WeRock, the owner of file transfer startup WeTransfer, is going public at a valuation of $714-813 million

WeRock, the parent company of file transfer startup WeTransfer, has filed to go public in an initial public offering (IPO) that will value the company at between 629 million and 716 million euros ($714-813 million). The IPO is scheduled for later this month in Amsterdam, the company said on Thursday.

In a prospectus published Thursday, WeRock, which will soon rebrand to The Creative Productivity Group NV, set a price range for the shares being sold at 17.5-20.5 euros each, with a mix of existing and new shares on offer.

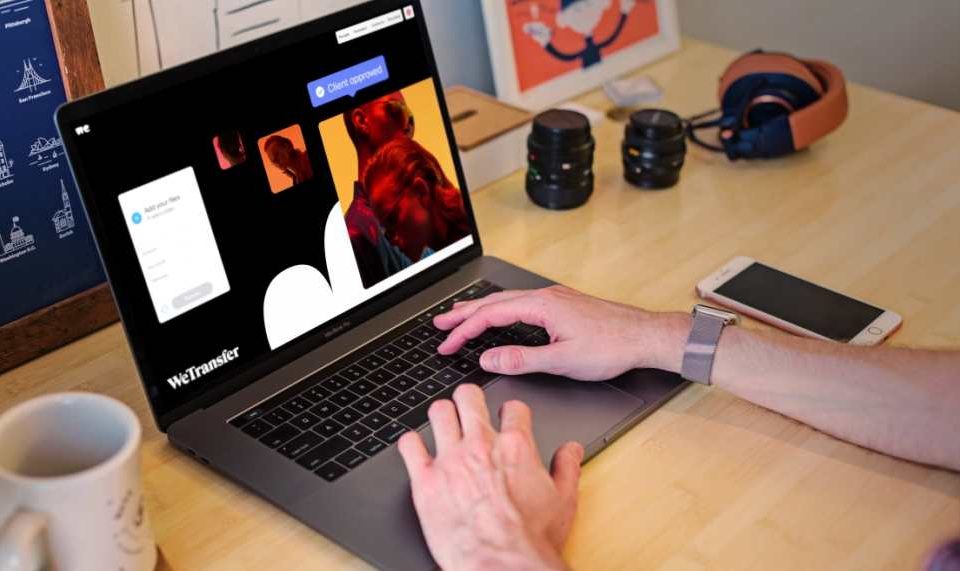

WeTransfer is a popular provider of internet-based file transfer services based in the Netherlands. The company was founded in 2009 in Amsterdam by Rinke Visser, Bas Beerens and Nalden. In October 2018, WeTransfer relaunched its app with the name “Collect by WeTransfer”

Meanwhile, WeRock said it expects to raise around 125 million euros in fresh capital from the new shares, while existing shareholders will sell up to 5.4 million shares, leading to a total offer size of 285-290 million euros and a free float of around 43.5%.

WeRock will use the IPO proceeds to develop the company’s business, finance possible acquisitions, and pay off management incentive plans, as well as settle a 23.4 million bill with its majority owner to convert preference shares into ordinary shares.

WeRock is best known for the WeTransfer file transfer service but it also offers collaborative tools. Its backers include current investors include Highland Europe Technology, which holds a 55% stake, and HPE Institutional Fund, which has 13%.

Gordon Willoughby, chief exec of the file-sharing platform group, said: “Today’s announcement represents another significant step on our journey towards an initial public offering on Euronext Amsterdam. The creative community remains at the heart of everything we do. It has allowed WeTransfer to establish itself as a trusted, authentic brand among its community of 87 million monthly active users.”

“Our focus remains on continuing to offer creative productivity tools that address the specific needs of our community, while we continue our growth trajectory and deliver sustainable value to all our stakeholders over the long term.”

Commenting on the IPO, Bloomberg capital markets reporter Swetha Gopinath said: “WeTransfer and its backers seek as much as 252 million euros ($286 million) in an Amsterdam initial public offering, in a key test of investor appetite as the rout in tech stocks deepens.

“The file-sharing platform is looking to raise 125 million euros in the listing, less than the 160 million euros initially targeted, amid a bad start to the year for the tech sector. The deal values WeTransfer at as much as 716 million euros.”