On-chain Metrics and Macro Events Signal a Positive Outlook for Blockchain Games, DappRadar’s January report shows

DappRadar, a global app store for decentralized applications, is out with their January blockchain games report reviewing on-chain metrics and macro events, signaling a positive outlook for games in the space.

Seizing the play-to-earn narrative, game dApps like Axie Infinity, Splinterlands, and The Sandbox have laid the foundations for a shift in the gaming paradigm. Play-to-earn and GameFi dApps conceive a new idea of how we spend playing time. Even amid the craze surrounding NFTs and a growing DeFi space that holds billions in Total Value Locked (TVL), blockchain games finally left a visible footprint in the blockchain industry last year.

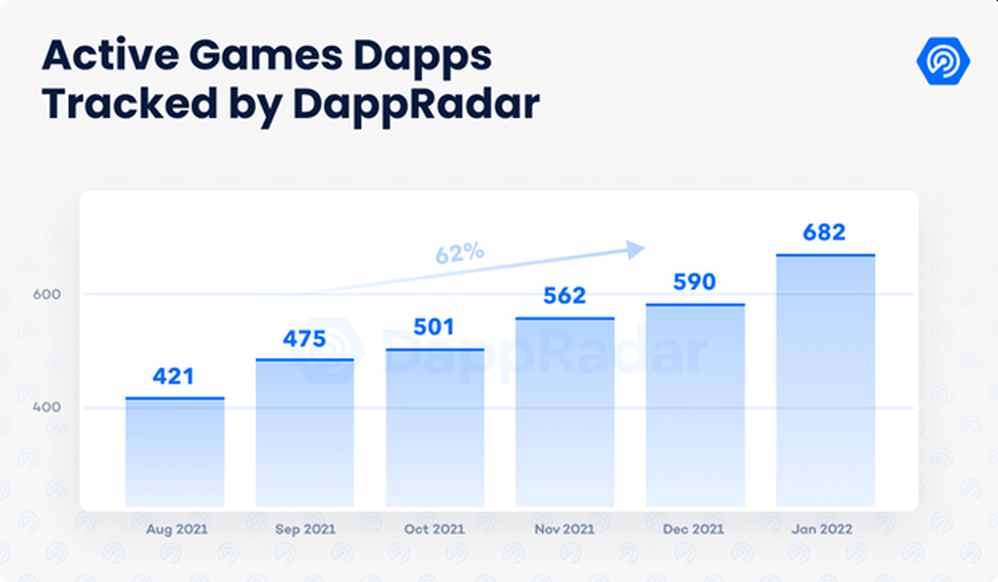

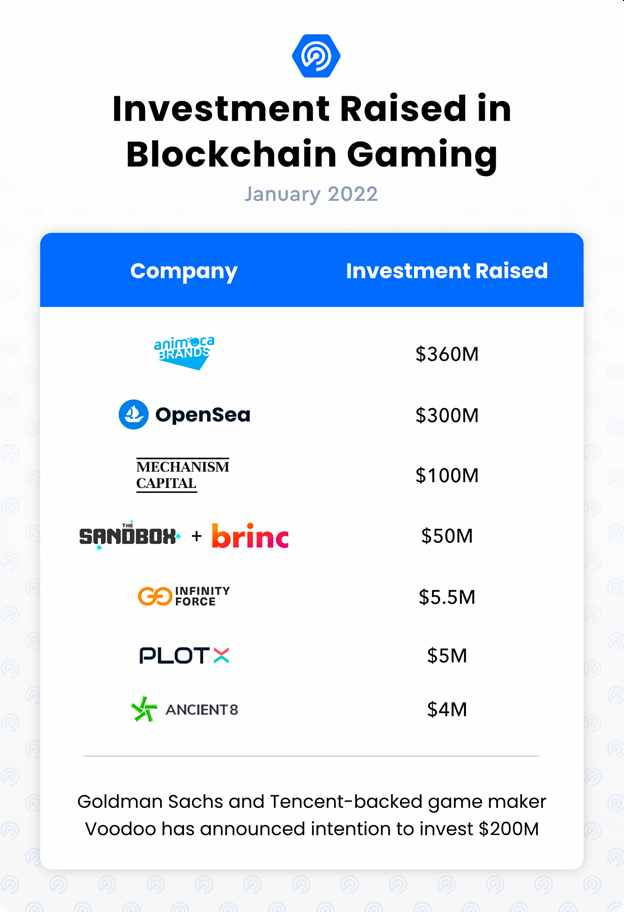

Furthermore, the mainstream news around the ownership granted by NFTs and the intersection with the metaverse have only added fuel to the outlook of blockchain games. The interest in the space is higher than ever, as $1 billion were invested in blockchain games and infrastructure in January, adding to the $4 billion raised in 2021.

