August blockchain industry report: DeFi activity increased by 3.7% while TVL decreased by 10.5% due to Tornado Cash

In July, we covered DappRadar’s blockchain industry report where we discussed the winners and losers of the crypto bear market. Now, DappRadar’s out with their August blockchain industry report, and things are as hectic as ever.

In recent months, it has seemed like the crypto market has been seized by one piece of negative news after another. August was touched by several breaches, including the Solana wallet attack, the Acala and Nomad exploits, and the Tornado Cash sanctions, which significantly influenced DeFi TVL, as we’ll see below.

Nonetheless, August also brought some positive news, as the Ethereum network completed one of the largest test networks, Goerli, in preparation for the upcoming Merge.

No doubt that the effects of the bear market are still visible, and the dapp activity is continuing to decrease month by month, currently being 1.67 million, the lowest daily Unique Active Wallets (UAW) connected to blockchain dapps, registered in the whole year. This represents a 3.52% decrease from last month, and a 14.73% decrease from August 2021.

For the first time since May, DeFi dapps show signs of recovery with a 3.7% increase in terms of daily average UAW month-over-month (MoM). Still, the DeFi category is far from its peak with under half a million daily UAW.

This growth is driven mainly by the Flow protocol, which has an increase of 577% UAW from last month, due to the support of Flow-based NFTs into Instagram (LINK) and the success of their game, Solitaire Blitz. Also, Optimism has an increase of 33% MoM, driven mainly by the upcoming Ethereum Merge.

In contrast, Solana UAW declined by 53% from the previous month, and the number of transactions dropped by 68%, due to the latest Solana hack that occurred at the beginning of the month.

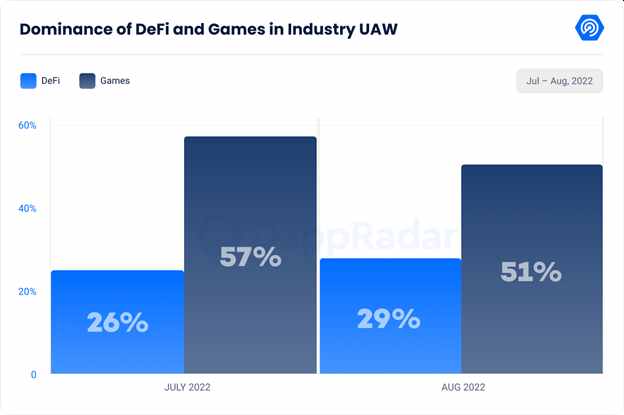

Even if it has 50% of the whole activity industry’s usage in the Gaming sector, the unique active wallets decreased this month by 11%. Also, looking at the number of transactions, we observed a 12.7% decrease, month-to-month.

Simultaneously, on the NFT side, the number of UAW decreased by 16.7%, to 114,542, the lowest since June 2021.

The most important trends from the previous month are covered in this report.

Key Takeaways

● DeFi-based activity ramps up with a 3.7% increase from the previous month; however the industry’s TVL decreased by 10.47% from July as a result of the Tornado Cash situation.

● DeFi dapps on Ethereum scaling solutions are enjoyng a considerable increase in their DeFi metrics amid the Merge; Optimism has cracked the top 10 blockchains in terms of TVL with $1 billion approximately.

● The Merge has been confirmed by the Ethereum Foundation around September 15; the event will bring a new consensus mechanism while turning ETH deflationary, with no changes to the chain’s scalability.

● More than $211 million were lost in August, with 90% of the amount attributed to the Nomad exploit.

● SudoSWAP’s new marketplace disrupts NFT trading by introducing an “automatic market maker” (AMM) model.

Contents

● Sanctions against Tornado Cash raise questions on web3 decentralization

● DeFi TVL shrinks 10.47% while scaling protocols shows signs of growth

● What effects will the Merge have on scaling solutions?

● Nomad’s exploit represents 90% of the total funding lost in August

● Fear of BendDao liquidations negatively influences the NFT market

● The NFT marketplace keeps evolving with SudoSWAP and the dominance of OpenSea continues to fall

● Gaming sector still accounts for 51% of the industry’s usage

● Closing

Sanctions against Tornado Cash raise questions on web3 decentralization

On August 8, the Office of Foreign Assets Control (OFAC) imposed penalties on the cryptocurrency mixer Tornado Cash. This led to a series of events that accidentally exceeded the United States’ borders, raising numerous doubts about the utility of decentralized blockchain technology.

