How this Web3 startup plans to simplify fine art investing with NFTs

As blockchain technology and non-fungible tokens (NFTs) continue to grow in popularity, we are witnessing a dramatic transformation in the art world. This is particularly evident when it comes to digital art, as artists now have a whole new way of creating, owning, and selling their work.

As a result, the global NFT market ballooned to a staggering $41 billion in 2021, and looks like it is well on its way to catching up with the conventional art market. When you consider how novel and relatively uncharted this territory is, that is quite an achievement.

Nonetheless, there is still a large disconnect between these two respective industries, despite their common goal of representing and monetizing art.

The problem lies in the fact that NFTs are predominantly used to help support the transaction of digital art between creators and investors, rather than for the purchase of real-world artistic creations.

However, with real-world assets such as real estate and bonds showing promise in being tokenized on the blockchain, it is clear there is a massive business opportunity for tokenizing the fine art industry. This is where Web3 startup Artfi comes in.

Meet Artfi

Artfi is a blockchain start-up that plans to revolutionize the way people interact and invest in the fine art industry. Traditionally, investing in fine art is a cumbersome process. Not only is it filled with a number of intermediaries, but it can be difficult to track provenance and verify authenticity.

With Artfi’s platform, they hope to streamline the process by tokenizing physical artworks and putting them on the blockchain. This would not only help with the issue of provenance but also allow for fractional ownership of artworks, making it more accessible to a wider range of investors.

In addition, by tokenizing art on the blockchain, Artfi also plans to make the secondary market for art more liquid. Currently, selling artwork can take months, if not years. But with Artfi’s system in place, artworks could be sold almost instantaneously, providing a much-needed boost to the art market.

In light of this, Artfi could be a key player in making fine art more accessible to the masses, made possible through a smarter, more user-friendly tokenized ecosystem.

How Artfi works

Tokenized fine art

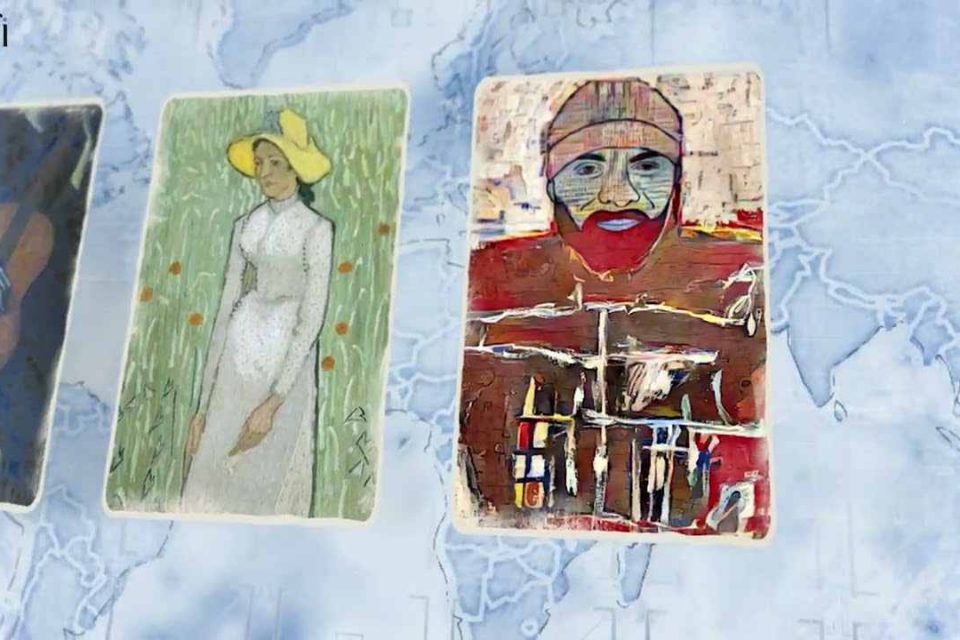

Artfi offers a consignment service for high-value paintings (ranging between $1m to $10m in value), which it then tokenizes and mints onto the Polygon blockchain.

After the painting has been appraised, it is then offered for sale in the form of NFTs, which represent fractional ownership of the painting. All Artfi NFTs are listed on its marketplace, where they can be bought and sold by anyone with a Web3 wallet.

Artist royalties

To sweeten the deal for artists, Artfi also offers royalties on any sales of their tokenized artworks. This opens up an entirely new revenue stream for artists, who can now earn royalties on top of the initial sale price of their work.

The beauty of this system is that royalties are paid out instantaneously since they are already stipulated in the smart contracts when the art was minted onto the blockchain, making it completely transparent and secure.

Real-world display

All the artwork that is purchased and sold by Artfi will be available for viewing in Artfi’s Dubai-based art gallery. Not only does this provide an extra layer of trust for buyers, but it could also help to increase (or at least stabilize) asset prices since they are backed by a tangible real-world asset, unlike most digital art. This is one of the key drivers of Artfi’s value proposition.

The $ARTFI token

In order to buy and sell fine art on the Artfi marketplace, you will need to use the $ARTFI token. The $ARTFI token is based on the Polygon network and allows for fast, cheap, and scalable transactions.

In addition to being used as a currency on the Artfi marketplace, the $ARTFI token will also be used to reward stackers. By staking $ARTFI, you will be able to earn a portion of the fees generated by the Artfi marketplace.

In addition, $ARTFI is a deflationary token, which means that as the Artfi marketplace grows and generates more fees, the $ARTFI token will become more scarce (and therefore more valuable) through token burns.

A potential major player

Founded by art connoisseur/collector Asif Kamal, Artfi has the potential to be a major player in the world of fine art investing as it offers a brand-new way to invest in this traditionally inaccessible asset class.

“This is an opportunity for people to now diversify their portfolios from stocks, and fixed deposits and invest in one of the largest asset classes that have outperformed all these traditional investments for over 30 years,” said Kamal.

With Artfi filling a much-needed void in the world of fine art investing, it will be interesting to see how they fare in the coming months and years. At the time of writing, the company has $16 million worth of paintings in assets under management, including two Sacha Jafri paintings and a painting by V.S. Gaitonde, so it’s safe to say that they are off to a good start.