This report looks at the most relevant January events that unfolded for blockchain games, a category that accounts for 52% of the blockchain’s activity in 2022.

Key takeaways

- Macro indicators for games signal a bullish scenario. This is emphasized by the fact that game dApps account for 52% of the dApp industry activity, along with $1 billion invested in blockchain games and infrastructure in January alone.

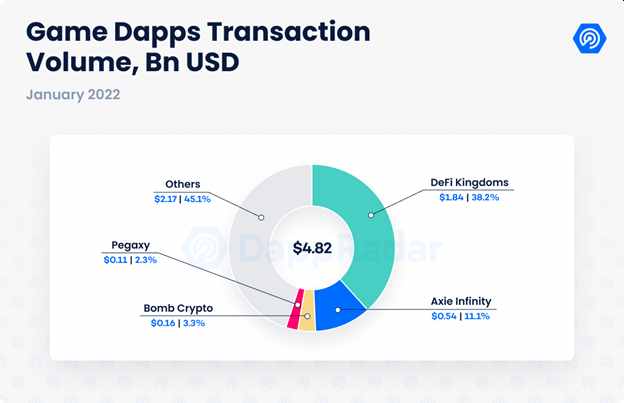

- DeFi Kingdoms generated over $1.6 billion in transactions in January alone, 243% more than Axie; the game dApp holds $775 million or 60% of Harmony’s Total Value Locked.

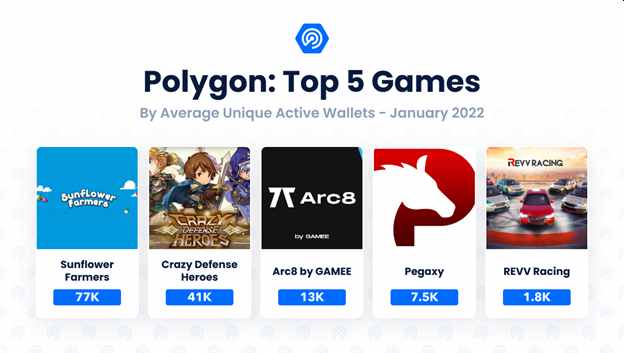

- Polygon flashes the potential of its complete game ecosystem; Crazy Defense Heroes becomes the second most used dApp in the network with 41,000 daily UAW on average.

- Bomb Crypto surpasses Mobox as the most played BSC dApp; the game dApp attracted nearly 40,000 daily UAW on average in January.

- Economic adjustments in the Axie ecosystem might impact the game’s metrics in the short term but improve its sustainability in the long run.

Table of Contents

- Are gaming giants preparing their blockchain entrance?

- DeFi and games collide on Harmony

- Polygon’s gaming outlook on the rise

- Top games retaining their audience despite the crypto crash

- Bomb Crypto becomes BSC’s most played game

- Road ahead

$1 billion invested in blockchain games and infrastructure

It is fair to say that the play-to-earn and GameFi trends are shifting the notion of how we spend our playing time, embedding the earning element to video games. The sustained usage of the top game dApps visibly increases the category’s exposure.

In January alone, blockchain games and their infrastructure raised close to $1 billion. The amount includes the $300 million investment in OpenSea, which, although might not be a direct gaming investment, the NFT marketplace plays an essential role in the trading market for game items.

The macro trends observed in the game dApps category, precisely the sustained demand and the capital invested, signal the massive potential of the $200 billion traditional gaming industry with 2.4 billion active users worldwide. Leading gaming and tech companies have shown increased interest in the potential of blockchain-based games and their role in the metaverse narrative.