OFAC’s primary justification for the Tornado Cash penalties is that the tool has been used for a host of illicit money laundering activities estimated to be worth $7 billion. Of this sum, it is estimated that $455 million was controlled by the notorious Lazarus Group, a North Korean state-sponsored hacking group. Additionally, Tornado Cash was also used to launder over $96 million of ill-gotten funds derived from June’s Harmony Bridge hack and $7.8 million from this month’s Nomad heist.

Immediately following the OFAC’s penalties, the token of Tornado Cash (TORN) was $30 and plummeted by 45% in only two days. Since then, it has decreased and is at $9, representing a 71% reduction.

In concrete terms, this policy should have solely applied to U.S. citizens, who are no longer permitted to utilize the protocol and interact with the different sanctioned wallets. However, the effects were immediately noticed outside of the United States. First, Circle, the USDC’s broadcaster, decided to ban some Tornado Cash-associated addresses, freezing $75,000 in cash. This decision, while not very important from a monetary standpoint, sparked the indignation of the crypto community, who saw it as the last straw in a decentralized environment.

This prompted Rune Christensen, the creator of MakerDAO, to doubt the DAI’s operation. In our stablecoins report, we analyze the impact of the Tornado Cash crisis on the stability of the DAI stablecoin, whose peg stability is maintained by USDC deposits.

Simultaneously, GitHub pulled the open-source code for Tornado Cash from its site. This freedom from a court judgment, which did not directly harm GitHub, has rekindled the issue that the wrongdoings of a few should not inevitably condemn everyone.

After OFAC’s judgment, protocols like dYdX and Aave have decided to prohibit the usage of their platform by anybody who has dealt with Tornado Cash. As a result of this step, Justin Sun, the creator of the Tron ecosystem (TRX), was prevented from accessing Aave. He complied with OFAC sanctions, but an anonymous user contributed 0.1 ETH to several well-known addresses in protest of US Treasury proceedings, including his. Since it is theoretically impossible to stop an incoming transaction on Ethereum, accepting payments via Tornado Cash puts you in violation of the penalties.

The Aave teams responded immediately upon becoming aware of the issue. It should be emphasized, however, that these blocks are only relevant from the interfaces of the respective platforms. Those with programming expertise may connect directly with the smart contracts of their choosing, bypassing the so-called “front-end.” In principle, even a blacklisted address might continue to utilize Aave and Tornado Cash, for instance.

Additionally, it cannot be ruled out that other developers may create alternative interfaces to circumvent these restrictions and provide access to these smart contracts for those who are restricted.

DeFi TVL shrinks 10.47% while scaling protocols show signs of growth

Even though DeFi shows signs of recovery when analyzing the Industry Unique Active Wallets, the overall DeFi TVL is still suffering and presently sits at $74.21 billion, an alarming decrease considering that this amount was $250 billion less than eight months ago. The last time the TVL was this low was in April of 2021, when the space was just beginning to get momentum. This indicates that the DeFi TVL has decreased by 56% or more since August 2021.

This month has been particularly difficult for the market because of the Tornado Cash crisis, and the TVL fell 10.47% month-over-month, losing about $8.7 billion.

