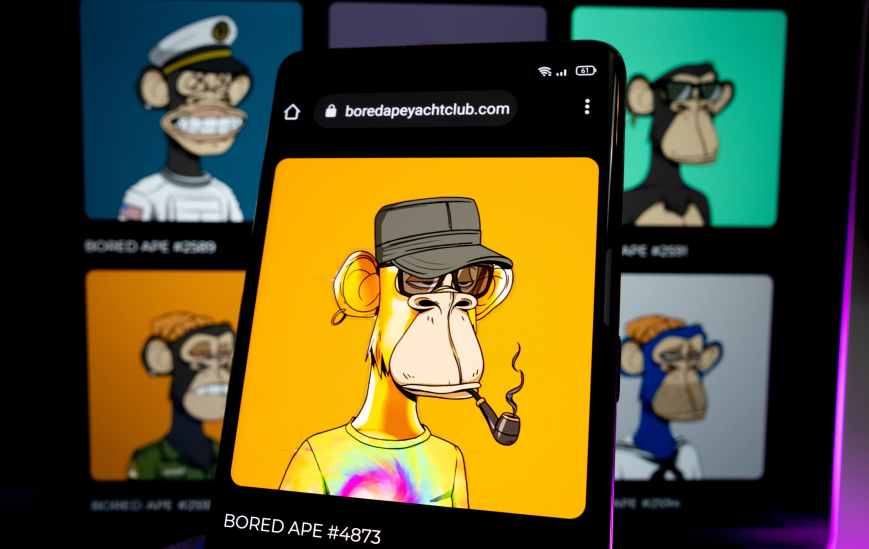

SEC launches investigation into Bored Ape Yacht Club creator Yuga Labs over securities violations

Non-fungible tokens (NFTs) are going through a difficult phase right now as crypto winter spreads across the entire digital asset markets. The NFT trading volume has plunged by 98% from January, according to data compiled from Dune Analytics. Now, one of the popular NFT projects appears to be in hot water with US federal regulators.

According to Tuesday’s report from Bloomberg, the United States Securities and Exchange Commission (SEC) is investigating Yuga Labs over whether its Bored Ape Yacht Club (BAYC) Ethereum NFTs and the ApeCoin token violate federal law.

The report, which cited an unnamed source familiar with the ongoing SEC investigations, claimed that the agency is exploring whether the crypto startup broke federal law by issuing NFTs that act like stocks, as well as exploring the distribution of the Ethereum-based ApeCoin token that launched earlier this year.

For now, the BAYC creator has not yet been accused of any wrongdoing, the report said.

Commenting on the investigations, Yuga Labs told Bloomberg in a statement:

We covered Yuga Labs after the creator of the “Bored Ape” series of non-fungible tokens (NFTs) raised $450 million in funding to build an NFT metaverse. The round, which was led by a16z crypto, with participation from top-tier game studios, brings the company’s valuation to $4 billion.

NFT is a type of cryptographic token on a blockchain that represents a unique digital asset that represents real-world objects — such as art, music, real estate, and beyond — and can’t be replicated.

In an online sale on April 30, Yuga Labs said it sold NFTs called “Otherdeeds”, which it said could be exchanged as plots of virtual land in a future Bored Ape-themed online environment called “Otherside.” The demand for high-profile NFTs has grown in recent months. The company said on Twitter that all the 55,000 Otherdeeds listed for sale at 305 ApeCoin each had sold out.