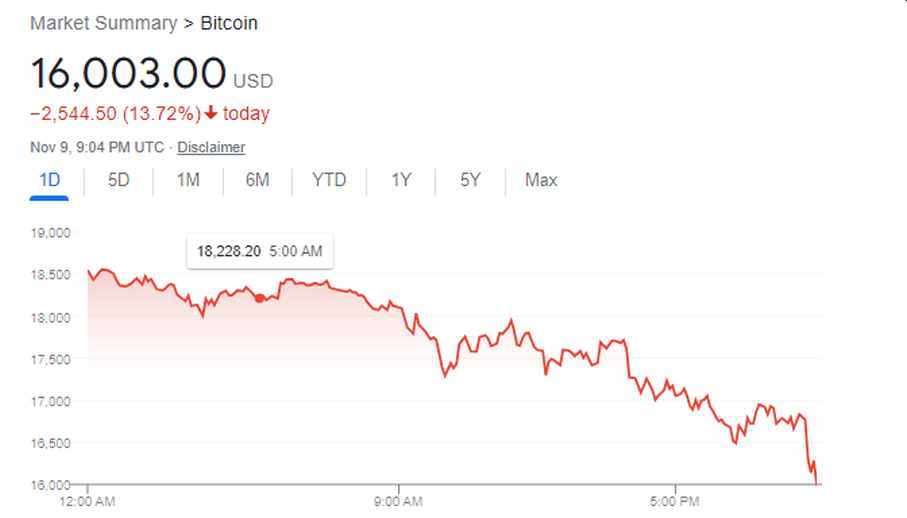

Crypto bloodbath: Bitcoin plunged to $15,000 as crypto rout continues

Today is probably the worst day in the crypto industry. In the past 48 hours, the cryptocurrency market lost over $200 billion of its value as millions of crypto investors withdrew their money from major crypto exchanges following the liquidity crunch at the now-distressed crypto exchange FTX.

Almost all the major cryptocurrencies lost at least 7 percent of their value. In the past two days, the world’s most popular cryptocurrency lost at least 19% of its value from a little over $20,000 to $16,003 as of the time of writing. The carnage didn’t stop there. Ethereum also lost over 10% of its value while the meme coin Dogecoin lost only 7 percent.

Bitcoin fell further this afternoon following the report that the world’s largest crypto exchange Binance has backed out of its deal to acquire rival FTX.

It all started over the weekend after Coindesk published an expose about the balance sheet of Alameda Research, the corporate sibling of FTX. A few days later, Binance CEO CZ tweeted that his exchange would reduce its exposure to FTX and slowly withdraw billions of its holdings in FTX’s native token, FTT, “due to recent revelations that have come to light.”

A few hours later, investors panicked and started to take their tokens off FTX just as Binance dumps its FTT. According to data from Nansen, mass withdrawals from FTX have accelerated, as investors’ weekly stablecoin outflows from FTX reached a whopping $451 million.

The earlier speculations that FTX is on the verge of insolvency turned out to be true although FTX CEO Sam Bankman-Fried denied the rumor when he said early Monday morning that “FTX is fine. Assets are fine.”

Immediately after the news, investors have withdrawn at least $6 from FTX as the crypto exchange continues on the downward spiral, according to a report from Reuters, citing a message to staff by its CEO Sam Bankman-Fried. “On an average day, we have tens of millions of dollars of the net in/outflows. Things were mostly average until this weekend, a few days ago,” Bankman-Fried wrote in the message.

“In the last 72 hours, we’ve had roughly $6b of net withdrawals from FTX,” he wrote, adding that withdrawals at FTX’s main unit, FTX.com, are “effectively paused,” an issue that would be resolved in “the near future.”

To make the matter worse, Bloomberg reported that US regulators are investigating whether FTX.com “properly handled customer funds,” as well as its relationship with other subsidiaries of Sam Bankman-Fried’s crypto empire. The ongoing investigations are being conducted by the SEC and the CFTC that relate to the liquidity crisis at the trading platform which led to the sudden and unexpected collapse of the company.