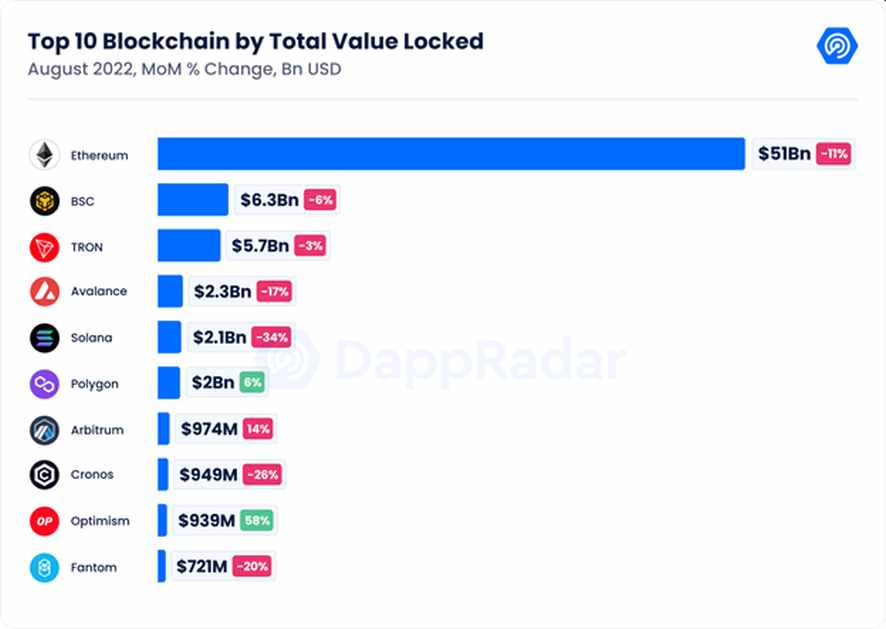

Ethereum continues to be the most prominent chain, controlling 69% of the DeFi TVL with $51.47 billion, which is 11% less than last month and 56.63% less than August 2021. BSC has also decreased by 6.44% month-to-month and by an alarming 75.67% year-over-year.

As a result of the wallet attack, Solana TVL dropped by 27% in the first four days of August, continued to decline by 6% for the remainder of the month, and is now valued at $2.11 billion, a loss of about $1 billion.

TRON TVL fell by 2.90% month-to-month to reach $5.70 billion, although it has increased by almost 68% since August 2021. Similarly, Avalanche has declined 17.20% month-on-month, although it has risen by nearly 11% since August 2021.

On a more positive note, only the Layer2 (L2 protocols based on Ethereum are showing indications of growth mainly driven by the upcoming Ethereum Merge. In first position is Optimism, which entered the top 10 blockchains with a total locked value of about $1 billion, a growth of 57.61% MoM. Next, Arbitrum has a MoM rise of 14.36%, followed by Polygon, which has a MoM growth of 6.50% but a year-over-year decline of 62.58%.

What effects will the Merge have on scaling solutions?

Since its inception, Ethereum has been the largest and most popular smart contract blockchain available. However, with better-equipped rivals attempting to catch up, Ethereum is switching to a less energy-intensive technology to operate its blockchain. Previously known as Ethereum 2.0 or Eth2, the Ethereum Foundation now refers to it as the Ethereum Merge.

This is one of the most awaited events in the history of the crypto industry, and if you want to learn more about Ethereum transition from proof of work into proof of stake, you can read this article.

It is important to explain what are the immediate effects of the Merge. First of all, the reduction in ETH token’s issuance rate will be a drastic one, due to the fact that the Ethereum network will no longer provide ETH token incentives to miners, resulting in a 90% fall in the yearly issuance rate of ETH. This substantial fall in issuance rate, coupled with the fee-burning mechanism established by the EIP-1559 proposal, would likely result in deflation on the Ethereum network during times of high blockspace demand. Unprecedented in its scope, this constitutes a fundamental, structural alteration to the Ethereum Network.

Another effect is the increasing interest from the institutions in the asset and network, driven by the increasing staking payouts. Previously, the transaction fees were paid to miners, and after the Merge it will be given to validators, causing a rise into the Beacon Chain incentives.

It is essential to remember that the Merge itself will not immediately increase the capacity or throughput of the network. This implies that block size stays intact and gas prices will continue to be determined by demand for block space, with Layer2 scaling solutions such as Starkware, Polygon, Arbitrum, and Optimism.

Dapps developed on Ethereum Mainnet will continue to migrate to Layer 2s, due to liquidity mining incentives, cheaper gas prices, and the possibility of retroactive token airdrops. As users accumulate on these rollups and TVL develops, new protocols will be encouraged to be created directly on L2s, necessitating UX enhancements across on-ramps, wallets, and bridges to enroll users directly onto L2s.

Even if the Merge goes off without a hitch, Ethereum has a long way to go before it reaches the speed and efficiency that its proponents promise are feasible. However, considering the robustness of Ethereum’s ecosystem and the size of its community, it would be difficult to wager against them. The crypto narratives will be dominated by the Merge through September, and we will continue to be attentive on how the events will roll up.

Nomad’s exploit represents 90% of the total funding lost in August

According to DEFIYIELD data, cryptocurrency hacking losses increased by about 60% to $1.9 billion in the first seven months of the year, driven by an increase in money stolen through decentralized finance (DeFi) protocols.