Microsoft, Sony, and Take-Two inked intriguing acquisitions involving top-class gaming companies in January. Considering the record amount of capital invested in blockchain games and infrastructure in the last 13 months, the interest for games and the metaverse is undeniable. This trend is seemingly spurred by the COVID pandemic and a general push towards more digital interaction, communication, and virtual work environments. In addition, these blockchain games can provide additional income for families in economically challenging situations.

However, the path to mass adoption will not come easy. The resistance from the traditional industry—one of the most challenging barriers for blockchain games and dApps is very latent. Ubisoft faced this problem last year when the announcement of NFT marketplace Quartz drew hostile critics from the Ghost Recon’s fan base. Still, a promising collaboration between the French-based gaming company and The Sandbox was announced last week, showing that the hype for this industry might be just starting.

DeFi and games collide in Harmony

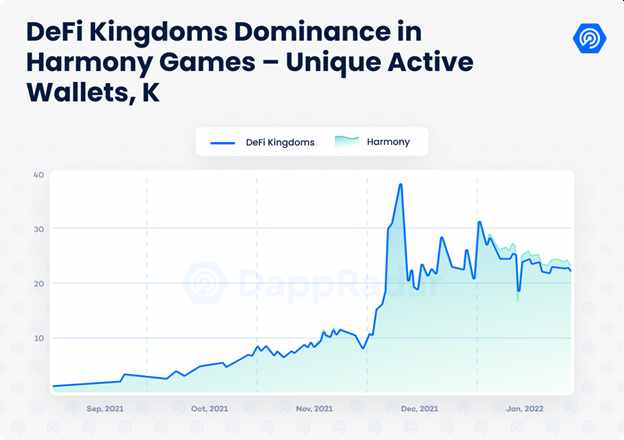

DeFi Kingdoms (DFK) is the perfect example of GameFi. The gamification of DeFi, or GameFi, is a trend where games naturally incorporate DeFi features into their playing mechanics. DFK takes GameFi one step beyond by creating an authentic gaming experience within its pixelated virtual world.

Technically speaking, DFK is a DeFi protocol consisting of contracts that enable a decentralized exchange, staking and liquidity pools, and an NFT marketplace. These DeFi attributes are represented by the game’s concepts, such as the bank, the gardens, or the tavern where JEWEL, the game’s utility and governance token, is required to play.

For instance, JEWEL can be staked in the bank or used for other game purposes. The game avatars or the Hero NFTs can be purchased in the tavern using JEWEL to bring additional utility to their holders. The Kingdom also has a marketplace where game items are traded to enhance the player’s level. Finally, the Kingdom’s gardens act as the ultimate DeFi layer by enabling the dApp’s liquidity pools.

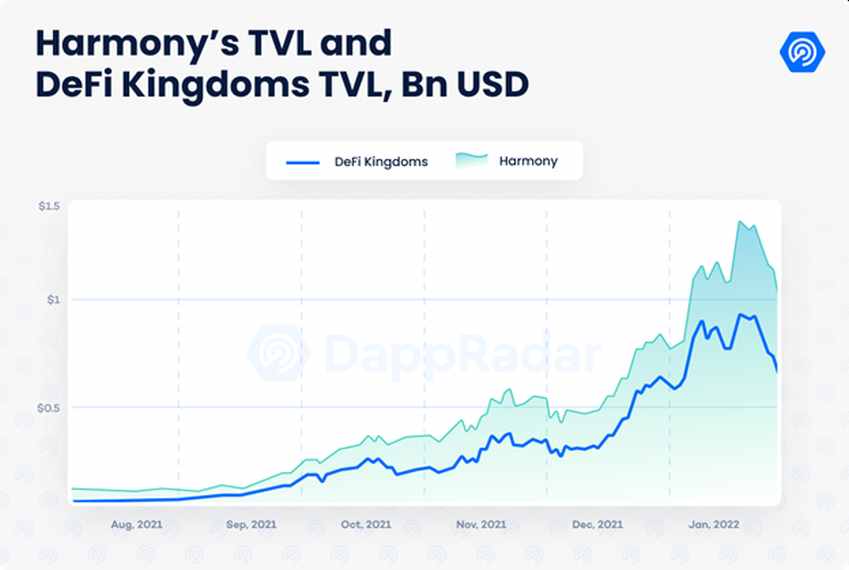

DeFi Kingdoms is the essential dApp for a rising Harmony ecosystem. The game dApp attracted over 22,000 daily UAW in January, retaining its player base at December levels. Most importantly, DFK holds 60% of Harmony’s $1.2 billion in TVL.

