The Euro is now at parity with the US dollar after dropping to a 20-year-low as Europe suffers one of the worst economic crises in a generation

Just last week, we wrote about some of the challenges faced by European tech startups as regulatory ‘friction’ hampers their growth. The situation is so bad that one in three European startups are now considering launching their business elsewhere due to the scale of the compliance burden.

But the regulatory burden is probably now the least of their worries as European countries continue to experience a prolonged period of economic and energy crises as the war between Russia and Ukraine rages on.

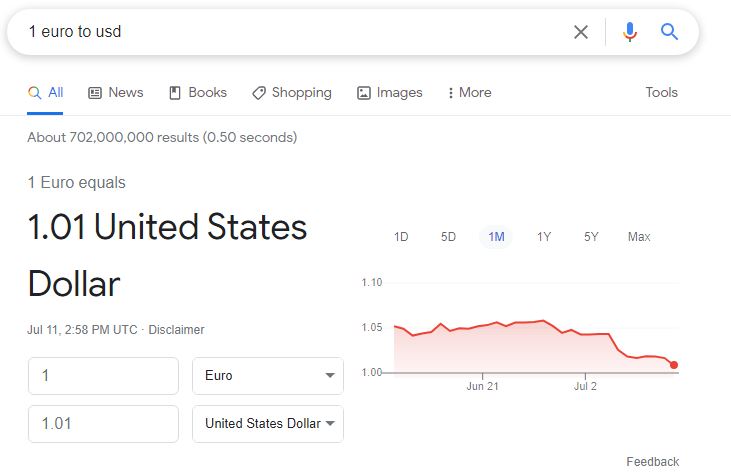

For the first time in two decades, the Euro, the common currency of the eurozone, is now at parity with the US dollar as Europe suffers one of the worst economic crises in a generation. The fall is also forcing currency traders to prepare for a world where one euro is worth less than a dollar. As of the time of writing, one Euro is now trading at $1.01. But the fall could even get worse.

Some analysts are saying Euro’s fall is far from over, there’s a possibility it could fall even further. George Saravelos, Global Head of FX Research at Deutsche suggested that “safe-haven” moves towards the U.S. dollar could become “even more extreme” as the U.S. enters a technical recession, thereby putting more downward pressure on the EURUSD trade. Saravelos said:

“We conclude that a move down to 0.95-0.97 in EUR/USD would match the all-time extremes seen in exchange rates and USD risk premium since the end of Bretton Woods.”

Other analysts attributed the decline to a number of macro events including fears of a recession and rising uncertainty about energy supply to the bloc caused by sanctions on Russia.

So, what does this mean for technology startups? The exchange rate between the two currencies may further cause instability for European startups looking to raise new funds. The rate fluctuation and volatility could also hamper their effort to plan their future operations.