The majority of cash stolen using DeFi protocols may be ascribed to “bad actors” associated with North Korea, particularly elite hacking teams such as Lazarus Group.

In the first week of August, $190 million were lost due to a cross-chain bridge Nomad attack. Hackers exploited a security flaw that let users enter any value into the system and siphon off the funds, even if there weren’t enough assets available in Nomad’s deposit base. The nature of the bug meant that users didn’t need any programming skills to exploit it. Others caught on and deployed armies of bots to carry out copycat attacks.

On August 2, more than 8,000 Solana wallets were hacked of just over $5.2 million in digital coins including solana’s sol token and USD Coin (USDC). As of today, there’s still no conclusive evidence about how the hack was done.

https://public.flourish.studio/visualisation/11059053/ (VISUAL)

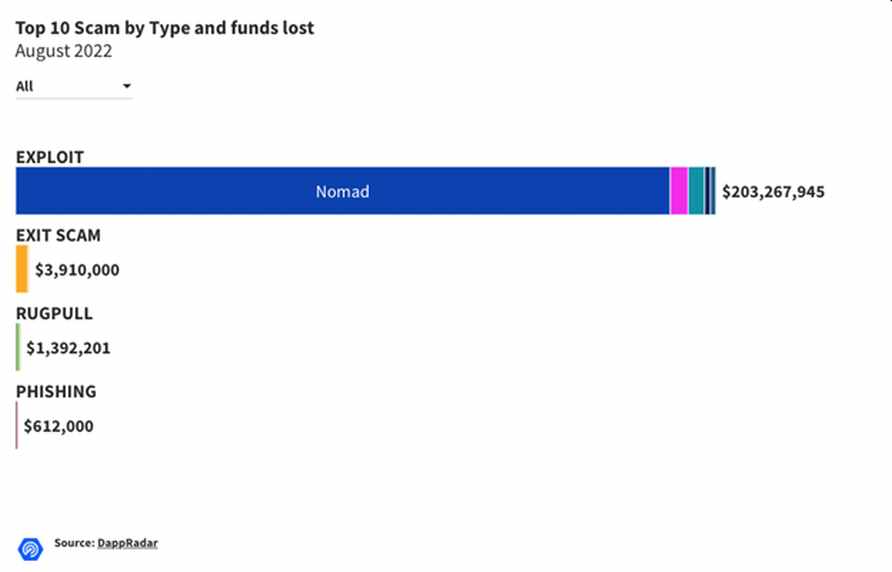

There were 31 hacks in total in August, for a total of $211 million, which 90% of it is represented by the Nomad hack. In total, the exploits represent 96% of the total lost funds, 1.85% is represented by exit scams, and the remaining by phishing.

DeFi protocols are uniquely susceptible to hacking, as their open source code can be studied ad infinitum by cybercriminals looking for exploits, and it’s possible that protocols’ incentives to reach the market and grow quickly lead to lapses in security best practices

Fear of BendDao liquidations negatively influences the NFT market

These are difficult times for the NFT market, as seen by the recent layoffs at Opensea, the decline in trading volume illustrated below, the devaluation of crypto-currencies, and the risk of mass liquidation of Bored Ape NFTs by BendDAO.

BendDAO, a peer-to-peer lending business that enables users to borrow ETH by giving their NFTs as “collateral,” is in the process of bankruptcy. BendDAO owns 272 NFT from the Bored Ape Yacht Club collection as collateral or 2.72% of the whole collection. Out of these 272 loans, 45 are dangerously close to the “Danger Zone” due to the decline in the floor price, and could be auctioned off in the next few days. An auction of this size, with an estimated value of $5.3 million might have implications on the whole BAYC collection.

The trading volume measured in USD continues to decline by 5% every month, mostly owing to the falling price of Ethereum. In contrast, the number of sales is growing by 23% from last month to over 7.24 million, which is the same amount as in August 2021.

While the number of unique traders fell by 8% from the previous month, it rose by 6% from August 2021.

