Inscribe raises $25M in funding to automate document fraud detection and fight financial fraud with AI

We live in a fast-paced digital world where buyers and consumers have come to not only enjoy — but also expect — frictionless interactions with the companies they buy from. However, as businesses move online, it is becoming increasingly difficult to know the exact identity of who you’re doing business with, making companies uncertain about which potential customers are trustworthy.

New research conducted by PYMNTS in collaboration with Ingo Money found that the average U.S. FinTech loses $51 million to fraud annually, and many lose even more. To address the trust and fraud issues, governments around the world introduced KYC or “Know Your Customer,” a set of standards used in the investment and financial services industry to verify customers and know their risk and financial profiles.

Over the years, however, the KYC rules have also weighed heavily on companies and many businesses are struggling to keep up. It’s for this reason that the fraud detection startup Inscribe is on a mission to automate document fraud detection and fight financial fraud with AI.

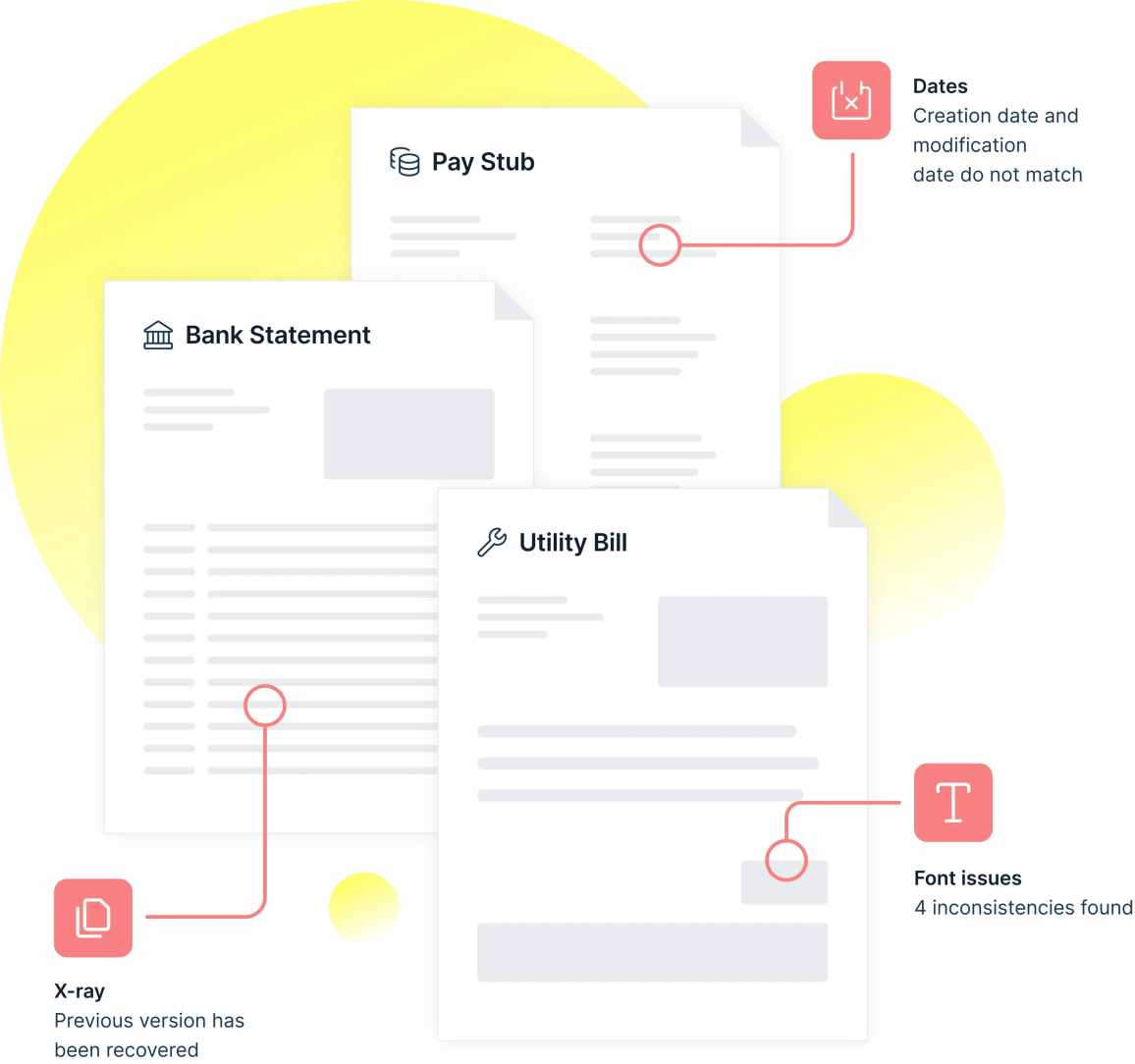

Using a combination of forensics and machine learning, Inscribe quickly and accurately detects fraudulent documents that are sent to insurers and lenders like proof of address documents and bank statements. The five-year-old startup uses a combination of natural language processing and computer vision to scan documents sent to insurance companies and lenders to catch fraudulent activity in documents in bank documents, pay stubs, and tax forms, among others.

To further accelerate its growth and meet its hiring goals, Inscribe announced Wednesday it has raised $25 million in Series B funding to “expand the breadth of our fraud detection capabilities, as well as introduce state-of-the-art Risk Intelligence innovations, “Inscribe said in a blog post.

The round was led by Threshold Ventures and joined by existing investors Crosslink Capital, Foundry, and Uncork Capital, as well as angel investors including Box co-founder Dylan Smith and Intercom co-founder Des Traynor, bringing the company’s amount raised to $38M.

The funding news comes on the heels of the company seeing a 3x year-over-year increase in ARR and a 4x year-over-year increase in monthly usage. Inscribe will also use the new capital infusion to grow its Dublin and US offices and expand deeper into the financial services sector.

Inscribe was founded in 2017 by co-founders Conor and Ronan Burke. The startup opened a Dublin, Ireland office after raising $3 million in funding in December 2018.

Inscribe, which works with fintech lenders, banks, and payment processors including BlueVine, Credito Real and Amount, along with numerous Fortune 500s, has experienced 12x growth year over year, as it has been used to help identify fraud within high-trust online applications such as lending and account openings.

“2020 kicked off a perfect storm for fraud, with the pandemic-driven shift towards applications and approvals moving from in-person to online only,” said Ronan Burke, co-founder and CEO of Inscribe. “Inscribe is helping financial institutions battle this increase in fraud—and save millions of dollars—by detecting false identities, inflated revenues, and inaccurate company information.”

“At BlueVine, we’ve taken action to provide fast Paycheck Protection Program (PPP) loans to the small businesses that have been hit the hardest,” said Ido Lustig, Chief Risk Officer at BlueVine. “Inscribe has been an instrumental partner in identifying and preventing fraud across all of our products, including the PPP application process, and has allowed us to focus on providing the best support possible for our small business customers.”