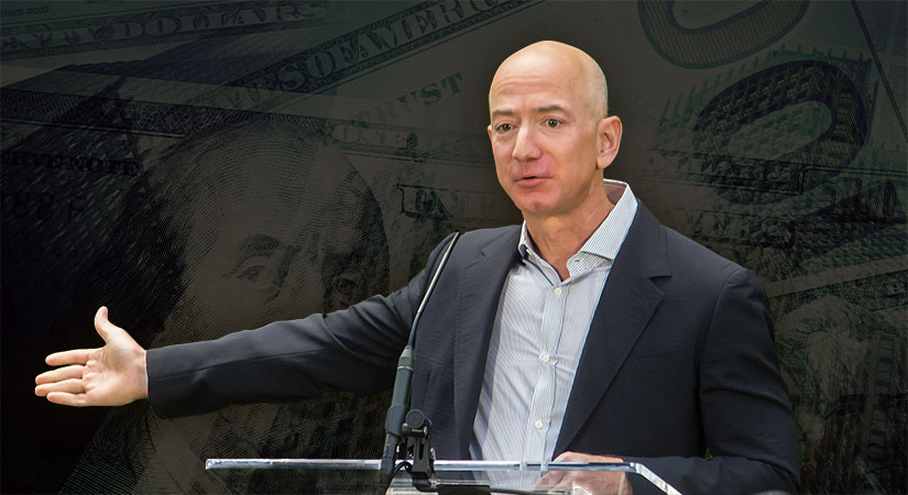

‘Don’t buy TV, fridge, hold onto your money,’ Jeff Bezos warns Americans to ‘prepare for the worst’ amid looming recession

Before Elon Musk’s ascension, billionaire Jeff Bezos was once the world’s richest person. The company he founded about three decades ago, Amazon, became the first company ever to lose $1 trillion in market value. As such, Bezos a thing or two about the ongoing economic downturn. Now, Bezos is warning Americans to ‘prepare for the worst.’

In an interview with CNN last week, Jeff Bezos recently warned consumers and businesses that they should consider postponing large purchases and big-ticket items in the coming months as an economic recession might be coming very soon.

The billionaire-turned-philanthropist warned Americans not to buy new cars and TVs as the US is staring at a recession, with household debt soaring to $16.5 trillion and Americans relying on credit to make ends meet.

“My advice to people, take some risks off the table. If you’re going to make a purchase, maybe slow down that purchase a little bit. Keep that cash, see what happens – take some risks off the table,” Bezos advised.

“Take as much risk off the table as you can,” he said. “Hope for the best, but prepare for the worst.”

“If you’re an individual considering to purchase a big-screen TV, you might want to wait, hold onto your money, and see what transpires. The same is true with a new automobile, refrigerator, or whatever else. Just remove some risk from the equation,” said Bezos during the interview.

“The economy does not look great right now,” he said, sitting alongside his partner Lauren Sanchez. “Things are slowing down. You’re seeing layoffs in many many sectors of the economy.”

Last week, Amazon announced plans to lay off approx. 10,000 employees in corporate and technology jobs. The layoff would be the largest job cut in the history of the company. Amazon becomes the latest in a series of tech companies to announce layoffs in recent months. Just last week, Facebook’s Meta laid off over 11,000 employees after losing $700 billion of its value over a risky metaverse bet.