Coinciding with the high TVL level, DFK was the leading game dApp in transaction volume, surpassing even Axie Infinity last month. DFK generated over $1.6 billion in transactions in January alone, 243% more than Axie. DFK accounts for 38% of the volume transacted by blockchain games.

It is worth noting that DeFi dApps were the most affected by the current three-month bear trend. Still, DeFi Kingdoms was able to keep its audience engaged by smoothly blending DeFi functionalities into an engaging gaming interface. How far can DFK climb in the game rankings?

Polygon’s gaming outlook on the rise

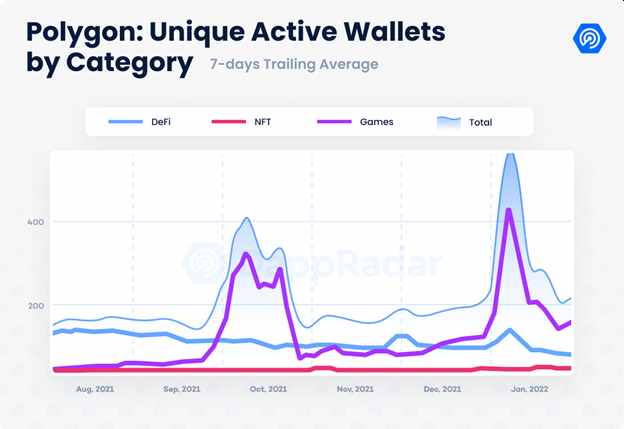

In DappRadar’s January Industry Report, we learned that Polygon was the most improved blockchain in terms of adoption. The number of UAW connected to the sidechain increased 76%, surpassing 209,000 UAW per day on average. Polygon usage was supported by games following the industry’s trend and becoming the network’s dominant category.

The sidechain has become host to some of the most popular games in the space. For instance, Crazy Defense Heroes (CDH), a play-to-earn tower defense game that is also available on mobile. CDH attracted an average of over 41,000 daily UAW in January, doubling the number of players registered in December. The tower defense game became the second most popular dApp in the network behind QuickSwap.

The mobile segment is one where Polygon has recently paid special attention. Arc8, a mobile play-to-earn dApp developed by Animoca Brands subsidiary Games, completed its preseason attracting over 58,000 UAW in January. The mobile play-to-earn dApp will launch its first official season, including new mini-games.

One Polygon game that stole the headlines in January was Sunflower Farmers. The play-to-earn dApp started the year with a blast, attracting over 400,000 UAW in the first seven days of 2022. However, due to a smart contract vulnerability, Sunflower Farmers was shut down by the game’s developers after the game congested the Polygon network, causing a spike in the price of gas fees. Yet, the smart contracts are still live on the blockchain and people can still ‘play’ that particular version of the game.

The Polygon game ecosystem already looks stacked with Pegaxy, Aavegotchi, Fear, Phantom Galaxies, REVV Racing, Zed Run, Doctor Who: Worlds Apart, and the upcoming Galaxy Fight Club, Riot Racers, among others. Plus, the network is continuously revamping its gaming perspective with strategic investments and partnerships. What is more, the Polygon team launched Polygon Studios with the help of a list of partners that include Animoca Brands, The Sandbox, Decentraland, and other leading dApps.

Top games retain audience despite the crypto crash

In Q3 2021, blockchain games became the most dominant dApp category in terms of usage. At that time, blockchain games accounted for 45% of the industry’s activity, which has risen to 52%.

One of the most critical indicators for games is retention. A feat that the most played game dApps are successfully achieving. These games retain users, but most are growing their player base further.

