Global startups raised $58.6 billion in the first quarter, down 13% from Q4 2022

Just last week, we reported that US startups raised only $37 billion from VCs in the first quarter of this year, the lowest in 13 consecutive quarters. The figure was based on a report from Bloomberg using data from research firm PitchBook and the National Venture Capital Association.

But now CB Insights is out with its own number for global venture capital funding, and the result is brutal. According to the latest CB Insights report, global venture funding and deals continued to fall as startups raised a combined $58.6 billion in the first quarter, down 13% from Q4’22. But before you start to think that doesn’t bad, remember the devil is always in the detail.

A closer look at the data revealed that those numbers are buoyed by a $6.5 billion mega-funding in payments giant Stripe. And when you take out the outlier and the global funding was actually down 22% from Q4’22. “Overall, funding hit the lowest quarterly funding total since Q4’19, which suggests that the underlying pace of the venture slowdown is not abating at least for now,” CB Insights explained.

This outlier is also confirmed in a Crunchbase report:

“Of the $76 billion invested in all the startup companies in the first quarter, $10 billion of that went to OpenAI, and another $6.5 billion in funding was awarded to Stripe, meaning the remaining VC funding pool in the first three months of the year was closer to a measly $60 billion”

Deal Activity Tumbled

The situation for deal activity, often the better gauge of the market, was also not great as deal activity tumbled for the fourth consecutive quarter. “There were 7,024 deals closed in Q1’23, a 12% decline from the previous quarter and the lowest tally since Q2’20,” CB Insights noted.

Every major region saw a double-digit drop in funding in the first quarter of 2023 except for the US.

Almost every region saw double-digit QoQ drops in funding in the first quarter of the year. Latin America saw the largest QoQ drop in funding at 54%, with only $0.6 billion raised in Q1’23. Asia saw funding fall by 27% to $ 12.5 billion while funding to Europe-based companies fell by 12% to $10.4B.

In contrast, US funding was more stable in Q1’23, dropping by just 1% QoQ to $32.5B. However, without Stripe’s exceptional $6.5B round, the US would have seen a funding decline of 21%, signaling that no region is immune to the ongoing venture slowdown.

All major regions also saw their deal count drop in Q1’23. US-based startups accounted for 36% of all deals so far this year — the biggest share of any region — followed by Asia with 34%.

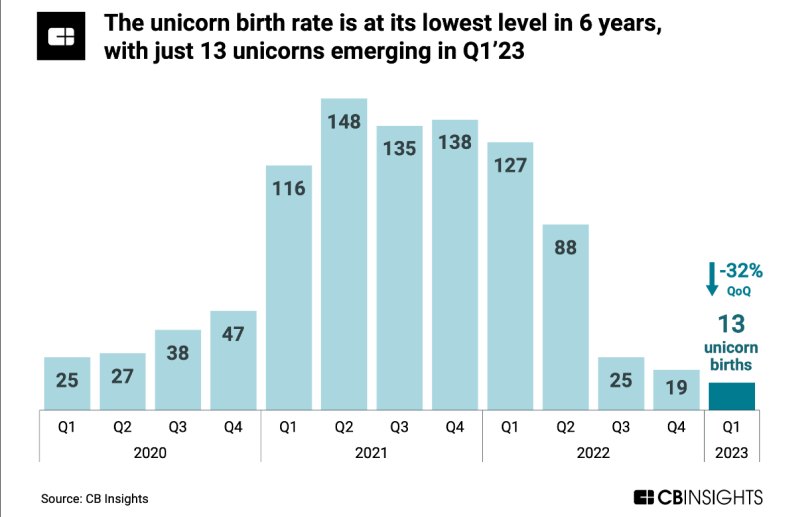

The unicorn game got tougher with only 13 companies getting their horn in Q1’23. This was the lowest unicorn birth count in 6 years as investors pulled back dramatically from late-stage rounds, which accounted for just 8% of Q1’23 deals.

Q1’23 saw the birth of only 13 unicorns (companies valued at $1B+), a 32% drop QoQ and the lowest quarterly level in 6 years. While it’s becoming rarer for startups to reach unicorn status, AI companies appear to have a better chance than most — 4 of the 13 new unicorns were AI developers:

- Anthropic, a US-based AI model developer and research outfit ($4.4B valuation)

- Adept, a US-based startup that trains AI to use enterprise software ($1B valuation)

- Character.ai, a US-based AI chatbot developer ($1B valuation)

- DeepL, a Germany-based AI-powered language translator ($1B valuation)

While unicorn births saw sharp drops in most major regions in Q1’23, new unicorns in the US held steady QoQ at 8. Meanwhile, unicorn births in Europe dropped by 85% to only 1 in Q1’23. Asia saw 2 new unicorns, a 33% drop in QoQ.

That’s not all. Deal sizes are also getting smaller. For example, the median late-stage deal size was actually smaller than the mid-stage. There’s also a 47% quarterly drop in IPOs.

You can read the full 47-page State of Venture Report here. Note that the report is only available to paying CB Insights customers.