Nexo Review 2022 – Everything You Need To Know

A platform like Nexo introduces a solution to crypto holders looking to put idle assets to work. An existing crypto asset holder can use their assets as collateral for a loan or lend it out to collect interest. Earnings are very appealing, and the platform supports a variety of crypto assets.

What Is Nexo Exactly?

Based in London, England, the company Nexo positions itself as “the world’s leading regulated financial institution for digital assets.” Their team consists of over 100 employees, and Antoni Li and Kosta Kantchev co-founded Nexo. Trayan Nikolov is the Chief Product and Operating Officer, and Tom Stanev is Head of Trading.

Since its inception in 2017, Nexo completed two funding rounds: a $52.5 million funding round by Arrington XRP Capital in March 2018 and a debt financing round for an undisclosed amount in April 2020.

Today, Nexo claims to have over $12 billion in assets under management and more than 3.5 million users worldwide. The company’s assets are monitored in real-time by leading accounting firm Armanino which is employed by some of the top corporations around the world, adding to its credibility.

Which Services Are Available?

The primary objective of Nexo is to bring digital assets into the spotlight through lending and borrowing solutions. Exiting crypto holders can earn interest by depositing funds to the platform or taking out loans using digital assets as collateral.

Earning Interest With Nexo

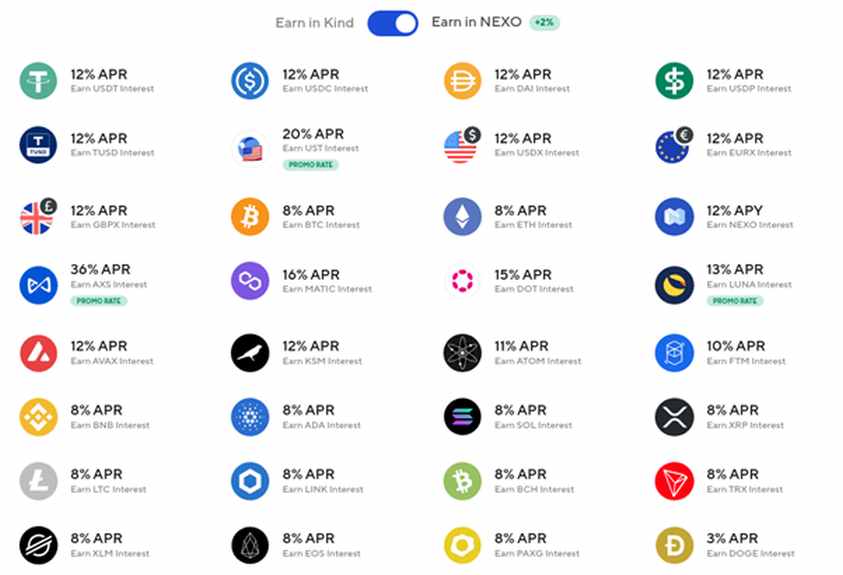

Users who feel comfortable with depositing their digital assets on Nexo can earn interest on crypto assets and stablecoins alike. Earnings on crypto assets are slightly lower – roughly 8-13% per year – whereas stablecoins can yield up to 20%. All interest compounds daily, ensuring users receive a payout every day. Moreover, you can withdraw or deposit funds at any time, as Nexo foregoes lockup periods on deposits.

On the withdrawal side, things are a bit different. Users can withdraw supported fiat currencies from Nexo at any time without limitations. However, crypto withdrawals are limited to 1-5 times per month, depending on your loyalty tier. Loyalty tiers are determined based on the amount of $NEXO tokens in your portfolio. These tiers also affect your earnings from depositing funds.

Nexo continues to enable support for more crypto assets and stablecoins over time. Today, the platform offers support for over 30 assets, with more to follow in the future. Moreover, there is support for three major fiat currencies – USD, EUR, and GBP – elevating the appeal of this platform.

Keeping funds locked into the Nexo protocol for a more extended period will ensure users earn slightly better rewards. For example, a one-month commitment increases earnings by 1%, whereas three-month commitments bump earnings by 4% or more. Those rates are added on top of the current returns.

Borrowing With Nexo

The other side of the Nexo medallion facilitates borrowing cash or stablecoins without intermediaries, credit checks, or any other red tape. Like traditional loans, users will need to repay the loan and may be required to cover interest rates. Nexo provides borrowing functionality starting at 0% APR and up to $2 million without monthly repayments. However, borrowed funds are traditionally subject to a 6.9% interest rate or higher.

The amount you can borrow depends on the amount of crypto held in the deposit. Accessible funds may vary depending on the collateral you provide, although the average is around 50% of your deposit.

However, users must keep an eye on the price of their collateral. If prices degrade, your collateral will need to be topped up, or funds will be taken from your savings wallet. Nexo will automatically sell off collateral to repay the loan if that wallet runs dry.

Nexo Fees Structure

The lending and borrowing services provided by Nexo do not require paying fees when depositing or withdrawing fiat. Nor are these surcharges for moving crypto assets to a Nexo Wallet. Users can also benefit from up to five free crypto withdrawals per month based on their Loyalty Tier.

However, there are some questions when making more withdrawals than you are allotted. The functionality is there, yet the fee structure seems a bit unclear. It will mainly depend on the currency and network used, as some blockchains- like Ethereum – are far more expensive to use than Bitcoin or Polygon, for example..

Conclusion – Is Nexo Worth It?

That is a tough question to answer. Users looking to extend their assets for loans by others can tap into lucrative returns, depending on their asset of choice. There are daily payouts to consider, which is rather appealing. Moreover, Nexo maintains insurance on custodial assets, which provides some peace of mind.

Nexo provides an appealing solution with fair interest rates for those looking to borrow money, and the collateralization requirements are on par with other providers. In addition, loans are approved very quickly, which is a major bonus.

One thing to consider is Nexo’s support, which is only available via email and support tickets. That is not a terrible system, although a live chat option would be useful to many users. A minor blemish, but one to take into account regardless.