Splinterlands

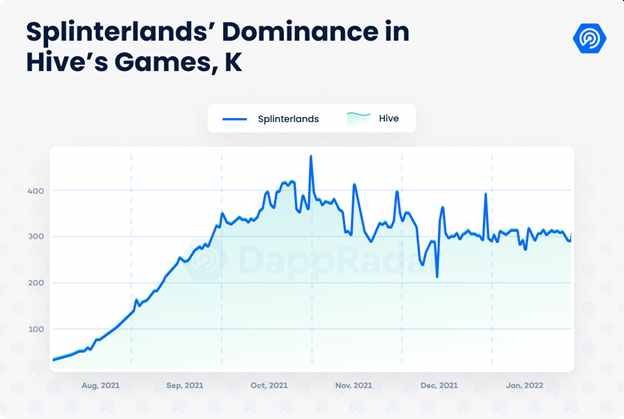

Splinterlands became the most played blockchain game in the industry based on on-chain activity. As a note, a dApp’s on-chain activity is measured by the number of Unique Active Wallets (UAW) that interact with the dApp in a certain period. Splinterlands attracted around 312,000 UAW on average per day in January, growing its player base by 4.5% from the end of last year.

The trading card play-to-earn game runs on Hive and accounts for almost 95% of the network’s unique wallets. Splinterlands has been successful due to a combination of factors. The game has been under constant updates preventing the game from entering a loop. The changes applied to the game mechanics present new challenges to players looking to optimize their playing strategies. Also, the team has continuously released new cards known as Chaos Legion packs. The 6th release of the Chaos Legion sold over 6 million packs in 24 hours, showing that the demand for the game is still high. If you’re interested in learning different ways to earn passive income with Splinterlands, you can take a look at this article.

Axie Infinity

While Splinterlands is the most played game based on the dapp’s on-chain activity, Axie Infinity is by far the most played blockchain game considering off-chain activity. According to Sky Mavis, 2.8 million Daily Active Users (DAU) are playing Axie Infinity per day. However, Axie ranks third with over 100,000 daily UAW on average in January when we look at on-chain activity.

Axie’s January activity represents a slight increase from the end of 2021. Sky Mavis is constantly upgrading the game’s concept and is expected to implement virtual land features sometime this year. Plus, the Ronin ecosystem is getting well-balanced. Katana holds over $620 million in Total Value Locked (TVL) at writing, while the recent release of the RON token will give holders a vote in the ecosystem’s plans. These events boost Axie’s on-chain outlook and help the game retain more users by creating a whole ecosystem.

In addition, Axie pets as NFTs are still the most traded NFT collection ever (excluding LooksRare activity), with $4.1 billion in historical sales volume and $130 million generated in January. While trading volumes were affected by the decrease in the price of the underlying cryptocurrencies. Sales count decreased less than proportionally, showing that demand for Axie Infinity is still high.

Wax games

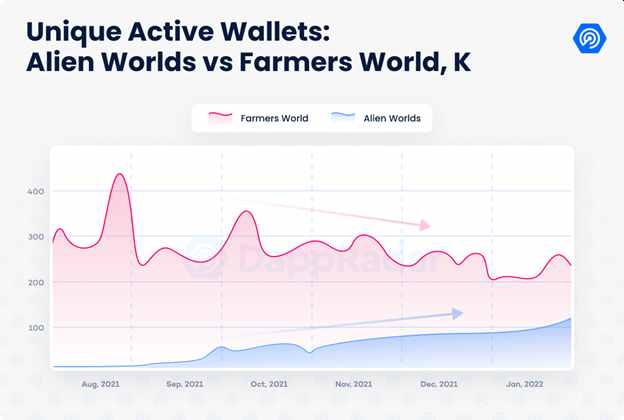

Thanks to its vast game activity, the World Asset eXchange (Wax) is one of the most utilized networks in the industry. Indeed, hosting two of the most played blockchain games helps the cause. Since early last year, Alien Worlds became a blockchain game referent attracting thousands of players each month. Despite being criticized for containing repetitive game tasks, and lacking an advanced playing experience, Alien Worlds drew more than 205,000 daily UAW on average in January, positioning it as the second most played blockchain game based on on-chain activity. This number includes the activity registered in BSC due to the Missions launched on the Binance network last year.

The Wax game ecosystem also includes Farmers World, a GameFi farming dApp that has been constantly growing its audience since September last year. At the end of January 2022, Farmers World was the fourth most played blockchain game, with over 83,000 UAW connecting daily to the dApp. That represents a 25% growth from the previous year.

Even though two dApps dominate Wax’s game scene, new game alternatives are already eying to make some contributions. Dark Country, a play-to-earn dApp, is expected to release its land gameplay in Q1, while Blockchain Brawlers conducted its first NFT sale in February.

