Web3 funding plummets by 74 percent

The decentralized web or Web3 has grown at a rapid pace in the last two years. From its glory days of static pages or Web 1.0, the Internet quickly evolved to Web 2.0 which brought platforms and user-generated content such as blogs, videos, social media, and other services. The idea behind Web3 is to decentralize this control and give it back to the people that create the value.

While all things Web3 have been hailed as the next revolution of the internet, it appears the hype is slowly cooling off as investors pulled back due to weakening confidence in crypto startups, DeFi hacks, the collapse of FTX, softening NFT sales, and a myriad of crypto-related bankruptcies.

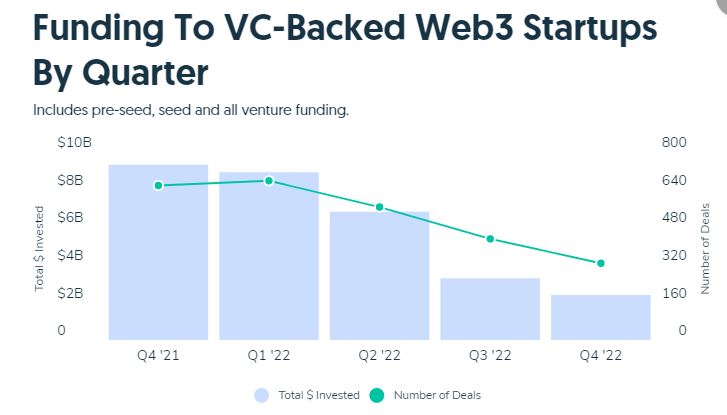

According to Crunchbase, a platform that shares information about private and public companies, investments in Web3 startups falls by a massive 74 percent in the last quarter of 2022 from the same quarter in 2021, dropping from $9.3 billion to just $2.4 billion. To put the funding drop in perspective, the total dollar amount makes the period the lowest quarterly total since just about $1 billion went to startups in Q4 2020.

Credit: Crunchbase

Although 2022 started out really strong. However, dealmaking dropped every quarter as investors shut their wallets to Web3 startup companies. Amber Group, Matter Labs, Uniswap and Mineplex were the only Web3 companies to announce rounds above $100 million last quarter, compared to Q4 2021 which had 20 such rounds.

The bad news didn’t end there. The first quarter of 2022 started with a staggering 677 funding deals. By the end of the year, only 327 funding deals were announced, Crunchbase reported.

2021 vs. 2022 Web3 Funding

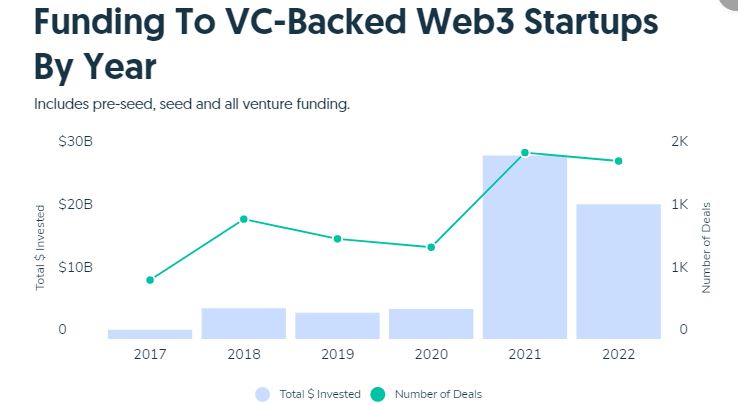

While funding to VC-backed startups in Web3 fell by about a fourth — from a record high of $29.2 billion in 2021 to about $21.5 billion last year, Crunchbase noted that there is a ray of hope for startups that may be looking for funding this year.

The report also shows that the number of deals remained pretty much the same, “with a difference of fewer than 100 deals for the year.” The major difference between the two years is that while 2021 witnessed major deals like FTX, NYDIG, and Robinhood raising rounds of $1 billion or more, there were no deals of that size in 2022.

Credit: Crunchbase

Is This The End of Web3?

Far from it! Web3 is still in its infancy. And just like any new technology, it will still go through the typical technology lifecycle where it’s first proven before it gains mainstream adoption. On the investment front, investors’ pullback is currently not isolated to Web3 projects. Rising interest rates, recession, and ongoing global economic slowdown have also contributed to slow funding.