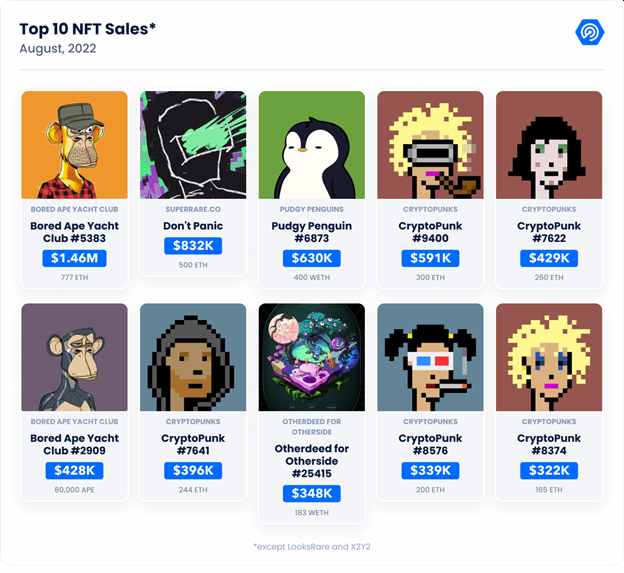

Despite the bear market Bored Ape Yacht Club gold token #5383 was sold for 777 ETH (about $1.5 million at the time of the deal). It is essential to note that The Yuga Labs collections continue to dominate the market, and this month, with its four projects CryptoPunks, Bored Ape Yacht Club, Mutant Ape Yacht Club, and Otherdeed for Otherside, the total trading volume exceeded $118 million, accounting for 13.7% of the entire total trading volume of August 2021.

Even if market circumstances are not optimal, a growing number of well-established enterprises from a variety of industries are joining the NFT ecosystem. On August 5, Tiffany & Co. introduced NFTiff, where NFTs are transformed into luxury wearable jewelry, while on August 10, 9GAG, the social media network, introduced Potatoz, a collection that symbolizes a bridge between web3 and memes.

The most recent entry is the candy brand Mars, which announced on August 24 that it had reached an agreement with the Universal Music Group (UMG) label to produce limited edition M&Ms based on Kingship, its virtual band comprised of Bored Ape Yacht Club and Mutant Ape Yacht Club avatars. If you want to know more details about this partnership, read this article.

As NFTs evolve and use cases emerge that are specific and unique from the speculation that has dominated the market in 2021, there is no question that NFTs will play a significant role in the next bull run.

The NFT marketplace keeps evolving with SudoSWAP and the dominance of OpenSea continues to fall

The landscape of NFT marketplaces evolves every month. July saw the introduction of two new marketplaces: Gamestop and Nickelodeon’s NFT Marketplace. This month sees the emergence of a new NFT marketplace, SudoSWAP, which is changing the way crypto consumers see NFT liquidity and trade. This is accomplished via the introduction of the ‘Automated Market Maker’ (AMM) concept to NFTs through this new marketplace.

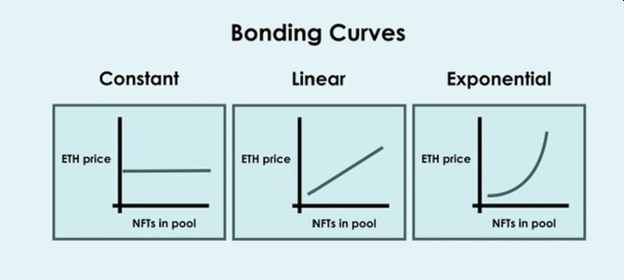

The Automated Market Maker (AMM) enables the trading of assets using crypto liquidity pools as counterparties, as opposed to the conventional market of buyers and sellers. In this system, automated market makers entice users to become liquidity providers in return for a portion of transaction costs.

Using the AMM architecture, Sudoswap allows users to trade and swap NFTs over a bidirectional liquidity pool. Thus, you may offer NFTs for sale in addition to ETH and in return, you will get a commission depending on the transaction spread.

Unquestionably, Sudoswap is pioneering the path for nontraditional financial offerings, distinguished by the ability of buyers and sellers to swap into customizable bonding curves supplied by liquidity providers.

Source: Finance Yahoo

As with the previous floor NFT protocols, the current sudoswap AMM protocol does not differentiate between ERC721 IDs. Pools willing to purchase or sell NFTs will yield the same price regardless of which NFT is added or removed. A liquidity provider offers liquidity for an NFT collection in return for swap fees, comparable to Uniswap V2.

Sudoswap’s disruption of the decentralized nature and creative marketplace enables the development of unique projects on its platform and gives consumers more control.

