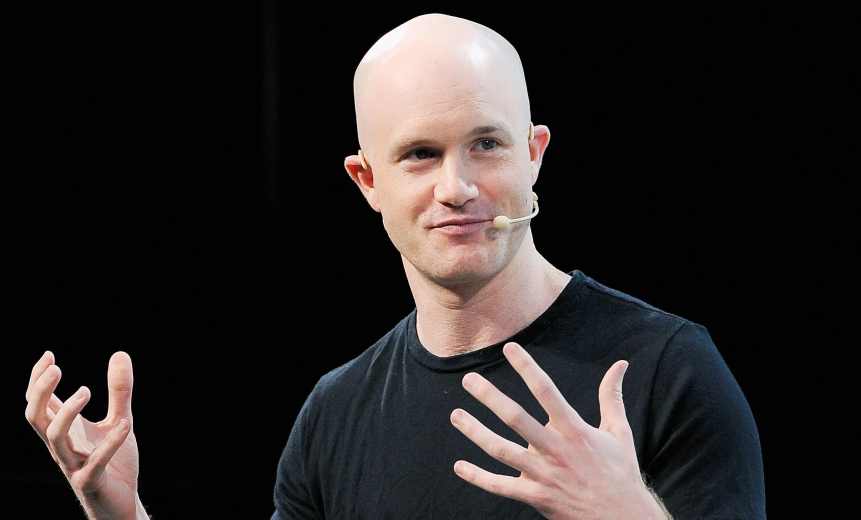

CEO Brian Armstrong has also expressed concerns that a hostile regulatory landscape might prompt more U.S. crypto firms to relocate offshore. He’s highlighted that Gary Gensler, the Chair of the SEC, adopting an enforcement-centric approach, which could potentially impede innovation within the industry.

The NFA’s endorsement, coming almost two years after Coinbase submitted its application, has the potential to open doors for the company to venture into a relatively untapped market.

The global derivatives sector constitutes nearly 80% of the entire cryptocurrency market, often being a source of market-wide volatility due to leveraged speculations on futures and other derivatives. According to research firm CCData, the trading volumes for crypto derivatives worldwide reached around $1.85 trillion in July.

Coinbase was founded in 2012 by Brian Armstrong and Fred Ehrsam. The San Francisco, California-based Coinbase is a digital currency wallet and platform where merchants and consumers can transact with new digital currencies like Bitcoin, Ethereum, and Litecoin.