Upland

Upland is one of the oldest blockchain games in the industry. Launched on an Open Beta in January 2020, Upland has maintained its position as one of the most played blockchain games nonetheless. The play-to-earn dApp reminds of Monopoly and portrays important cities like Manhattan, Chicago, and San Francisco in its virtual world where players act as digital real-estate agents. In January, Upland attracted over 63,000 UAW per day, improving its usage by 10% from December’s metrics.

Overall, the essential blockchain games have fostered an established audience, vital for further growing the community. Four out of the top five most played games are expanding their audience despite the negative trend in the crypto market. If the new wave of upcoming blockchain games captivates an engaged user base, mass adoption may arrive sooner than originally thought.

Bomb Crypto becomes BSC’s most played game

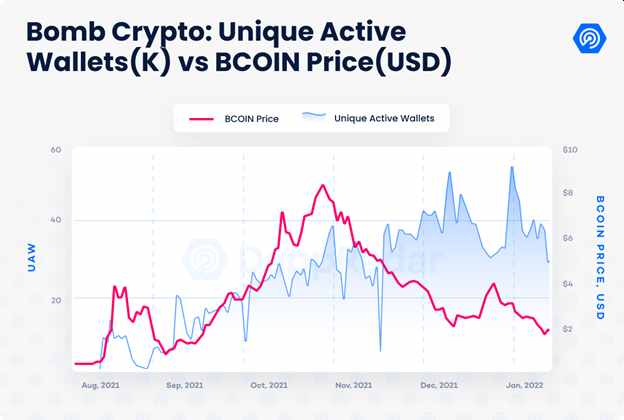

Besides Mobox: NFT Farmer, the game scene on BSC appeared to be on the downside after the documented collapses of CryptoBlades and CryptoBay. However, Bomb Crypto seems to be reverting the trend. This blockchain-based game inspired by the classic gaming franchise Bomberman allows players to earn BCOIN. This unofficial clone of the Konami classic lets gamers place bombs to defeat opponents and earn rewards. Each Bomb hero is an NFT that can be upgraded and traded.

Ever since launching at the end of September, Bomb Crypto has increased its player base each month. In January, almost 40,000 UAW connected daily to the BSC game on average, growing 19% from December. In this way, Bomb Crypto has surpassed Mobox as the most played game in BSC’s gaming ecosystem.

Bomb Crypto is currently generating more value than any other game in the Binance-branded network. It for example has 458% more transaction volume than Mobox. This achievement is even more remarkable, as it happened despite facing delays in the game’s development. These development hurdles left the repetitive BCOIN mining task as the only option available to play.

While other games on BSC, like CryptoBay and CryptoBlades, have seen their audience drop off after a few months due to mistakes in the economic design, Bomb Crypto is still going strong. There’s no clear correlation between the success of the game at finding an audience and the price of the native BCOIN. Even when the price drops, the game finds a bigger audience. Plus, the game is expected to launch new game mechanics and its NFT marketplace in the upcoming weeks.

Road ahead

January’s on-chain metrics show a good performance for the blockchain games industry in general. The most popular game dApps continue to increase their player base, and a new generation of game dApps starts to find an audience. Games like DeFi Kingdoms, Bomb Crypto, and Crazy Defense Heroes are boosting the category for different blockchains like Harmony, BSC, Polygon, and others.

On the macro level, the increased interest in blockchain games is imminent. It will be necessary for solutions like Solana and Ronin to prepare technically to onboard more users than ever. All in all, 2022 will be an important year for space. One which will have expected developments along the way, including upcoming events like:

- Illuvium’s close beta– Illuvium is one of the most anticipated blockchain games ever. Labeled as a AAA game, the play-to-earn dApp will allow a limited number of qualified players to test one of the game’s functionalities in the Immutable X solution.

- Virtual worlds alpha – Virtual worlds continue to expand seamlessly. The Sandbox’s second alpha will bring more players and new mechanics. Meanwhile, Nifty Island’s open social virtual world will conduct its first alpha on February 17.

- Axie Infinity economic adjustments – changes in the SLP reward rate might impact the game’s metrics in the short term but will improve the ecosystem’s sustainability in the long run.