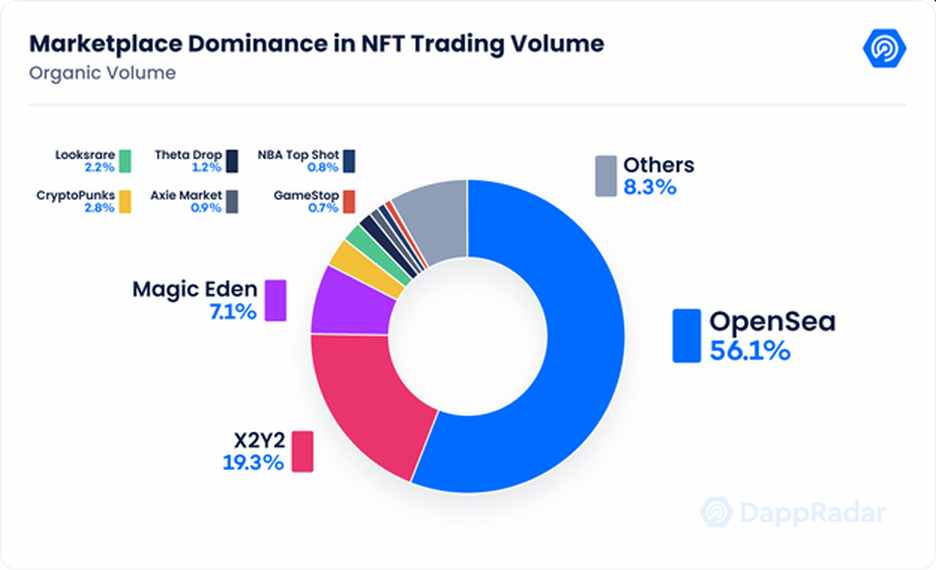

While the emergence of new marketplaces has made things harder, OpenSea continues to hold its place as the dominant market leader, accounting for $482 million in total trading volume, a 9% decrease MoM, or roughly 56% of the month’s reported volume activity. The decline in the total trading volume of OpenSea comes at a time when it is cutting 20% of its workforce, citing the company’s need to adapt to current market conditions.

Declines can be seen elsewhere across the NFT marketplace ecosystem. Solana-focused Magic Eden has seen $61 million in volume, compared to $70 million in July — a roughly 13% decline. LooksRare’s volume for August is $18 million, a 25% decrease from the previous month.

Axie Marketplace had an increase of 17%, driven by the new marketplace update called “the “Great Reset”. This update includes a variety of new features, but the most anticipated is the infrastructure to support ERC 1155, which is the standard NFT runes and charms. ERC 1155 is a standard interface for contracts that manage multiple token types. A single deployed contract may include any combination of fungible tokens, non-fungible tokens or other configurations (e.g. semi-fungible tokens).

The forecast for NFT marketplaces, which accounted for about $25 billion in sales in 2021, seems promising, particularly since competition among NFT marketplaces has intensified. Despite the fact that all markets are experiencing heightened volatility in times when interest rates and inflationary factors are uncertain, wars and global conflict continue, and other factors influence the markets, NFTs and their underlying marketplaces are exhibiting strong indications of enduring regardless of the ebbs and flows that occur.

Gaming sector still accounts for 51% of the industry’s usage

Gaming blockchain technology is one of the emerging, promising industries of the web3 with 847,230 daily Unique Active Wallets and $698 million in transactions.

The best blockchain games keep their player base, which demonstrates actual engagement at the top of the rankings. In addition, investments in metaverse and blockchain-based gaming businesses continue to rise.

It is worth mentioning that even if the dominance of games for the UAW has decreased from 57.30% to 50.51% MoM, it still represents a good indicator for the sector.

To get more insights on blockchain games and trends like virtual worlds, move-to-earn, and the leading game dapps, read our latest BGA Games Report.

Closing

When economic growth has been robust, interest rates have been low, and the economic climate has lacked shocks, cryptocurrencies have shown the strongest returns and most independence from other asset classes. But, in the following climate, where the worldwide economic landscape is uncertain, more funds are lost due to hacks or exploits, and the effects caused by the latest Tornado Cash sanctions, the web3 industry has shown significant weakness this year.

Is important to remember that the history of cryptocurrency is brief; the major currencies have been around for around a decade, and the cryptocurrency industry has developed significantly each year, therefore it is safe to assume that the future looks bright.