Bitcoin surges past $28,000 as Federal Reserve printed $300 billion out of thin air in one week to save failed banks

Investors are turning to Bitcoin after the realization that the US Federal Reserve Bank (Fed) just printed $300 billion out of thin air last week to bail out the banks. Bitcoin topped $28,380 on Sunday and jumped 5.19%, adding $1,400 to its previous close. As of the time of writing, the world’s most popular cryptocurrency is trading at $28, 275.50

The boost in the price of Bitcoin came after a series of banking collapses that started with Silvergate earlier this month. The sudden collapse of Silicon Valley Bank sent depositors including venture capital firms and tech startups into a panic before the US government injected billions of dollars to prevent the fire from spreading to other banks. However, the carnage spread to First Republic and New York-based Signature Bank.

With the Federal Reserve money printer going brrr and bond crash, investors fear further inflation and ran to save haven assets inlcuding bitcoin.

The US Federal Reserve Bank (Fed) just printed $300 billion out of thin air last week to bail out the banks. What a joke and a voodoo economics.

This is not free market or even capitalism.

If developing nations want $300 billion, they have to sell their sovereignty to the IMF… pic.twitter.com/G6efRJsI7O

— S.L. Kanthan (@Kanthan2030) March 16, 2023

Fortune reported that the Federal Reserve allocated $143 billion to holding companies of failed banks, including Signature Bank and Silicon Valley Bank, with the intention of using the funds to reimburse depositors.

Additionally, the Fed provided $148 billion through the “discount window” program, which is a larger amount than the typical weekly borrowing range of $4 to $5 billion, according to another report from The Guardian.

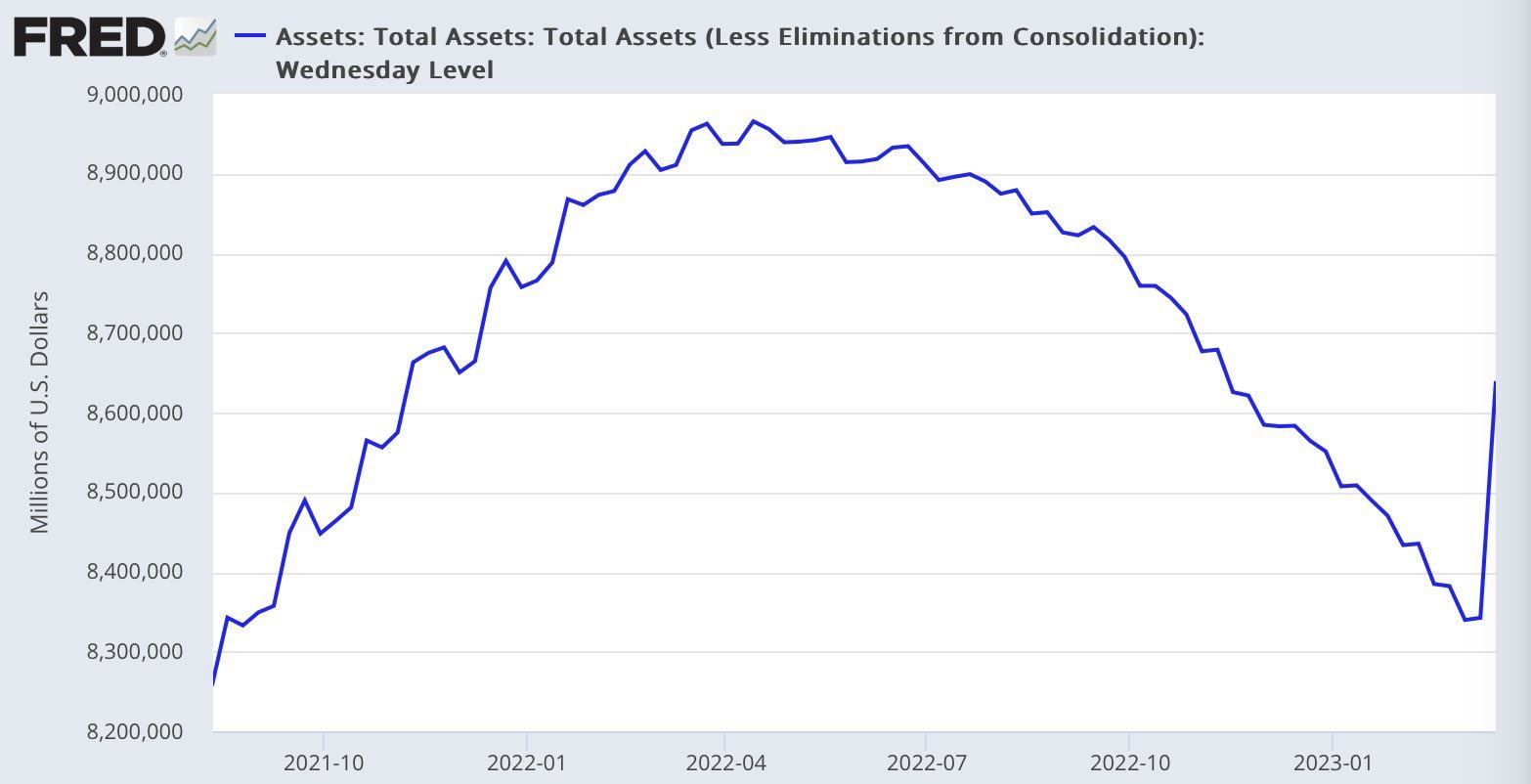

US Federal Reserve Balance Sheet Grew $300 Billion in Just One Week

Meanwhile, the emergency rescue by the US government led to a $300 billion increase in the US Federal Reserve balance sheet in just one week. As you can see from the chart below, the US Federal Reserve had been implementing quantitative tightening from $9 trillion to $8.3 trillion as part of its effort to control inflation but has added $300 billion to its balance sheet to rescue the failed banks.